Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jun, 2025

Global private equity buyouts of corporate units, also known as carve-outs, have increased as corporations focus on balance sheets in an environment of shifting taxes, regulations and tariffs.

Private equity asset and business unit acquisitions amounted to $23.72 billion across 145 deals between Jan. 1 and June 3, higher than the roughly $19.37 billion across 127 carve-outs in the first five months of 2024, according to S&P Global Market Intelligence data.

"A lot of corporates are reassessing their priorities and refocusing on core operations. And because of that, they're divesting noncore operations," said Bob Rivollier, partner at Ropes & Gray LLP, citing tax and regulatory changes and tariffs as drivers.

Rivollier expects more private equity carve-outs for the rest of the year, with a number of regulator-forced divestitures already underway that will create opportunities for private equity.

"We're seeing more forced divestitures from an antitrust perspective," Rivollier said. "There's a number of transactions and strategic combinations that are in the market right now that are going through [Federal Trade Commission] or [Department of Justice] review, and where as part of the government's approval of the transaction, they're requiring divestitures."

On the buying end, private equity is motivated to pursue deals due to ample committed yet unused capital. Private equity dry powder as of mid-June stood at $2.51 trillion, up from $2.42 trillion as of the end of 2024, according to Market Intelligence data.

"You have a whole private equity industry that is trying to do deals and deploy capital, and you combine that with corporates that are increasingly divesting noncore operations. You take those two together, you'll see an increasing volume," Rivollier said.

– Download a spreadsheet with data featured in this story.

– Catch up on private equity deals in May.

– Read about private equity trends in Japan.

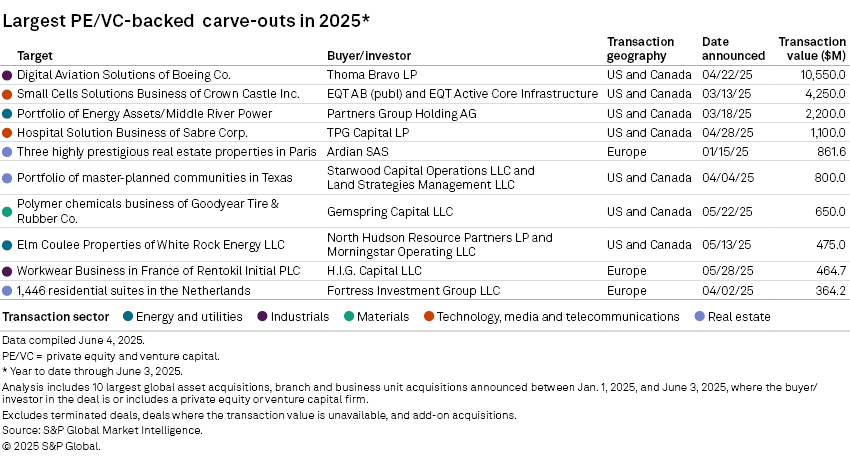

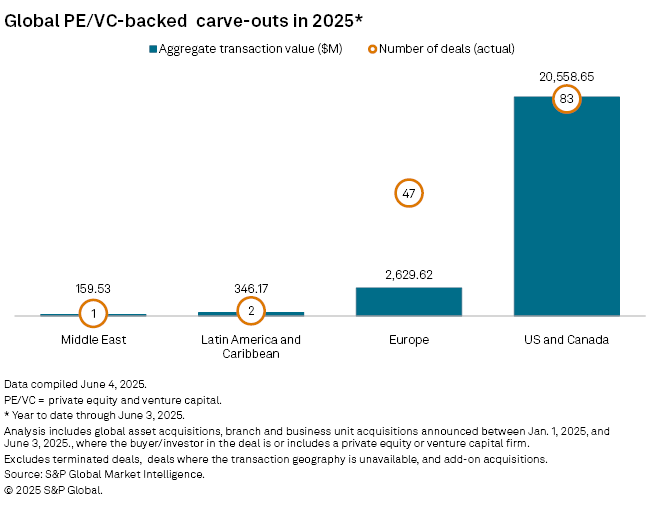

The US and Canada had the highest private equity carve-out deal value and volume in 2025, with 83 transactions totaling about $20.56 billion. Europe was a far second with roughly $2.63 billion across 47 deals.

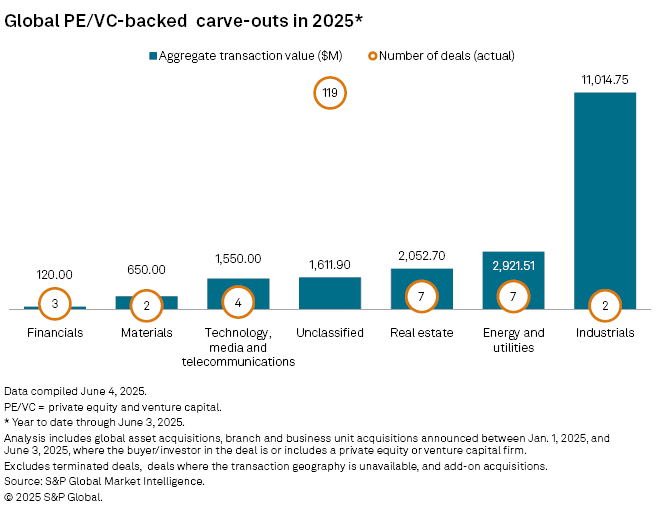

Industrials had the highest deal value with two transactions totaling about $11.01 billion in 2025. Energy and utilities ranked the second-largest sector with about $2.92 billion across seven deals.

Largest private equity carve-outs

The largest private equity carve-out announced so far in 2025 is Thoma Bravo LP's proposed $10.55 billion acquisition of portions of the digital aviation solutions business of US airplane manufacturer The Boeing Co.

EQT AB (publ)'s $4.25 billion deal to acquire the small cells solutions business of Houston-based cell tower operator Crown Castle Inc. via the Swedish firm's EQT Active Core Infrastructure fund is the second-largest carve-out deal of the year so far.

The third largest is Partners Group Holding AG's $2.2 billion acquisition of a California portfolio of 11 natural gas power plants and operator Middle River Power from a fund managed by Avenue Capital Group LLC.