Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Jun, 2025

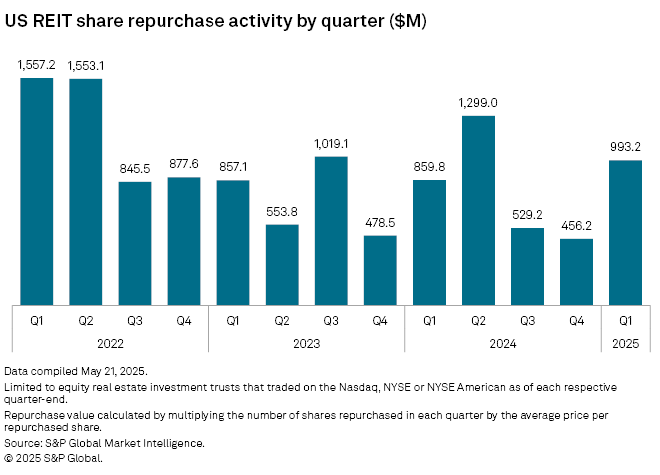

Share buyback activity by US equity real estate investment trusts more than doubled in the first quarter, according to an analysis by S&P Global Market Intelligence.

The US REIT sector bought back around $993.2 million in common stock in the period, more than twice as much as the $456.2 million in the fourth quarter of 2024 and up 15.5% year over year.

This analysis includes equity REITs that traded on the Nasdaq, NYSE or NYSE American.

Largest common stock repurchases

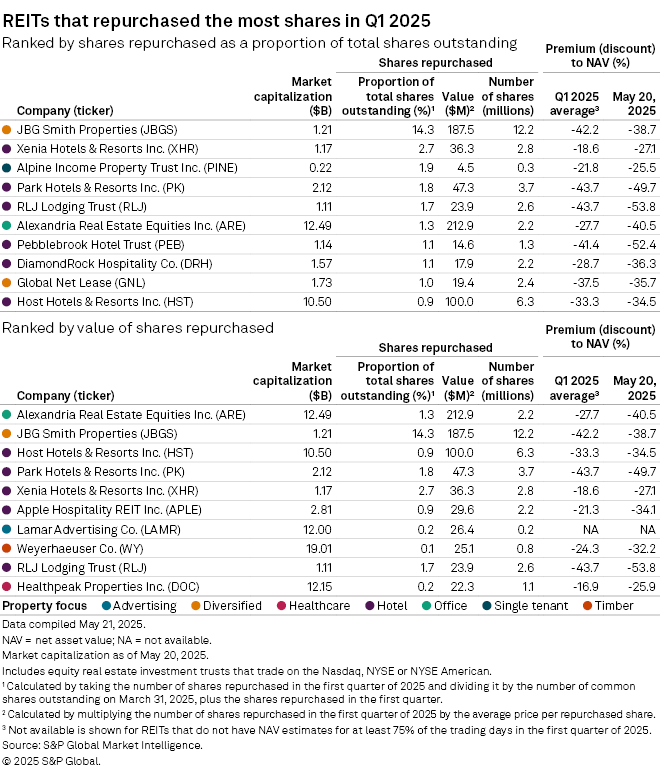

Office landlord Alexandria Real Estate Equities Inc. was the biggest repurchaser in the quarter from a value standpoint, buying back $212.9 million of its common stock. The 2.2 million shares it repurchased represented approximately 1.3% of its total shares outstanding.

JBG Smith Properties was the most active repurchaser in terms of proportion to total shares outstanding. The diversified REIT bought back 12.2 million common shares for approximately $187.5 million, representing about 14.3% of its total outstanding shares.

Xenia Hotels & Resorts Inc. bought back 2.8 million common shares during the first quarter for about $36.3 million, representing about 2.7% of its total common stock outstanding.

– Set email alerts for future Data Dispatch articles.

– Read other Data Dispatch articles by S&P Global Market Intelligence.

– Explore more real estate coverage.

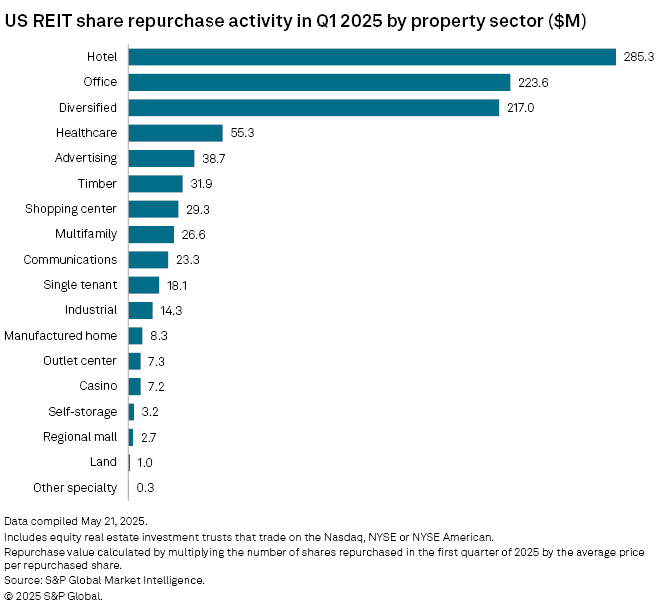

Among all property sectors, hotel REITs were the biggest repurchasers, buying back $285.3 million in shares during the first quarter. Host Hotels & Resorts Inc. bought back nearly $100.0 million of its common stock, Park Hotels & Resorts Inc. repurchased $47.3 million, Apple Hospitality REIT Inc. bought back $29.6 million and RLJ Lodging Trust repurchased $23.9 million of its shares.

The office and diversified sectors followed the hotel sector, repurchasing $223.6 million and $217.0 million in common shares, respectively.

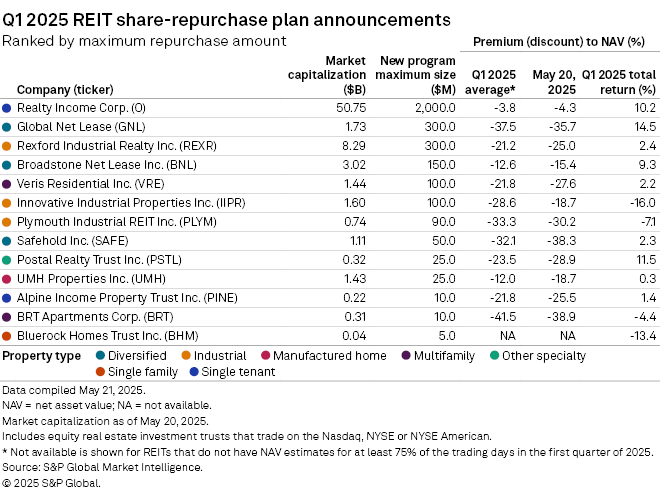

13 new buyback plans

More than a dozen REITs announced new share repurchase programs during the first quarter.

The largest new share plan announced was from single tenant REIT Realty Income Corp., as its board in February authorized the repurchase of up to $2.0 billion of its shares Diversified REIT Global Net Lease's board in March approved the company to buy back about $300 million; industrial-focused Rexford Industrial Realty Inc.'s board authorized a program of the same amount.

Diversified REIT Broadstone Net Lease Inc.'s board re-authorized a repurchase of up to $150 million in common shares, while the boards of multifamily-focused Veris Residential, Inc. and industrial REIT Innovative Industrial Properties Inc.'s authorized buyback plans of up to $100 million.