Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jul, 2025

By Brian Scheid

The S&P 500 hit multiple record highs over the past month, rallying against US policy uncertainty, but experts warn that the market bubble could be reaching bursting point.

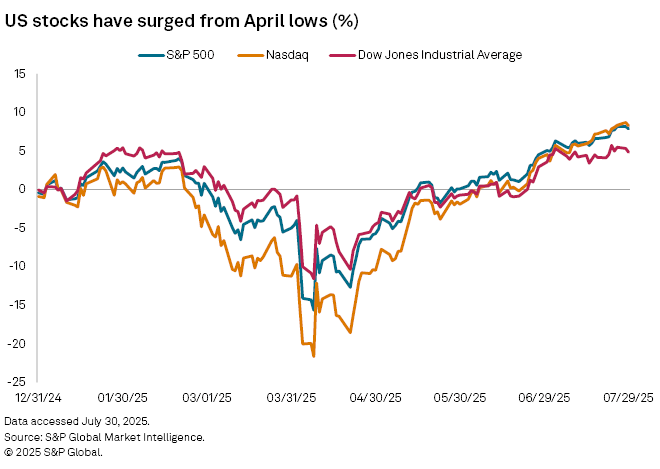

On June 27, the S&P 500 settled at a record high for the first time in 128 days, hitting record highs another 11 times since then and posting a new record every day in the week of July 20. This record-breaking rally in US stocks has taken place amid a groundswell of policy uncertainty, including higher tariffs and stricter immigration enforcement, volatile geopolitics, inflation that refuses to cool and a job market showing signs of strain.

As stocks continue to rally in spite of it all, investors fear that a bubble has formed, with some bracing for it to burst soon, economists and market strategists said.

"With the current bubble, there is more confirming evidence of the existence of a bubble than you can shake a stick at," said Steve H. Hanke, a professor of applied economics at Johns Hopkins University.

"But the problem with bubbles is that it is next to impossible to predict when they will pop, or whether the air will simply be released slowly as markets adjust to more realistic valuations."

Since falling to an April trough over worries about President Donald Trump's push to raise tariffs to historically high levels, the S&P 500 has surged close to 30%. The sentiment that drives the market has shifted quickly to bullish from bearish, and now appears to be close to a speculative frenzy as new headlines of war, torpid economic data and middling consumer confidence are met with increasing stock gains, Hanke said.

"No matter what the news, the market just goes up," Hanke said.

Michael O'Rourke, chief market strategist at JonesTrading, said the S&P 500 is now trading at a record 188% of US GDP, well above the 177% peak in late 2021 and the 125% peak during the dot-com bubble in 2000.

The recent resurgence of meme stock trading — where retail investors target heavily shorted, low-priced stocks — is an argument that the market has reached bubble status, O'Rourke said. Shares of GoPro Inc., Kohl's Corp. and Krispy Kreme Inc. saw steep and sudden price increases in July, similar to the sudden rallies GameStop Corp. and AMC Entertainment Holdings Inc. saw in 2021, at the height of the meme stock craze.

"We are not seeing investment based on earnings power, it is speculation counting on greater fools," O'Rourke said. "The stock market has become a caricature of investing."

AI narrative

Every market bubble in modern history has been backed by a narrative, such as the financial viability of the internet, which bolstered the dot-com bubble, and the sweeping pull of earnings potential in real estate, which led to the 2008–2009 financial crisis, said Tyler Richey, co-editor of Sevens Report Research.

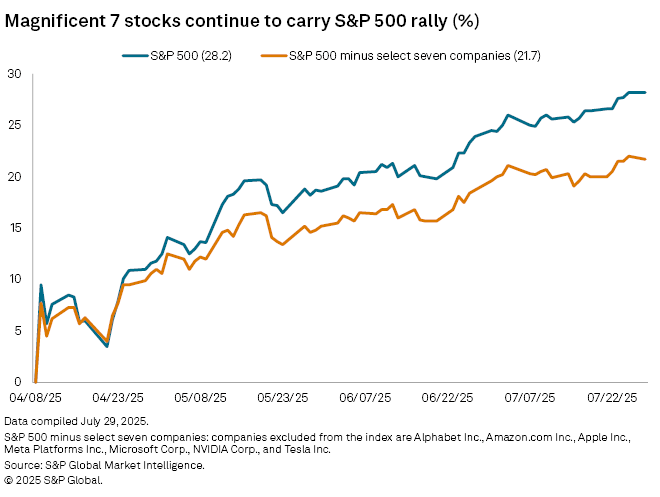

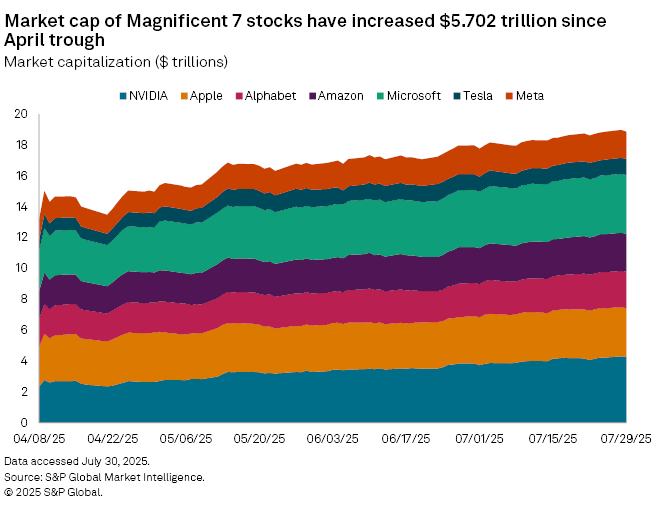

The bubble-inflating theme now is likely the promise of AI technology, as tech stocks have seen outsize gains in stock prices and valuations. NVIDIA Corp., a proxy for the health of the AI trade, saw its market capitalization cross $4 trillion in July. NVIDIA's market cap increased $1.933 trillion since the market bottomed in April.

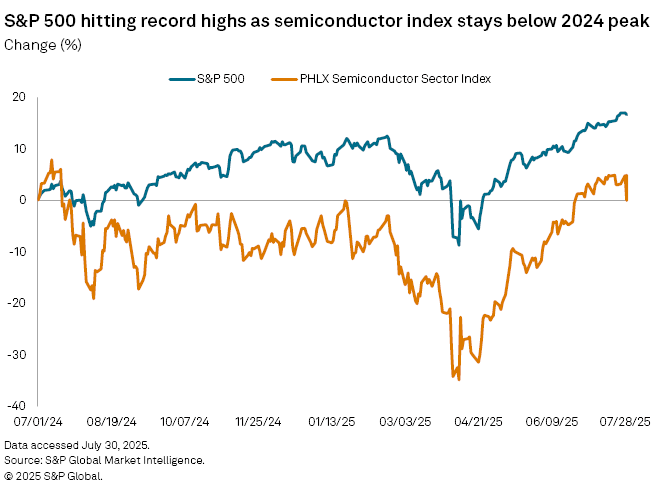

Still, the robust health of NVIDIA is likely an extreme outlier, Richey believes, as the broader-based semiconductor index — which includes other major AI chipmakers such as Advanced Micro Devices Inc., Qualcomm Inc., Micron Technology Inc., Broadcom Inc. and Marvell Technology Inc. — remains below both its July 2024 high and the S&P 500.

Richey compared the relative performance of the semiconductor index over the past 12 months to the Road Runner in the "Looney Tunes" cartoon series and the S&P 500 to the Wile E. Coyote character. The semiconductor index has now stopped abruptly at the edge of a cliff, while the S&P 500 has gone screeching off the side "to face the laws of gravity," Richey said.

"A downward force that the broader stock market could very well be on the brink of facing itself," Richey added.

Multidecade extremes in the relative strength of equity indexes, imbalances in the technical outlook for market sectors and a downside divergence in investor sentiment reading despite market highs are signs that the equities bubble could burst soon, according to Richey.

No disconnect

Still, the rally could have more room to run.

"Current S&P 500 valuations and price levels do not seem disconnected from today's economic conditions, corporate earnings or consumer strength," said Adam Hetts, global head of multi-asset and portfolio manager at Janus Henderson. "Although high valuations warrant increased vigilance in security selection, this market continues to be broadly justified by fundamentals."

The market appears content to continue to break new highs despite the headwinds of US economic policy and other global events.

"The market has shown remarkable resilience this year," Hetts said.