Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jul, 2025

By Brian Scheid and Umer Khan

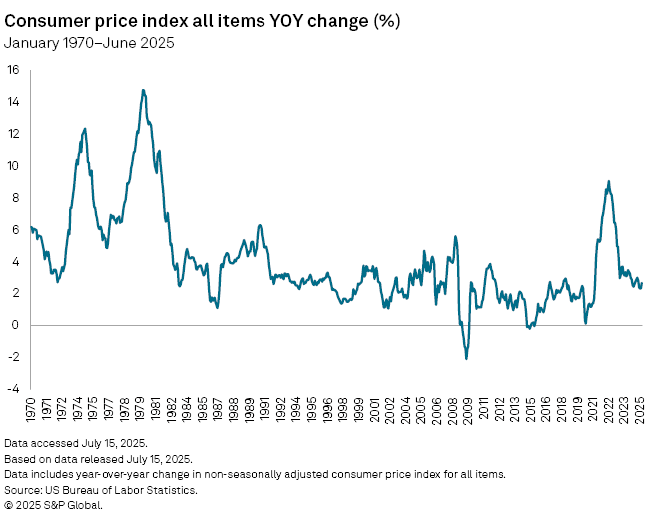

Inflation is moving higher and the impact of tariffs are only beginning to show up in government data, likely keeping interest rates on hold as Federal Reserve officials appear increasingly unlikely to ease monetary policy this summer.

The consumer price index, the market's preferred inflation metric, increased 2.7% from June 2024 to June 2025, its largest annual increase since February, the US Bureau of Labor Statistics reported July 15. Core inflation, which strips out volatile energy and food prices, jumped 2.9% from June 2024, also its largest annual increase since February.

The Fed wants annual core inflation to show meaningful progress lower, near a 2% target, before cutting rates. But inflation is now moving in the wrong direction and could worsen as tariffs take effect in the coming months.

Nearly 98% of the futures market on July 15 expected the rate-setting Federal Open Market Committee (FOMC) to hold its benchmark federal funds rate at the current target of 4.25%-4.5% when its next meeting concludes July 30, according to CME FedWatch. About 44% of the market also expected the Fed to keep rates unchanged after its September meeting, up from less than 29% a month ago.

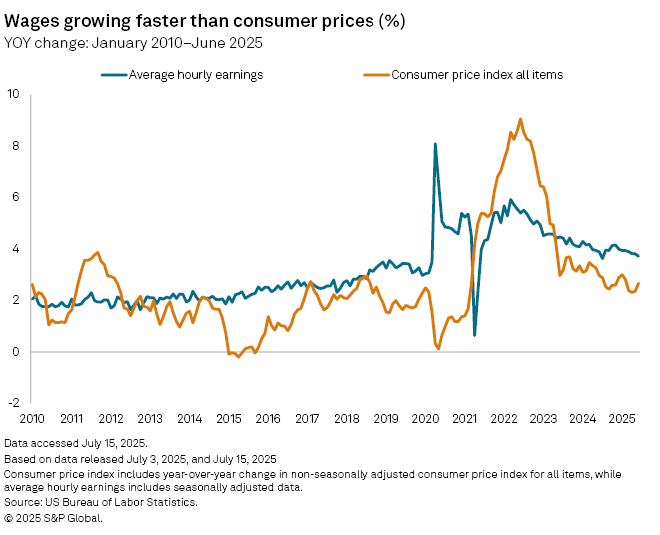

"The summer is really the crux. The FOMC needs to be assured inflation and inflation expectations are not rising or at least not uncontrollably," said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics. "At the same time, a worsening labor market could tip the scales for easing."

Fed Chairman Jerome Powell has repeatedly cautioned that the Fed is unlikely to change rates until it sees the full extent of tariffs on inflation, but a slowdown in the domestic jobs market could compel officials to move sooner.

"Tariff increases have yet to fully work their way through the data," said Kathy Jones, managing director and chief fixed income strategist at the Schwab Center for Financial Research. "We continue to think that the Fed will most likely cut in September in response to weakening labor market data, rather than inflation."

With the Fed getting pressured by the White House to cut rates, it could move well before that 2% inflation target is reached, according to David Russell, global head of market strategy at TradeStation.

"Markets think they'll act in September, so Powell might have to get more hawkish in his comments if he wants to change that expectation," Russell said. "That, in turn, could lead to more conflict with the White House."

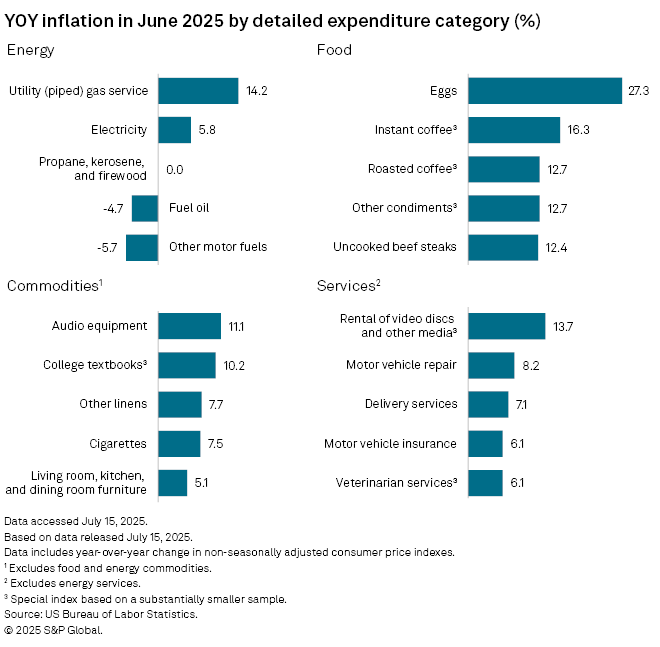

As for June inflation data, economists said there were some early signs of the tariffs on prices.

The price of goods categories that rely on imports, such as audio equipment and furniture, have risen steeply from a year ago.

"Tariff impacts are visible under the hood if you look at several CPI components," said Oren Klachkin, a financial market economist at Nationwide. "We think the bulk of the tariff pass-through will happen over the summer and into the fall."

Still, aside from absorbing the higher tariff costs into their margins, companies may use other strategies to reduce the need to pass through the tariffs to their customers, boosting the risk that inflation may not increase as much as many expect, Klachkin said.

For now, the June consumer price index report likely validated the Fed's decision to "wait and see" on rates, said Bret Kenwell, an investment and options analyst at eToro.

"Now the Fed will have to see whether those increases are a one-off blip or if more significant price increases are on the horizon," Kenwell said. "Ultimately, if inflation remains under control, the Fed could move forward with rate cuts — and could potentially do so as soon as September. However, if future reports suggest otherwise, the Fed may need to delay its next cut even further."