Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Jul, 2025

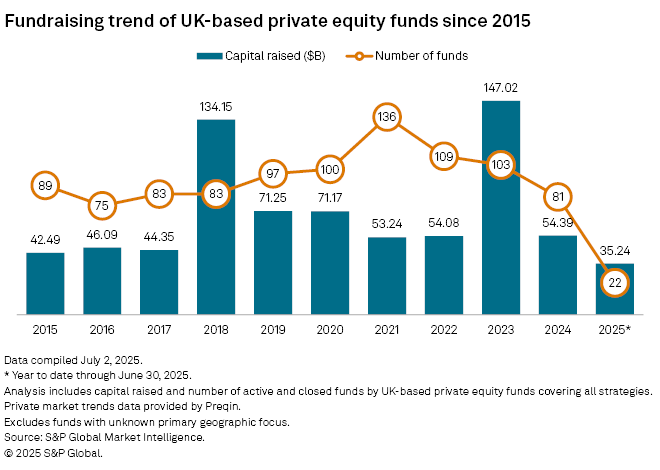

Private equity fundraising in the UK grew 2.6% to $35.24 billion in the first half compared to $34.35 billion in the same period in 2024, according to S&P Global Market Intelligence data.

The number of active and closed funds dropped to 22 from 49 in the first half of 2024.

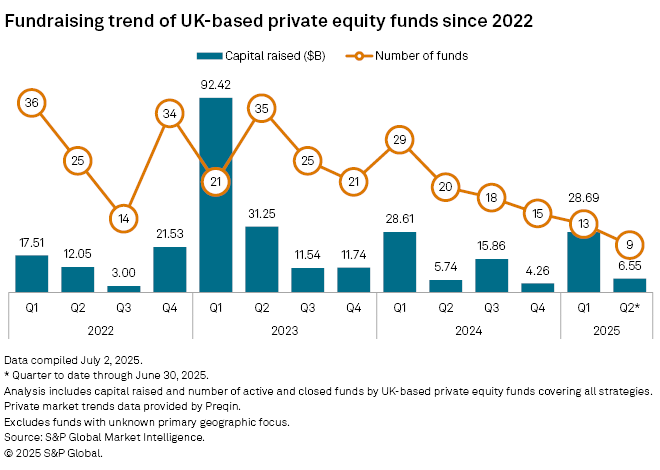

In the second quarter, fundraising climbed to $6.55 billion, up 14% from the $5.74 billion collected in the same period in 2024. The number of funds decreased to nine from 20 the previous year.

– Download a spreadsheet with data in this story.

– Read about private equity secondaries fundraising.

– Explore more private equity coverage.

Exit impact

Slow fundraising results from a sluggish PE cycle.

"Exits have been tough to come by. The M&A market has been slower, and the IPO window shutting has had a bigger impact on the larger managers," said Michael Henningsen, managing director at placement agent Raymond James Private Capital Advisory.

Private equity-backed exit deal value in the UK decreased to $11.01 billion in the first six months of 2025 from $16.24 billion in the same period a year ago, according to Market Intelligence data.

Globally, private equity exits fell to their lowest level in two years in the first quarter as tariff-related concerns rattled markets.

"Smaller mid-market funds are a little bit insulated from [macroeconomic uncertainty] in the sense that they're not raising as much capital," Henningsen said, adding that middle-market fund managers enjoy relatively healthy liquidity compared to larger managers.

Largest UK fund closes

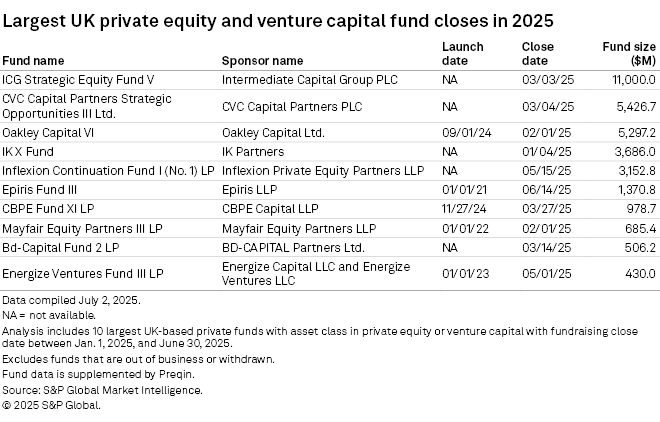

Six private equity funds made their final close in the first half with at least $1 billion in capital.

The largest UK-based private equity fund was Intermediate Capital Group PLC's ICG Strategic Equity Fund V, which raised $11 billion at its close in March.

CVC Capital Partners PLC's CVC Capital Partners Strategic Opportunities III Ltd. was second, with $5.43 billion in commitments at its close.

The largest active fund based in the UK is CVC's Glendower Capital Secondary Opportunities Fund VI Scsp, which has so far raised $1.87 billion.

Gresham Partners LLC has so far raised $1.85 billion for its Gresham Private Equity Strategies LP.