Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 Jul, 2025

By Brian Scheid and Gaurang Dholakia

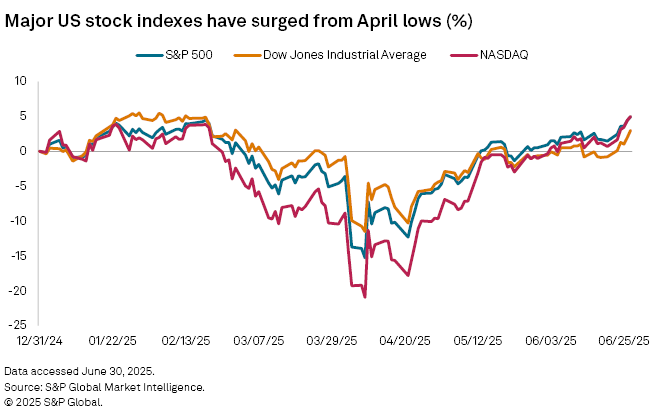

A moribund spring for equities has quickly transitioned into a scorching summer as the S&P 500 has hit new record highs and investors appear undeterred by tariffs or geopolitical uncertainty.

"Despite the constant barrage of trade- and geopolitical-driven headlines, the market continues to shrug off any news of what is or what could go wrong," said Bret Kenwell, a US investment and options analyst with eToro. "Lacking any major disruptions in early July, it's possible that stocks may continue to melt higher before investors turn their attention to the second half of the month, when we get to earnings season and the [Federal Reserve's] next meeting."

The S&P 500 finished the first half of the year at an all-time high of 6,204.95, up 24.5% from its April 8 low.

After reaching its previous record high Feb. 19, the S&P 500 tumbled 18.9% in less than two months, hitting its lowest point of the year shortly after President Donald Trump unveiled plans to significantly boost tariffs on nearly all global trading partners. Since then, however, the worst fears on the impacts of those tariffs have eased, market participants have been unmoved by the US bombing Iran, inflation has moderated, and unemployment remains at the same level it was a year ago.

"The pundits on Wall Street spent all of April and May hating and disavowing the rally," said Paul Schatz, founder and president of Heritage Capital. "Sentiment was fearful, despondent and terrified. Fast forward to now, sentiment is heading towards giddy and greedy. Wall Street pundits are once again chasing their tails to raise their year-end forecasts."

Market momentum stems from the pullback of the "more extreme" tariffs, particularly those on China and some lower inflation data, which has altered interest rate expectations and made it possible that the Fed will lower rates by as much as 75 basis points before the end of this year, said Sonu Varghese, vice president and global macro strategist with Carson Wealth.

"That's a lot for just six months and a tailwind for equities too," Varghese said.

While the Republican tax cut and spending bill making its way through Congress is expected to further increase deficits to an estimated 7% of GDP this year and 7.5% in 2026, that will likely boost aggregate corporate profits, Varghese said.

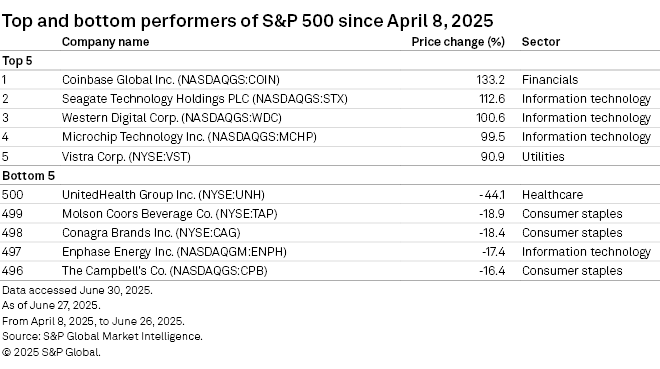

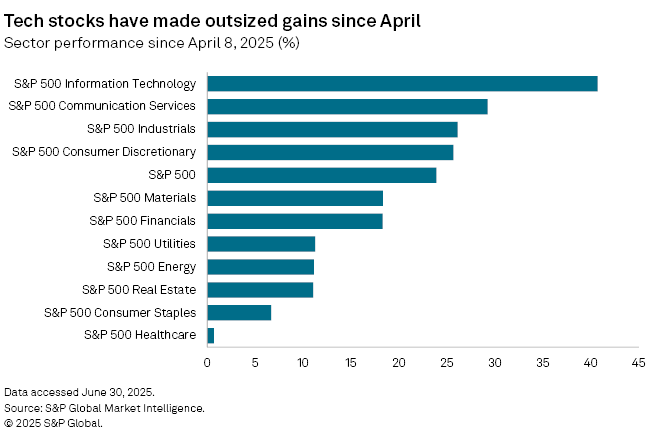

The ongoing rally is partly fueled by the outperformance of tech stocks, with the S&P 500 information technology sector and its communication services sector well outpacing the broader market.

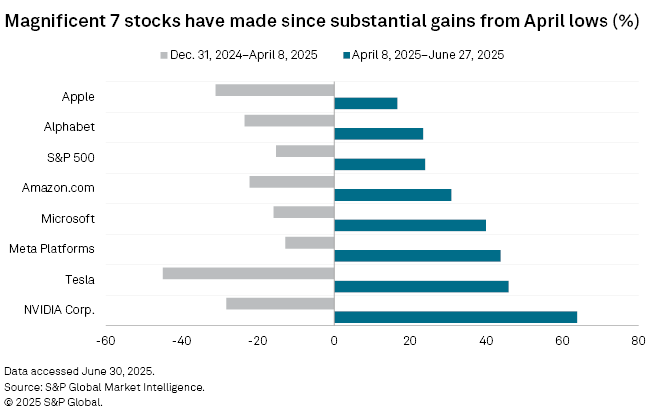

Five of the S&P 500's mega-cap stocks, a group collectively known as the Magnificent Seven, have outperformed the broader index from the April 8 low, especially NVIDIA Corp., which has rallied more than 63%.

However, with consumer spending on services cooling, hiring slowing, the housing market struggling with higher interest rates, and US manufacturing strolling with rates and tariff uncertainty, there are signs that the ongoing stock market rally could soon fizzle out.

"There are some cracks developing in the economy," Varghese said.

Typically an external shock, such as Trump's tariff announcement in early April, is what derails a rally, Varghese said. But the tariff risk is always present and multiple factors, including manufacturing, housing and hiring, are all grinding down at once.

"If these get worse, we'll likely see more rate cuts. So the question is really how far behind the curve the Fed will be if the data does get progressively worse," Varghese said.