Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Jan, 2026

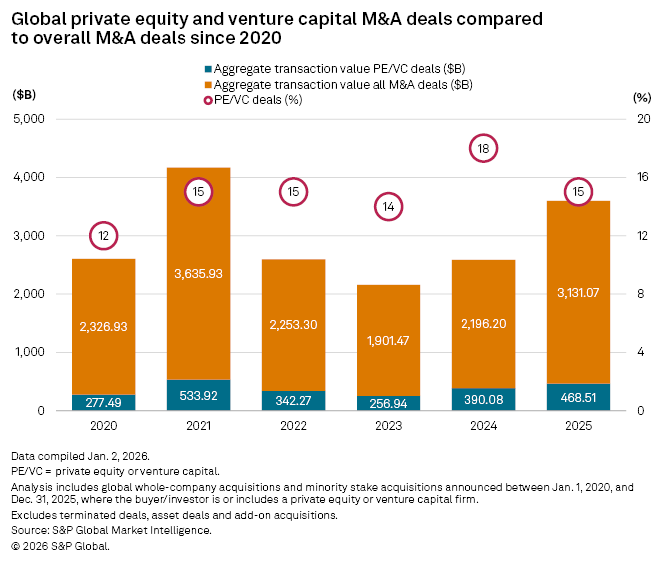

The value of global private equity and venture capital deals rose 42.57% year-on-year to $468.51 billion in 2025, as later-stage investments and middle market transactions added to large-scale buyout momentum.

Private equity and venture capital deals accounted for 15% of the total value of mergers and acquisitions globally, which reached $3.13 trillion in 2025, according to S&P Global Market Intelligence data.

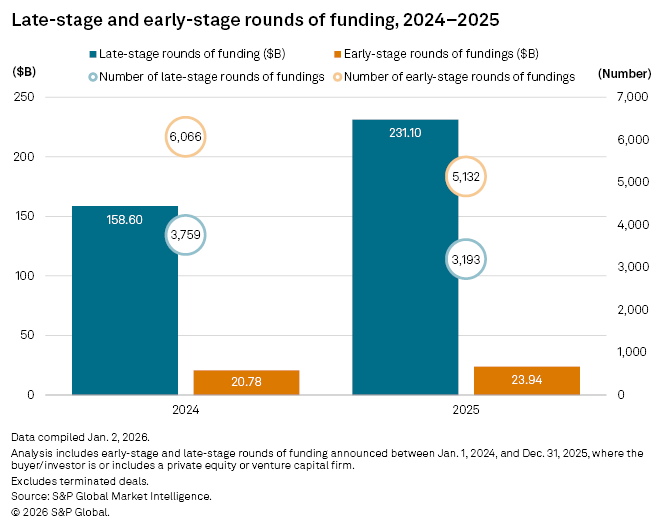

Data from Market Intelligence shows that in 2025, the value of late-stage rounds of funding, which include growth and mature rounds, rose 45.71% year-on-year to $231.1 billion from $158.6 billion in 2024.

The value of early-stage rounds also grew in 2025, albeit at a slower pace than late-stage deals. Early-stage deal value increased by 15.21% year-on-year to $23.94 billion from $20.78 billion in 2024.

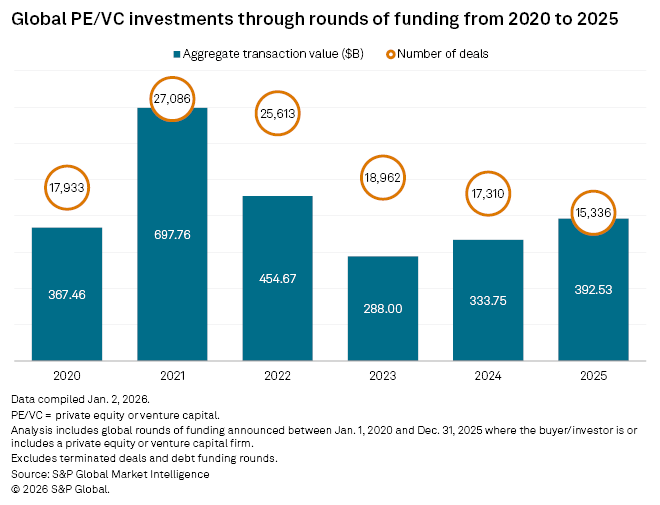

Globally, the value of rounds of funding rose 17.61% year-on-year to $392.53 billion in 2025.

Later-stage venture rounds and growth equity investments are likely to see the most activity from firms in 2026, said Dax Lim, partner at law firm Simmons & Simmons LLP, as investors look for companies with established business models and clearer exit paths.

Early-stage funding will continue, but Lim said investors will likely be selective and prioritize sectors such as artificial intelligence and healthcare technology.

Goh Hong Chuan, a partner in financial advisory at Forvis Mazars LLP in Singapore, said financial services will also be a focus sector next year.

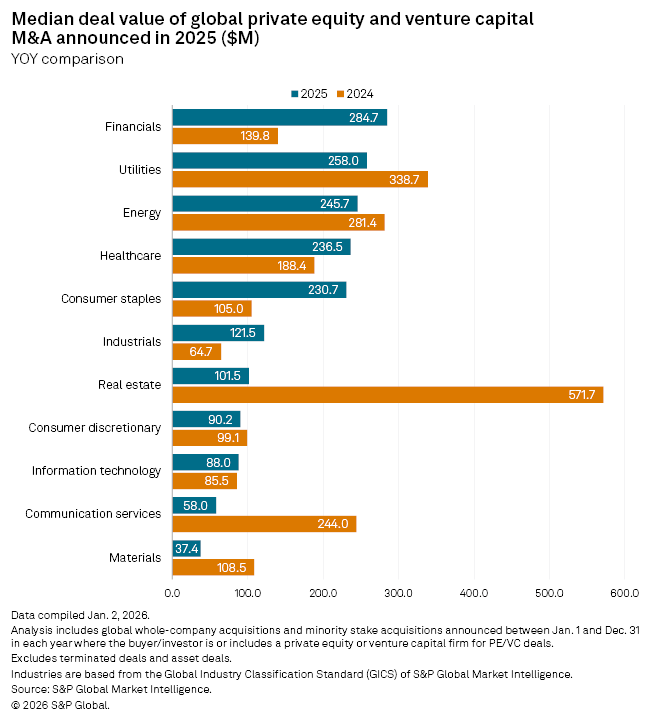

Median deal size

The financial sector was the top sector in terms of median deal value of global private equity and venture capital deals in 2025 at $284.7 million, up 103.65% year-on-year from $139.8 million in 2024.

Healthcare ranked fourth with a median deal value of $236.5 million, which represented a 25.53% year-on-year uptick from 2024's $188.3 million.

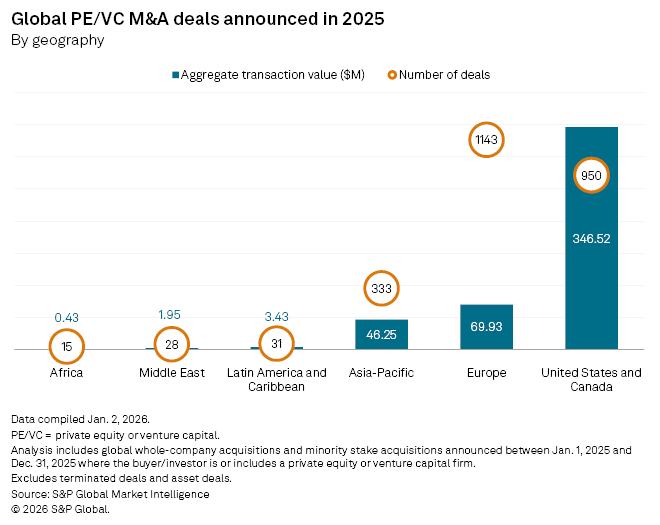

Geographically, Lim said North America and Europe remain key areas of private equity investment. The US and Canada led in deal value with $346.52 million across 950 deals, followed by Europe with $69.93 million from 1,143 deals and Asia-Pacific with $46.25 million from 333 deals, according to Market Intelligence data.

Lim said there has been heightened interest in European tech hubs and select Asian markets, where there is a supportive regulatory environment.

Goh added that Singapore's Equity Market Development Program, which helps de-risk the pathway to listing for mature portfolio companies, could boost late-stage deals in the city-state.

Among the features of the program are rebates and concessionary tax rates for companies seeking to list, the option for eligible local firms to pursue dual listings on the Singapore Exchange Ltd. and Nasdaq Inc. using a single set of offering documents and a shift to a disclosure-based listing regime.

– Download a spreadsheet with data featured in this story.

– Read more about private equity investment trends in Asia-Pacific.

– Be updated on the latest private equity deals.

Middle market over large buyouts

In 2025, middle market transactions were more prevalent than larger buyouts, a trend expected to persist, Lim said.

"Clients are finding that the middle market offers more manageable valuations and greater scope for operational improvements," he said, adding that large buyouts could become more viable with improved financing conditions.

Investors' focus on helping portfolio companies in areas such as operational efficiency and digital transformation will likely lead to more add-on acquisitions, growth equity, and minority stakes, especially in businesses with strong fundamentals in 2026, said Lim.

Overall, Josh Zweig, co-head of North American Private Equity Research at Cambridge Associates LLC, expects 2026 to have a better liquidity environment, given that investors and general partners are becoming more comfortable in deploying capital and seeking exits in the face of economic uncertainties.