Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 11, 2021

By Alice Gladen

The coronavirus pandemic has undoubtedly impacted all aspects of life in 2020 and looks to continue significantly into 2021 with many countries still facing serious restrictions. This report summarises the effects of COVID-19 on the Maritime Industry so far.

Global Economic Conditions

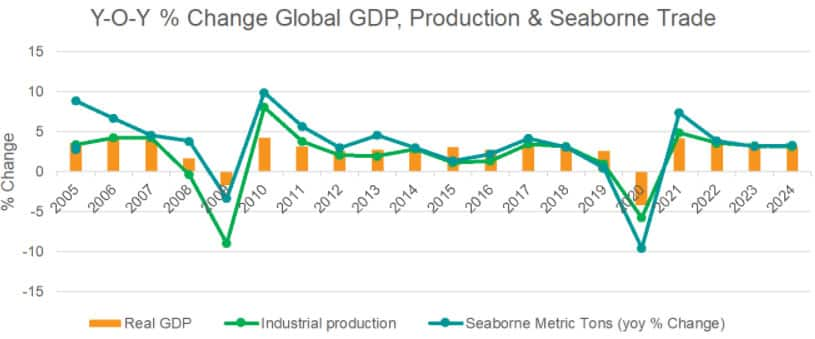

COVID-19 hit the global economy hard. With lockdowns, reduced demand, increased unemployment and debt, it is not surprising that 2020 saw a massive decrease in GDP with global GDP down 4.2% and a significant drop in Industrial production (Figure 1 & 2). There were many aspects of the pandemic that affected the maritime industry including significant shifts in demand from normal practice, the global lockdown and serious restrictions on normal operating procedures. We also observed increased congestion in ports, decreased demand for key commodities, supply chain issues for PPE and coronavirus cases on vessels.

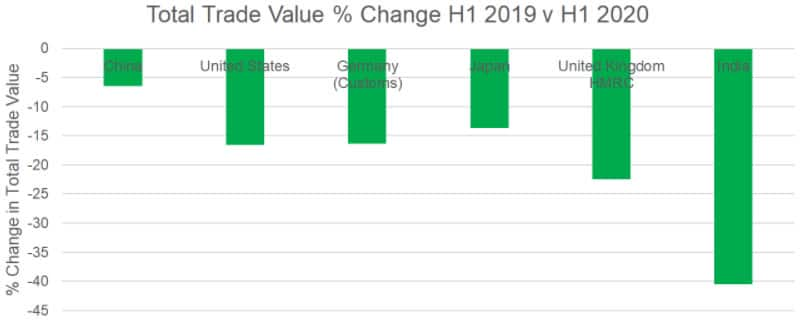

Maritime trading volumes took a hit with seaborne trade down by 9.5% (Figure 1) and total global trade slowing down significantly in H1 of 2020, which was down 16% against H1 of 2019 with significant variation between countries (Figure 3).

Figure 1: Trends in Year-on-Year % Change of Global GDP, Industrial Production & Seaborne Trade Source: (GTA, GTA Forecasting, Global Executive Summary)

Figure 2: GDP Growth in 2020 v 2019. Source: Global Executive Summary (IHS Markit)

Figure 3: Total Trade Value % Change H1 2019 v H1 2020 Source: Global Trade Atlas

Containerized Trade

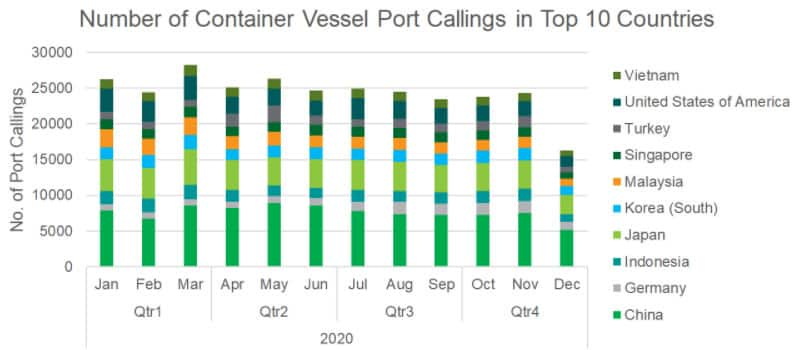

Containerized trade has overall remained stable due to its high dependence on China. China makes up a high percentage of the global containerized trade and so China activity heavily influences the global picture. China's containerized vessel port calls dropped 16% in February, while they were in strict lockdown (Figure 4). However, these strict controls meant recovery was swift in China and the levels of calls soon returned to normal levels.

Figure 4: Number of Container Vessel Port Callings in Top 10 countries Source: Maritime Data

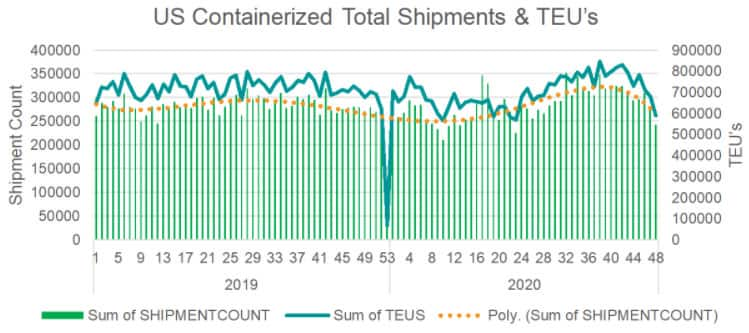

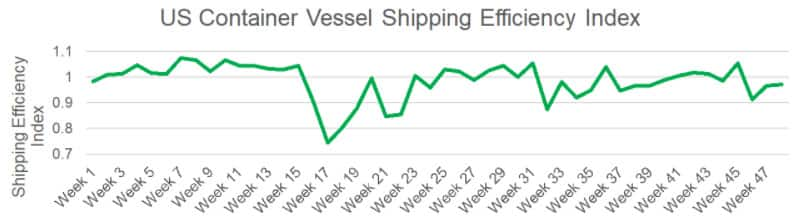

In the U.S. however, we can see a drop off in both shipment count and total TEUS shipped during the beginning of 2020 followed by recovery in H2 2020 (Figure 5). This shipping activity seems to be in line with U.S. governmental guidelines which, following strict measures in H1, were largely loosened in the second half of the year. The Shipping Efficiency Index is calculated looking at the average TEUS per Shipment each month compared to the average TEU/Shipment value for 2019-2020. The Shipping Efficiency Index showed low efficiency in Week 17 (April) when the US was under stricter coronavirus conditions (Figure 6).

Figure 5: U.S. Containerized Total Number of Shipments and Total TEU's Source: PIERS Bill of Lading

Figure 6: U.S. Container Vessel Shipping Efficiency Index in 2020 Source: PIERS Bill of Lading

Cruise Liner Industry

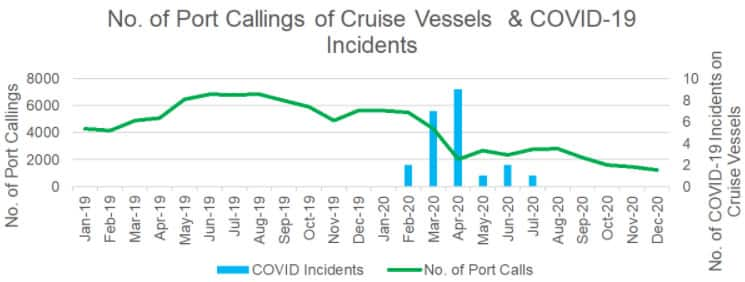

The Cruise Ship industry has been decimated by COVID-19 as the travel industry stalled. During the first few weeks of the pandemic we saw high publicity of COVID-19 cases on cruise vessels and the subsequent quarantine restrictions. April saw the peak of incidents involving COVID-19 on cruise liners, with nine incidents during the month. The number of port callings of cruise vessels has massively decreased though-out the year and shows no sign of recovery (Figure 7). The recovery of this industry is going to be slow as continued travel restrictions limit demand.

Figure 7: No. of Port Callings of Cruise Vessels & COVID-19 Events on-board Source: Maritime Data

Tanker Industry

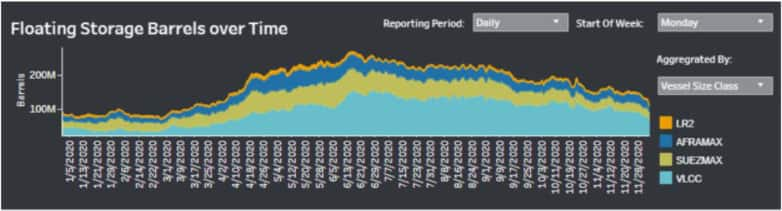

Within the tanker industry the crash in oil prices was the key moment of 2020. Lockdowns and the associated lack of activity helped to influence the low prices within oil sectors, with unit prices dropping to as low as 29 US$ per barrell. While prices continued to fall, we saw the rising trend of using vessels as floating storage (Figure 8). This altered the supply and demand balance in 2020 with the number of laden tankers rising above that of ballast globally in April & May.

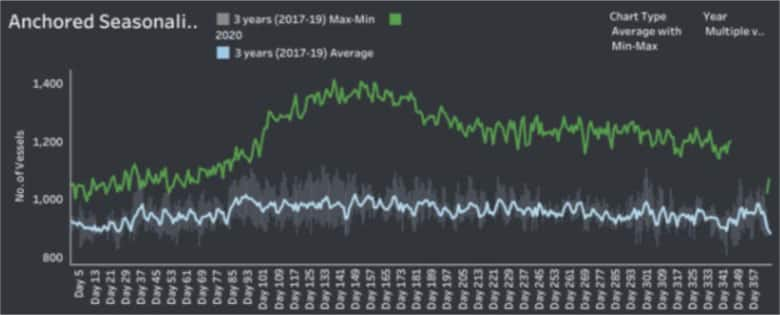

Further impacts on the tanker industry included an increasing level of congestion outside ports as COVID-19 restrictions slowed down Port Activity (Figure 9).

Figure 8: Increasing usage of vessels as floating storage over 2020 Source: Commodities at Sea, Liquid Bulk

Figure 9: Number of tanker vessels anchored globally compared to the three year average Source: Commodities at Sea, Liquid Bulk

COVID-19 Impact on Safety & Operating Conditions

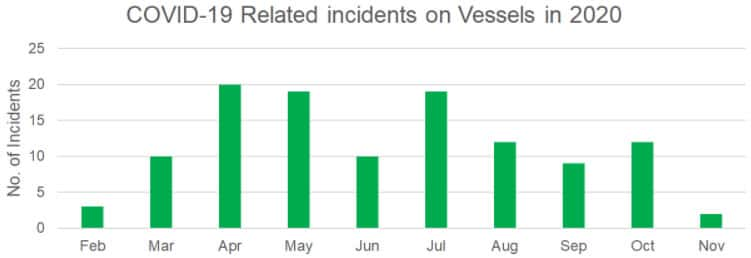

There were reports throughout the year of the many issues for crew caused by COVID-19. These included crew members stranded due to quarantine restrictions and longer working periods at sea. Hence, we also observed an increasing number of crew and passenger events linked to COVID-19 on vessels throughout 2020 with up to 20 incidents a month at the peak (Figure 10). These have begun to reduce throughout Q3 and Q4 as better testing and restrictions take effect.

Figure 10: COVID-19 Related incidents on Vessels in 2020 Source: Maritime Data

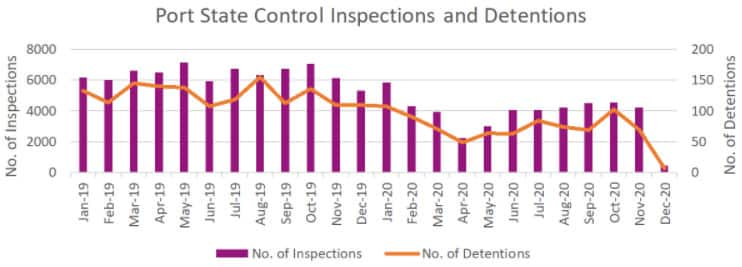

Port State Control inspections are routinely carried out to determine the condition of vessels both in terms of physical defects and crew conditions. They ensure vessels are maintaining high safety standards for the crew onboard. We observed a drop in the number of PSC inspections throughout 2020 as inspectors struggled to board vessels, leaving potential defects or issues undetected.

Figure 11: Port State Control Inspections & Detentions Source: Maritime Data

Looking forward

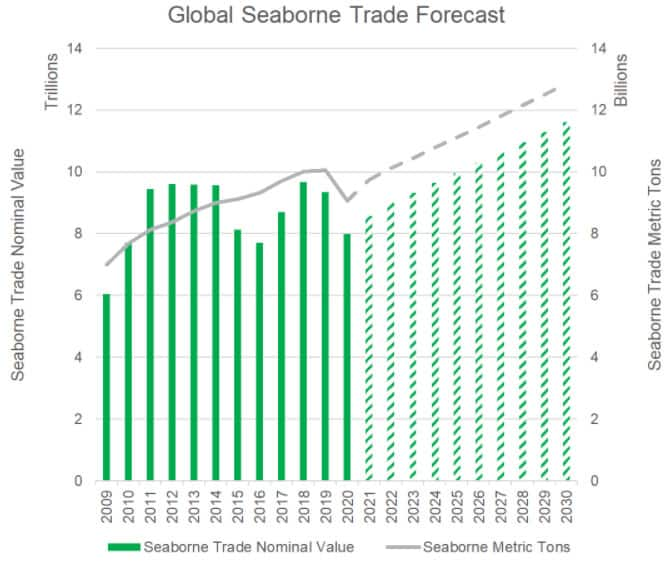

Forward planning with COVID-19 has proved difficult, with new variants, restrictions and long-term effects proving hard to predict. The Global Trade Atlas Forecast suggests recovery for the maritime industry in 2021 with seaborne trade forecasted a 6.9% growth rate from 2020 to 2021 (Figure 12).

Figure 12: Global Seaborne Trade Forecast Source: Global Trade Atlas Forecasting

Some of our key future predictions are:

Infection rates will remain high in January while effective treatments will be widely available in the first half of 2021.

Fully approved, effective vaccines will be available to large populations across several countries in mid-2021.

Financial stresses of households and businesses, crowd avoidance, eventual withdrawal of fiscal stimulus have potential to impede the post-crisis recovery.

Possible Economic risks that may give cause for concern include: potential for a more severe pandemic, a rise in tensions between the US and China, rising debt levels, geopolitical conflicts, or political uncertainties in many parts of the world.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

Posted 11 January 2021 by Alice Gladen, Consultant, Chemical Consulting, S&P Global Commodity Insights

How can our products help you?