Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — June 30, 2025

By Russell Ernst

The electric and gas utility ratemaking process is expected to be quite active during July, as major developments are slated to occur in various pending proceedings.

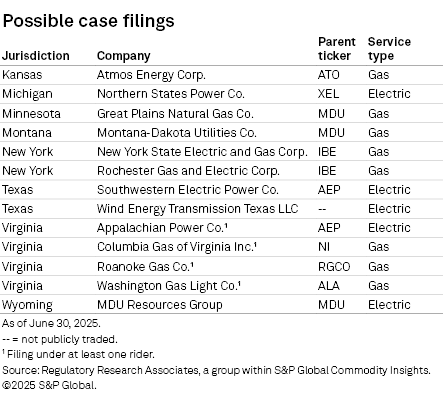

➤ At least 13 new rate cases could be filed by US electric and gas utilities during July, as these companies initiate the rate change process for their businesses.

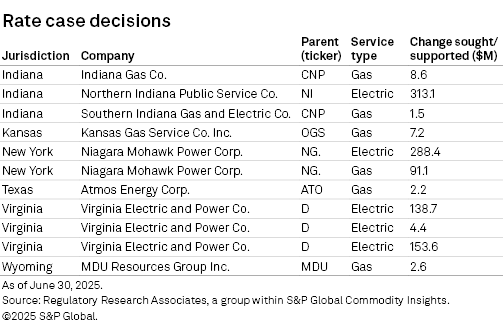

➤ In addition, decisions could be issued in at least 11 pending rate proceedings that Regulatory Research Associates is following across six jurisdictions. Most of these proceedings are traditional base rate cases, but six pertain to limited-issue riders.

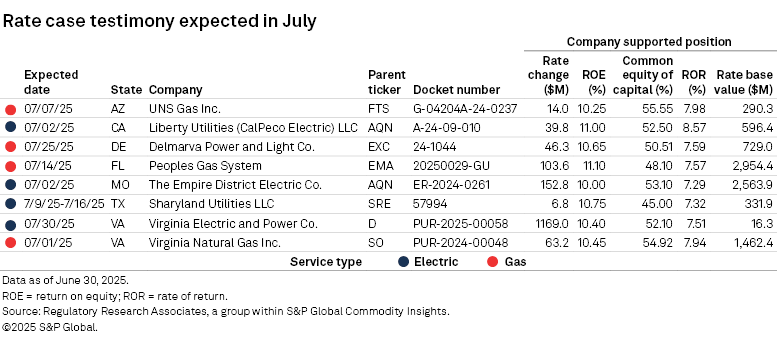

➤ Administrative law judges or hearing examiners are expected to issue recommended decisions in four proceedings, including a substantial multiyear rate proceeding in California.

➤ Stakeholders and consumer groups are to file testimony in eight other pending proceedings, and there could be developments regarding ongoing settlement negotiations in three pending rate cases.

➤ Several commissioners continue to serve pending reappointment/replacement or confirmation. There are also vacancies on five state-level regulatory bodies. Action could occur regarding some of these commissioner seats in the coming weeks.

➤ Settlement conferences will be held at the Federal Energy Regulatory Commission regarding one formula rate proposal. The commission will also hold its regular monthly agenda meeting. In addition, there is a vacancy at FERC.

As of June 30, 116 electric and gas rate cases were pending across 39 states and Washington, DC. The rate changes sought in these pending proceedings aggregate to slightly more than a $24 billion net rate increase, excluding some of the later-year steps of multiyear rate requests.

With regulatory activity picking up in the second quarter, RRA has observed that 2025 has been busier than usual. The fourth quarter is generally the most active time of the year for rate case decisions, with December being the busiest month, on average, as regulators try to clear their slates before the new year begins. However, filing activity tends to taper off toward year-end.

A list of expected events for July and beyond is available in the Regulatory Research Associates Events Calendar.

Expected decisions

Indiana — Indiana Gas Co. Inc. — A decision could be issued in Indiana Gas' transmission, distribution and storage system improvement charge (TDSIC) rider proceeding (Cause 45611-TDSIC-6). The CenterPoint Energy Inc. subsidiary proposes an $8.6 million rate increase that reflects a $490.0 million rate base. The portion of the increase associated with pipeline-safety initiatives was calculated using a 9.80% return on equity (47.38% of a regulatory capital structure) and a 6.55% overall return. The portion of the increase associated with TDSIC projects was calculated using a 9.80% return on equity (48.12% of a regulatory capital structure) and a 6.60% overall return.

Indiana — Northern Indiana Public Service Co. LLC — A decision could be issued in NiSource Inc. subsidiary Northern Indiana Public Service's electric rate proceeding (Cause 46120). The company is a signatory to a settlement that calls for a $313.1 million multistep rate increase premised upon a 9.75% return on equity (53.01% of capital) and a 7.14% return on a $9.13 billion rate base.

Indiana — Southern Indiana Gas and Electric Co. — A decision could be issued in Southern Indiana Gas and Electric's TDSIC rider proceeding (Cause 45612-TDSIC-6). The CenterPoint Energy subsidiary proposes a $1.5 million gas rate increase that reflects a $142.3 million rate base. The portion of the increase associated with pipeline-safety initiatives was calculated using a 9.70% return on equity (48.06% of a regulatory capital structure) and a 6.37% overall return. The portion of the increase associated with TDSIC projects was calculated using a 9.70% return on equity (47.23% of a regulatory capital structure) and a 6.36% overall return.

Kansas — Kansas Gas Service Co. Inc. — A decision could be rendered in Kansas Gas Service's gas system reliability surcharge (GSRS) rider proceeding (Docket 25-KGSG-386-TAR). The company, a division of One Gas Inc., seeks a $7.2 million rate increase under the rider that reflects a $56.4 million rate base. As specified in a prior rate case settlement, an 8.97% return that is "gross of tax" is to be utilized to calculate rate adjustments under the GSRS rider.

New York — Niagara Mohawk Power Corp. — A decision could be issued by July 31 in Niagara Mohawk Power's electric and gas rate proceedings (Case 24-E-0322 and 24-G-0323, respectively). The National Grid PLC subsidiary has signed a joint proposal that calls for a $288.4 million first-year electric rate increase premised upon a 9.50% return on equity (48.00% of capital) and a 6.87% return on an $8.986 billion rate base. The joint proposal also calls for a $91.1 million first-year gas rate increase premised upon a 9.50% return on equity (48.00% of capital) and a 6.87% return on a $2.242 billion rate base.

Virginia — Virginia Electric and Power Co. — A decision may be issued in Dominion Energy Inc. subsidiary Virginia Electric and Power's Rider SNA proceeding (Case PUR-2024-00154), assuming a hearing examiner's report is forthcoming early in July. The company proposes a $138.7 million rate increase under the rider premised upon a 9.70% return on equity (51.99% of capital) and a 7.20% return on a $1.453 billion rate base. Rider SNA pertains to the company's proposal to pursue license extensions for the Surry and North Anna nuclear units.

Virginia — Virginia Electric and Power — A decision may be rendered in Virginia Electric and Power's Rider DSM proceeding (Case PUR-2024-00222), assuming a hearing examiner's report is forthcoming early in July. The company proposes a $4.4 million rate increase under the rider, premised upon a 9.70% return on equity (51.99% of capital) and a 7.20% return on an $83.4 million rate base. Rider DSM pertains to the company's energy conservation and demand-side management programs.

Virginia — Virginia Electric and Power — A decision may be issued in Virginia Electric and Power's Rider OSW proceeding (Case PUR-2024-00206), assuming a hearing examiner's report is forthcoming early in July. The company proposes a $153.6 million rate increase under the rider premised upon a 9.70% return on equity (51.99% of capital) and a 7.20% return on a $7.764 billion rate base. Rider OSW pertains to the company's investment in the Coastal Virginia Offshore Wind Project.

Wyoming — MDU Resources Group Inc. — A decision could be issued in MDU Resources' Wyoming-jurisdictional gas distribution rate proceeding (Docket 30013-415-GR-24). The company proposes a $2.6 million rate increase that reflects a 10.80% return on equity (50.18% of capital) and a 7.82% return on a $30.0 million rate base.

Administrative law judges' recommendations

California — Southern California Edison Co. — An administrative law judge's proposed decision could be issued in Edison International subsidiary Southern California Edison's rate case (Application 23-05-010). The company supports a $4.049 billion multiyear electric rate increase. Specifically, the company is backing a $1.90 billion increase in 2025, a $668.1 million increase in 2026, a $748.6 million increase in 2027 and a $732.3 million increase in 2028.

Virginia — Virginia Electric and Power — A hearing examiner's report is likely to be issued in Virginia Electric and Power's Rider DSM proceeding (Case PUR-2024-00222). The company proposes a $4.4 million rate increase under the rider, premised upon a 9.70% return on equity (51.99% of capital) and a 7.20% return on an $83.4 million rate base. Rider DSM pertains to the company's energy conservation and demand-side management programs.

Virginia — Virginia Electric and Power — A hearing examiner's report is likely to be issued in Virginia Electric and Power's Rider OSW proceeding (Case PUR-2024-00206). The company proposes a $153.6 million rate increase under the rider premised upon a 9.70% return on equity (51.99% of capital) and a 7.20% return on a $7.764 billion rate base. Rider OSW pertains to the company's investment in the Coastal Virginia Offshore Wind Project.

Virginia — Virginia Electric and Power — A hearing examiner's report may be issued in Virginia Electric and Power's Rider SMR proceeding (Case PUR-2024-00205). The company proposes a $17.2 million rate increase under the rider premised upon a 9.70% return on equity (51.99% of capital) and a 7.20% return on a $6.1 million rate base. Rider SMR is proposed to recover the projected and actual project development costs associated with the development of one or more small modular reactors on company-owned property adjacent to the existing North Anna Power Station.

Settlements

Kansas — Evergy Kansas Central Inc./Evergy Kansas South Inc. — A settlement conference is scheduled for July 8–9 in a consolidated rate proceeding (Docket 25-EKCE-294-RTS) for Evergy Inc. subsidiaries Evergy Kansas Central and Evergy Kansas South. The deadline for the parties to file a settlement is July 14. The companies seek a $192.1 million base rate increase premised upon a 10.50% return on equity (51.97% of capital) and a 7.69% return on a $6.733 billion rate base. The net rate increase would be $196.4 million, after considering the transfer to base rates of a $4.3 million credit reflected in the property tax surcharge.

Missouri — Spire Missouri — A settlement conference is scheduled for July 8–10 in Spire Missouri's base rate proceeding (Case GR-2025-0107). The company seeks a $289.5 million base rate increase premised upon a 10.50% return on equity (55.00% of capital) and a 7.69% return on a $4.386 billion rate base.

Pennsylvania — UGI Utilities Inc. — The deadline for the parties to file a settlement in UGI Utilities' rate proceeding (Docket R-2024-3052716) is July 9. The UGI Corp. subsidiary seeks a $110.4 million rate increase premised upon an 11.20% return on equity (54.11% of capital) and an 8.42% return on a $4.003 billion rate base.

Other

Georgia — Georgia Power Co. — A decision is expected July 1 regarding Southern Co. subsidiary Georgia Power's alternate rate plan, or alternatively, a rate case filing may be required.

Maryland — Parties are to file comments by July 23 in response to the Maryland Public Service Commission's June 13 order in its ongoing "Future of Gas" proceeding (Case No. 9707). The June 13 order directed the state's gas local distribution companies (LDCs) to do away with "line extension policies" under which a portion of the cost to serve new customer locations is included as part of the utilities' overall cost of service. Going forward, these costs will be paid by the new customer directly. The commission rejected the Office of People's Counsel's proposal to revamp the current review process for the LDCs' gas procurement strategies. The commission indicated that issues related to the LDCs' recovery of investments in gas infrastructure upgrade and replacement programs would continue to be reviewed.

Minnesota — Allete Inc. — An administrative law judge's recommendation regarding the proposed Allete sale to Global Infrastructure Management, Canada Pension Plan Investment Board is due July 15.

Pennsylvania — At its July 10 or July 24 public meeting, the Pennsylvania Public Utility Commission may release the results of its quarterly assessment of the earnings of the state's utilities. The commission generally identifies the proxy returns on equity that the utilities will use to set the revenue requirements for quarterly adjustments under their distribution system improvement charges.

Texas— Southwestern Public Service Co. — The Public Utility Commission of Texas may render a decision in July regarding a settlement reached by the parties to Southwestern Public Service Co.'s system resiliency plan proceeding (Docket 57463). Southwestern Public Service is an Xcel Energy Inc. subsidiary. In its filing, the company had proposed to expend $538.3 million between 2025 and 2028 on initiatives to improve reliability, including distribution overhead hardening, distribution system protection modernization, communication system upgrades, operational flexibility improvements (e.g., mobile substations) and wildfire mitigation. It appears that the settlement incorporates all but about $5.9 million of the proposed spending. The PUC discussed the settlement at its June 20 open meeting, but a written order has not been issued.

Commissioners

Developments are expected in July that will impact the composition of several state commissions.

The term of Alessandra Carreon (D) of the Michigan Public Service Commission is due to expire in July.

The following commissioners are serving beyond the expiration of their terms, pending reappointment or replacement: Chairman John Espindola of the Regulatory Commission of Alaska; Michael Caron of the Connecticut Public Utility Commission; Chairman James Huston (R) of the Indiana Utility Regulatory Commission; Chair Angela Hatton (D) of the Kentucky Public Service Commission; Cecile Fraser (D) of the Massachusetts Department of Public Utilities; Maida Coleman (D) of the Missouri Public Service Commission; Chairman Daniel Goldner of the New Hampshire Public Utilities Commission; Floyd McKissick (D) and Jeff Hughes of the North Carolina Utilities Commission (NCUC); Abigail Anthony of the Rhode Island Public Utilities Commission; Chairman Delton Powers II, Carolee Williams, Headen Thomas and Stephen Caston of the Public Service Commission of South Carolina; and Chair Charlotte Lane (R) of the West Virginia Public Service Commission.

In several instances, commissioners have been appointed or reappointed and are serving pending confirmation, including Justin Tate of the Arkansas Public Service Commission; Michael Carrigan (D) of the Illinois Commerce Commission; Mary Pat Regan of the Kentucky Public Service Commission; Marian Abdou of the New Jersey Board of Public Utilities; Floyd McKissick Jr. and Steve Levitas of the North Carolina Utilities Commission; Lawrence Friedeman (D) of the Public Utilities Commission of Ohio; Karen Bradbury of the Rhode Island Public Utilities Commission; and Kristy Nieto and Marcus Hawkins of the Public Service Commission of Wisconsin.

In Maryland, the Senate has approved Gov. Wes Moore's (D) nomination of Ryan Charles McLean, the chief public utility law judge for the commission, to succeed Michael Richard (R) for a new five-year term extending through June 2030. McLean will likely not join the PSC until after Richard leaves office in June.

There are also vacancies on the Connecticut Public Utilities Regulatory Authority, Kentucky Public Service Commission, the Missouri Public Service Commission, the New Jersey Board of Public Utilities and the Texas PUC.

FERC

There is currently one vacancy on FERC after Commissioner Willie Phillips resigned on April 22. Phillips' term was scheduled to expire June 30, 2026, and his departure leaves FERC with two Republicans and two Democrats. Chairman Mark Christie's term expires on June 30, 2025, and he is expected to leave the commission in the coming weeks.

On July 7, stakeholder comments are due in Docket AD25-7, following a June 4–5 commissioner-led technical conference regarding the challenge of resource adequacy in regional transmission organizations and independent system operators.

On July 24, FERC will hold its regular monthly agenda open meeting.

On July 27, FERC will convene the third public meeting of the Federal and State Current Issues Collaborative in Docket AD24-7 to explore cross-jurisdictional issues relevant to FERC and state utility commissions. According to FERC, gas-electric coordination is the overarching topic the collaborative will discuss.

On July 30, FERC will convene a settlement conference in Docket ER25-270 to consider a transmission formula rate filing submitted by Sempra subsidiary San Diego Gas & Electric Co. (SDG&E). The utility submitted a new transmission formula rate for 2025 as the successor to its currently effective formula rate. SDG&E's proposed new formula rate incorporates a base ROE of 11.75%, an increase from the utility's currently authorized 10.10% base ROE.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings

Segment

Language