Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Jul, 2025

By Brian Scheid

Tariffs, threats to the Federal Reserve's independence, rising US debt and fears of worsening inflation have caused the US dollar to log its worst first-half performance in more than five decades.

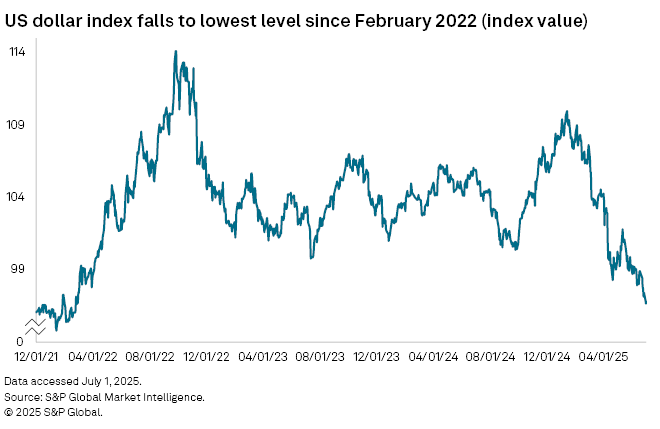

The US dollar index, which tracks the dollar against a basket of its currency peers, has fallen about 10.8% since the start of the year. That marks its worst first six months of a year since 1973. The greenback now sits at its lowest levels since February 2022 and stands to weaken further, according to currency strategists.

Shortly before President Donald Trump won his second presidential victory, the dollar was at its highest since 1984 in real effective exchange rate terms, which measures the value of the dollar against a weighted average of several foreign currencies. Once Trump moved into the White House once again, the dollar began a steep decline.

"The trigger for the move may have been uncertainties over the policy outlook, on trade in particular, but the erratic nature of policy formation as well," said Derek Halpenny, managing director and head of research with MUFG Bank.

In real effective exchange rate terms, the dollar remains more than 15% above the long-term average since its 1973 low, providing "ample scope for further decline," he added.

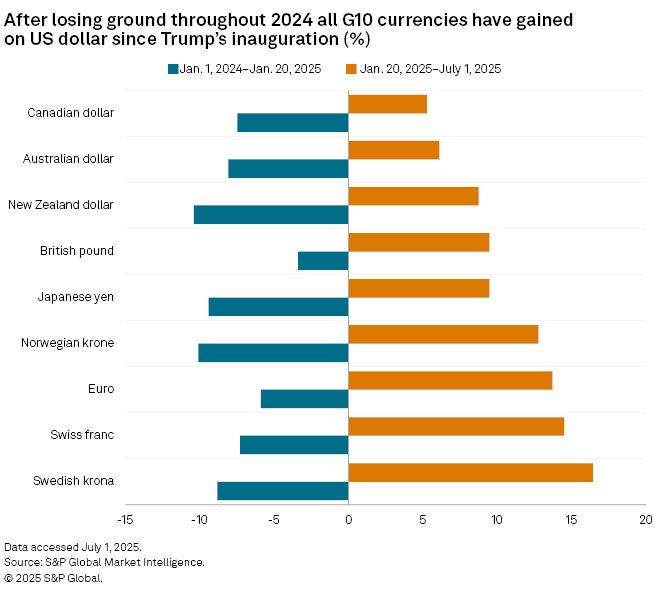

Since Trump's inauguration, the dollar has fallen against all of its G10 currency peers, including roughly 10% declines to the New Zealand dollar, Norwegian krone and the Japanese yen.

Structural drag

The dollar's slide comes amid rising risk of US stagflation; a combination of high inflation and unemployment and slow economic growth; and waning confidence in US trade, fiscal and security policies, said Elias Haddad, a global macro strategist with Brown Brothers Harriman. The Trump administration implicitly supports a weaker dollar and the president's ongoing push to get the Fed to cut interest rates poses a threat to the US currency, Haddad said.

While the US dollar is unlikely to lose its position as the world's reserve currency or its status as a safe haven for global investors in the near term, current conditions pose a "structural drag."

"By all measures the dollar dominates on the international stage as a store of value, medium of exchange, and unit of account," Haddad said. "However, loss of confidence in US trade, fiscal, and security policies, and political meddling with the Fed's independence threaten to accelerate the dollar's declining role as the primary reserve currency."

Haddad expects the euro, the renminbi and gold to gain a more prominent role in coming months.

Data dependent

While trade, debt and a higher demand for US dollar hedging have all weighed on the dollar for the last year, recent weakness has largely been due to expectations for lower interest rates, said Francesco Pesole, a foreign exchange strategist with ING. The dollar's near-term path will hinge on US labor market data, according to Pesole.

"If jobs data deteriorate materially, those dovish bets will be validated, and the dollar should stay pressured," he said. "We think instead that the jobs market will continue to slow only gradually and that a tariff-led inflation bump in the coming months will force markets to price out a September Fed cut."

Any perceived reduction in the Fed's independence from political pressures could drive the dollar down further, said Jane Foley, managing director and head of foreign exchange strategy with Rabobank.

"If Fed independence prevails, the US dollar should find some support," Foley said. "Indeed, if US data remains more robust than expected, the dollar should benefit from some short-covering pressure."

The dollar's overall performance this year will likely depend on how the domestic economy performs. A dollar rally could be possible if the economy proves more resilient than expected, said Halpenny with MUFG.

"We should not rule this prospect out," Halpenny said. "The US economy keeps proving forecasters wrong."

Still, consumer sentiment remains low, post-pandemic excess savings are gone and there is little to fuel strong consumer spending in the second half of this year, indicating further dollar declines.

"If the labor market weakens and income growth slows further, the economy will be a lot weaker," Halpenny said.