Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Aug, 2025

By Brian Scheid

Points of weakness in one of the strongest domestic labor markets in generations are now expected to trigger the end of the US Federal Reserve's nearly nine-month standstill on interest rates.

In his highly anticipated speech in Jackson Hole, Wyoming, on Aug. 22, Fed Chairman Jerome Powell said the central bank remains on course toward its dual mandate for maximum employment and lower inflation, but "the balance of risks appears to be shifting."

Significantly higher tariffs and more stringent immigration policy are driving inflation up and slowing the supply and demand for workers, creating a "curious kind of balance" that could result in a steep rise in layoffs and unemployment, Powell said. At the same time, substantial changes in federal tax, spending and regulatory policies have boosted uncertainty, Powell said.

"In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside — a challenging situation," Powell said.

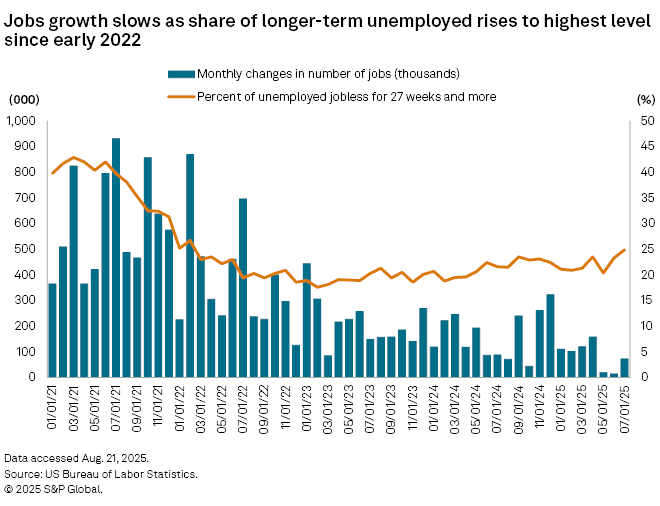

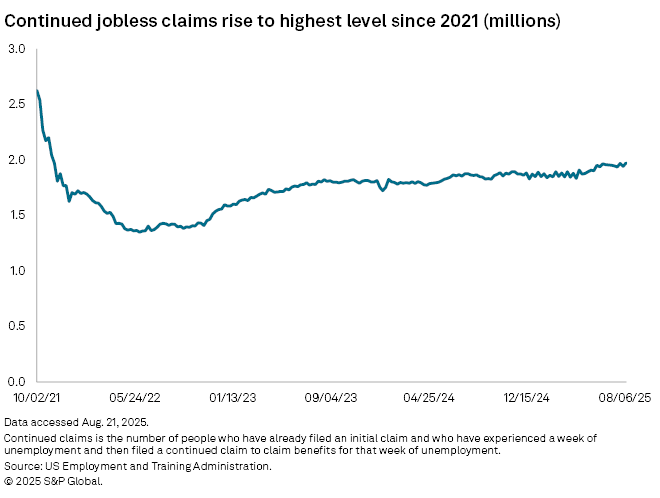

While unemployment has stayed steady, hiring has stalled, the share of those jobless for longer has risen, and job growth has plunged. Employment grew by 106,000 jobs from May through July, well below the 368,000 jobs created during the same three-month stretch a year earlier, according to the latest government data.

"The weakening labor market is a material change that merits a slightly easier stance, opening the door for a September rate cut," said Michael O'Rourke, chief market strategist at JonesTrading. "Beyond that, it is wait and see."

With inflation heating up and the job market cooling, the Fed's goals are "in tension," Powell said. While unemployment still remains a relatively low 4.2%, monetary policy remains restrictive and as the economic outlook changes "the shifting balance of risk may warrant adjusting our policy stance," Powell said.

These views could again shift, with the consumer price index (CPI) and jobs reports for August scheduled for release before the Sept. 16-17 meeting of the Fed's rate-setting Federal Open Market Committee. But, as for now, Powell has indicated that lower interest rates are near.

"The message is that barring a major shift in the data they will cut," said George Pearkes, a macro strategist at Bespoke Investment Group.

Inflation risk

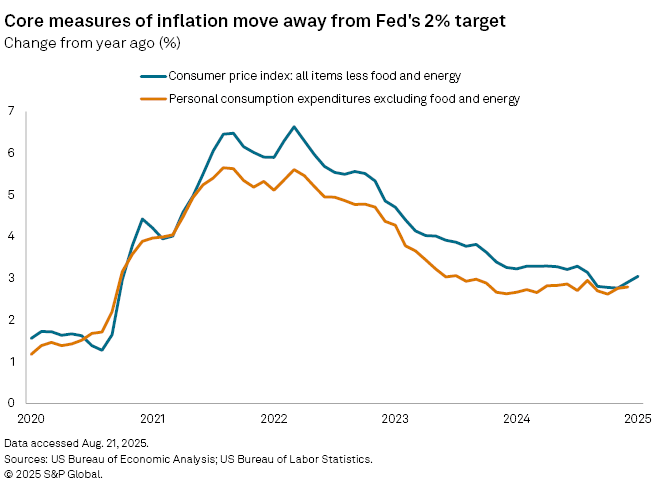

While much of Powell's speech stressed concern over the labor market, rising inflation remains the main obstacle for a rate cut in September with core consumer price inflation — a metric that excludes volatile food and energy prices — still about 100 basis points above the Fed's 2% target and other recent data showing mounting price pressures, said David Russell, global head of market strategy at TradeStation.

"A hot reading [on CPI] might revive worries about stagflation and push long rates higher," Russell said. "Other data like wages, unemployment and even retail sales have some potential impact, but CPI will likely dominate."

The Fed has not moved its benchmark federal funds rate from its current target of 4.25% to 4.5% since December 2024. Shortly after Powell's Jackson Hole speech, the odds of a 25-basis-point cut in September surged above 91% from 75% a day earlier, according to CME FedWatch. Nearly 40% of the futures market now expects three 25 bps cuts before year-end, up from about 20% a month earlier, according to CME FedWatch.

Powell's speech was a clear shift from his July 30 press conference, when the Fed voted to hold rates steady for the fifth straight meeting, said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

"His language was very downbeat on real-side employment risks and almost complacent on inflation," Tang said. "He seemed much more fearful of recession than of inflation accelerating, and now sees 4.5% policy as 'restrictive,' not just modestly so."

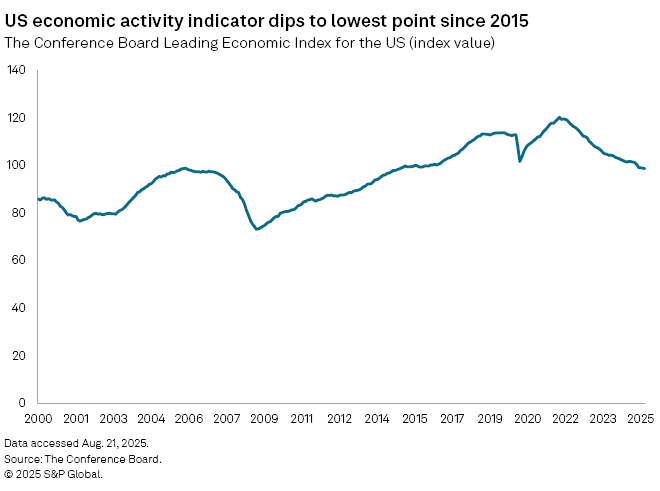

On Aug. 21, The Conference Board reported that its Leading Economic Index for the US, a tool aimed at forecasting business cycle turning points roughly seven months before they occur, fell to its lowest level since March 2015.

The index bases its forecast on 10 economic components, including S&P 500 performance, the spread between the 10-year US Treasury bond yield and the federal funds rate, an average of consumer expectations and building permits for new housing.

The index was weighed down by pessimistic consumer expectations for business conditions and weak new orders for consumer goods and materials, and is now signaling that a recession is nearing, said Justyna Zabinska-La Monica, The Conference Board's senior manager, business cycle indicators, in a statement.

"The Conference Board does not currently project a recession, though we do expect the economy to weaken in [the second half of] 2025, as the negative impacts from tariffs become more visible," Zabinska-La Monica said.