Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jun, 2025

By Audrey Elsberry and Ronamil Portes

Analysts say Park National Corp. is close to finding a partner that will end its years-long streak of hovering just below the $10 billion asset cap.

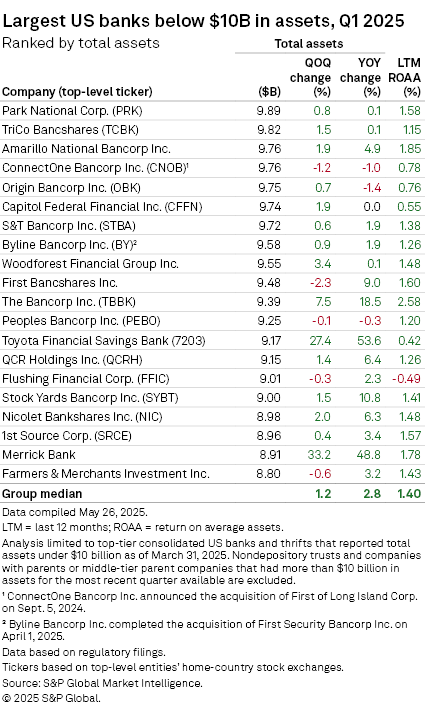

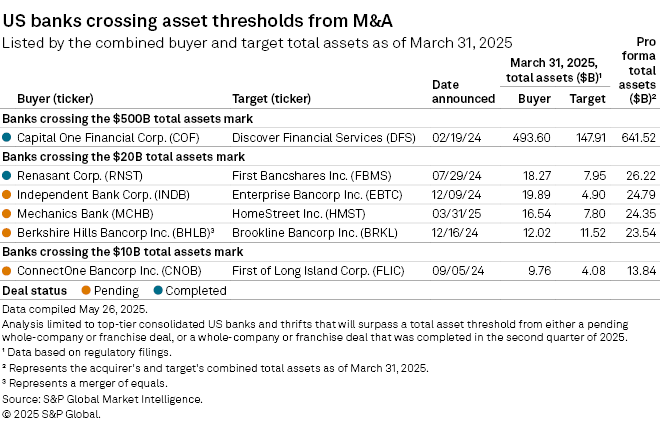

Park National has maintained full-year total assets of more than $9 billion since 2020 and more than $9.8 billion since 2022, according to S&P Global Market Intelligence. As of the end of the first quarter, it was the closest US bank to crossing the threshold, followed by TriCo Bancshares, Amarillo National Bancorp Inc. and ConnectOne Bancorp Inc..

Park National has stagnated its assets in order to find the most advantageous method of crossing the $10 billion asset threshold, and an acquisition is its most likely path across, analysts covering the bank said in interviews.

Park National is engaged in four to five active discussions with potential M&A targets to catapult its assets over the $10 billion threshold, Piper Sandler analyst Nathan Race said in an interview, adding that the targets are likely between $2 billion and $5 billion in assets. The bank's management is picky about which institution they want to partner with, favoring a management team that would want to stay on with the combined company, Janney Montgomery Scott analyst Christopher Marinac said in an interview.

"I feel like this next 12 to 18 months, is probably when the dam breaks," Marinac said. "You could see the company doing multiple acquisitions just because they're looking at a lot. They do want to expand. It's just a question of kind of when the right time and opportunity comes into focus."

Park National, which does not hold public quarterly earnings calls, did not respond to requests for comment.

Regulatory changes

Crossing the $10 billion asset threshold comes with increased regulatory scrutiny and oversight and makes banks subject to the Durbin Amendment, which limits debit card processing fees. An acquisition of a bank with at least $1 billion in assets would provide the capital, clients and scale to comfortably pass the threshold.

While some banks still have to advance strategically past the asset mark for now, regulators could have it on their agenda to raise the asset mark to $15 billion or $25 billion eventually, analysts said.

"I don't know that it's high on the priority list, but I do think it's on the list," Marinac said. "It's high time for them to kind of at least index it for inflation. That would take $10 billion to $14 billion. That would make a lot of sense."

The new leadership at the FDIC and the Federal Reserve could be instrumental in bringing about such changes to incentivize banks of Park National's size to grow and lend more, Marinac said. There has been increased optimism about the idea of upping the threshold, Keefe Bruyette & Woods analyst Damon DelMonte said in an interview.

"You can make an argument that maybe $100 billion is much more significant because if you were to fail at $101 billion in assets versus $11 billion, that would be more detrimental to the system as a whole," DelMonte said.

– Set email alerts for future Data Dispatch articles.

– Download a template to generate a bank's regulatory profile.

– Download a template to compare a bank's financials to industry aggregate totals.

M&A musings

Park National would probably want to spend 25% or 30% of its market cap at most on a target, but smaller deals are more likely, Marinac said. Its last acquisition was Spartanburg, South Carolina-based CAB Financial Corp. in 2019, so the Carolinas and the broader Southeast are likely areas that Park National's management is considering for its next deal, in addition to metro areas in Kentucky, Louisville and Ohio, where the company is headquartered, analysts said.

A potential target's credit quality is highly important to Park National. Park National had major credit issues after its 2006 acquisition of Vision Bancshares Inc., which "left a bad taste in their mouth in terms of acquiring a franchise where credit quality was going to impair the combined franchise for several years to come," Race said.

Park National could announce a transaction by the end of 2025, but there is also a chance that a deal announcement could take several quarters, Marinac said. Analysts said the company's management team is sophisticated and patient enough to wait and continue to maintain assets just below $10 billion until they find the right partner.

"I think the last few quarters, their commentary has been supportive of increased conversations around M&A," DelMonte said. "They can probably manage through the end of this year, but I think at some point, they kind of want to take the restrictor off and kind of go full tilt."

Asset maintenance

The impact on the company of the Durbin Amendment would be meaningful: DelMonte said the impact of the fee would be roughly 7% dilutive to the institution.

"Like any company, they would like to not pay that fee," Marinac said. "It's a fee, it's a tax, it's a charge, and they would rather not do it if they can."

The company has already crossed the threshold in past quarters. In the third quarter of 2023, Park National's assets grew to $10 billion, but they were back down to $9.84 billion by the end of 2023, according to S&P Global Market Intelligence data.

The year-end asset count determines if a bank is subject to the regulatory changes associated with crossing $10 billion in assets. Excluding a deal announcement in 2025, Park National could cross $10 billion again in the second or third quarter, as long as fourth-quarter total assets are below the threshold, Marinac said.

In order to maintain its consistent asset level for multiple years, the bank has had to do some "financial engineering," DelMonte said. At the end of a quarter, the bank will sometimes offload some of its deposits to stay under $10 billion in assets, he said.

While the company has been skirting the $10 billion asset mark, its management has been busy improving its infrastructure to support the heightened regulatory requirements that will come with crossing it, such as enterprise risk management, technology investment and sufficient employee resources, DelMonte and Race said.