Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Jun, 2025

By Robert Clark and Zain Tariq

More banks are racking up frequent losses, while the cumulative net loss at credit unions has jumped in recent periods.

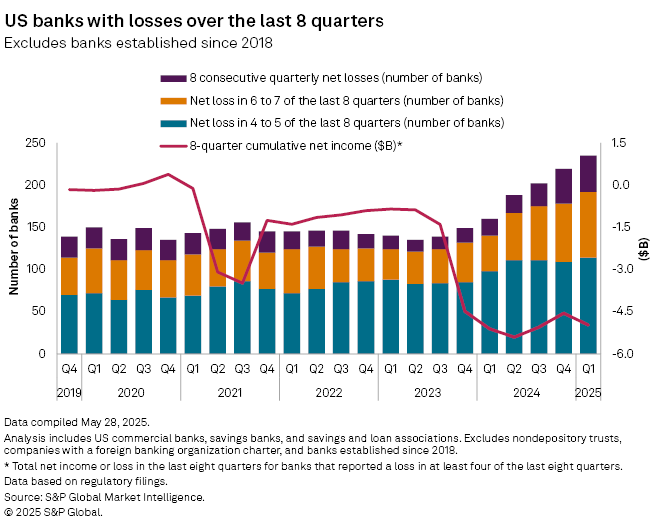

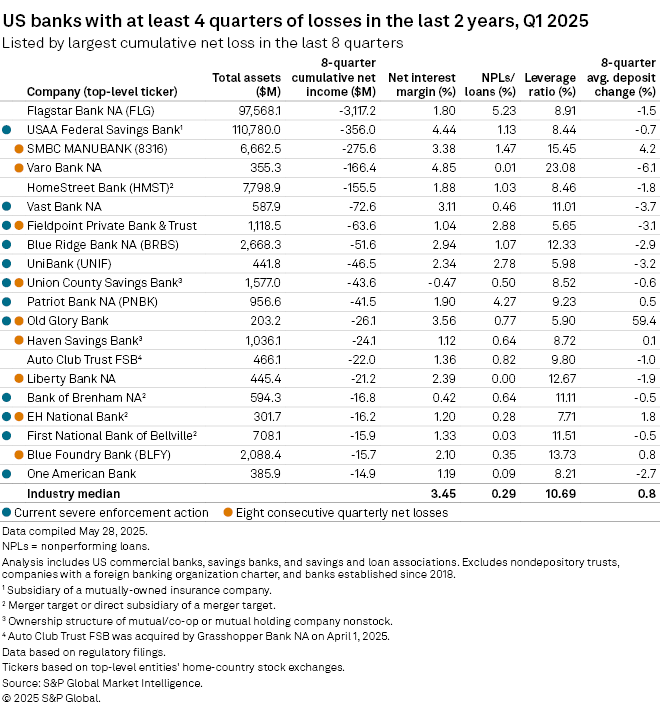

In the first quarter of 2025, the number of banks with losses in at least four of the last eight quarters increased to 235 from 219 in the 2024 fourth quarter and 160 in the year-ago period. Banks with eight or more consecutive losses totaled 43 in the first quarter, up from 41 in the fourth quarter and 20 a year ago. The analysis examined US commercial banks, savings banks, and savings and loan associations but excluded those established since 2018.

Consistently losing money invites more intense regulatory scrutiny and could limit strategic options like M&A activity and common equity offerings. In a worst-case scenario, pervasive losses deplete equity or overwhelm liquidity, forcing regulators to shut down or liquidate an institution.

Despite the recent rise in the number of banks in the red, the cumulative eight-quarter net loss for banks on the frequent loss list fell to $4.97 billion in the first quarter from $5.10 billion in the year-ago quarter. Still, the total was up compared to $4.56 billion in the fourth quarter. The cumulative loss, however, has been elevated since the fourth quarter of 2023 when it skyrocketed to $4.49 billion following eight quarters between $855.5 million and $1.40 billion. Initially, the majority of the increase was from two banks: Banc of California, which completed a reverse merger in November 2023, and Silvergate Bank, which announced a plan of voluntary liquidation in March 2023.

Of late, the cumulative loss has been fueled by Flagstar Bank NA, which has lost money for six quarters in a row and amassed net losses of $3.12 billion over the two years ended March 31, 2025. Its streak began in the 2023 fourth quarter, when it reported a total loss of $2.68 billion, including goodwill impairment of $2.42 billion. In March 2024, the bank's parent company Flagstar Financial Inc., previously known as New York Community Bancorp Inc., announced a new CEO, new directors and a capital raise totaling more than $1 billion. Management is projecting a return to profitability for the company in the fourth quarter this year, at which time the rolling eight-quarter loss will be much improved just from no longer accounting for the fourth quarter of 2023.

CUs at a loss

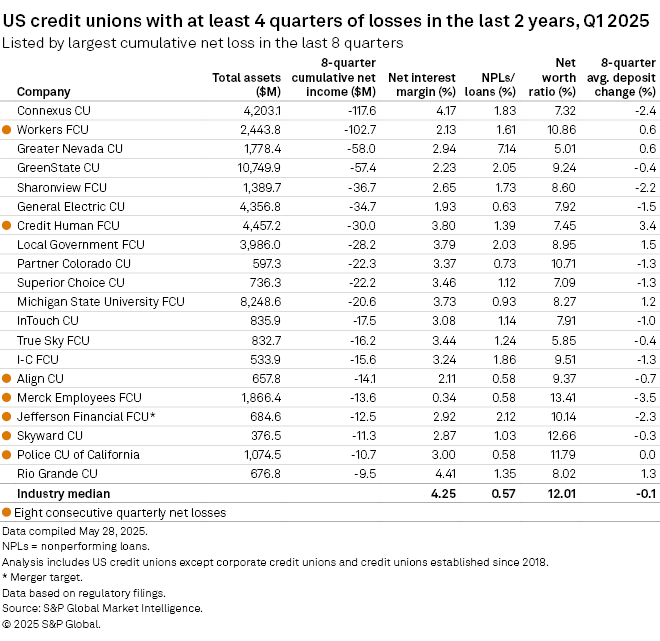

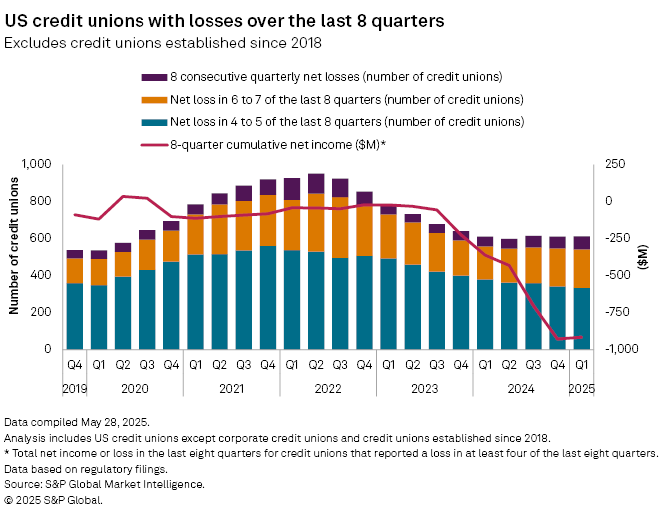

In the credit union space, 612 institutions, excluding those established since 2018, incurred a net loss in four or more quarters during the last two years as of the 2025 first quarter, compared to 610 in the 2024 fourth quarter and 611 in the 2024 first quarter.

The cumulative eight-quarter net loss for those unprofitable credit unions, however, has increased significantly on a percentage basis, jumping to above $900 million the last two quarters. The year-ago total was $361.6 million, preceded by $222.8 million in the 2023 fourth quarter and before that, nine straight quarters under $100 million.

While the cumulative losses for credit unions are more widely distributed relative to the banks, various issues at larger credit unions have pushed up the totals in recent quarters. A fourth-quarter 2024 spike in credit loss expense for loans and leases led to Wausau, Wisconsin-based Connexus CU posting the largest deficit at $117.6 million among credit unions with at least four quarters of losses over the last two years. Connexus has been on the frequent loss list since the third quarter of 2024, and so has North Liberty, Iowa-based GreenState CU, which has recorded the fourth-highest cumulative loss in the group at $57.4 million and dealt with a fourth-quarter 2023 jump in credit loss expense for loans and leases.

Second on the list with a $102.7 million cumulative loss is Littleton, Massachusetts-based Workers FCU, which realized losses on available-for-sale securities in the fourth quarter, and third is Carson City, Nevada-based Greater Nevada CU, which disclosed higher noninterest expenses and negative noninterest income in the fourth quarter, at $58.0 million.

On the bright side for banks

More than half of the banks with a net loss in at least four of the last eight quarters are positioned to eliminate or mitigate the impact of the losses through an M&A transaction, recent profitability or a sound capital position.

Sixty-eight of the 235 banks were profitable in the first quarter, including 29 with profits for the last two quarters. Those levels compare favorably with the 2024 fourth-quarter analysis, when 53 of the 219 banks with frequent losses reported a profit in the fourth quarter and 16 had a two-quarter profitability streak.

Four of the 235 banks in the first-quarter 2025 analysis — Bethesda, Maryland-based Presidential Bank FSB; Dubuque, Iowa-based Capra Bank; Clarence, Missouri-based Neighbors Bank; and Vermont, Illinois-based Vermont State Bank — have reported four consecutive profitable quarters following at least four quarters of losses.

Another five banks — Darien, Connecticut-based DR Bank; Greenfield, Wisconsin-based PyraMax Bank FSB, a subsidiary of 1895 Bancorp of Wisconsin Inc., which is exploring strategic options; Jamestown, Tennessee-based Union Bank; Irwinton, Georgia-based Apex Banking Co. of Georgia; and Turton, South Dakota-based Farmers State Bank of Turton — have not lost money in the last three quarters.

USAA Federal Savings Bank, which is a subsidiary of mutually owned insurance company United Services Automobile Association and the largest bank on the frequent quarterly loss list with $110.78 billion in total assets as of March 31, may have turned the corner. After losing money from the third quarter of 2023 through the first quarter of 2024, it has been profitable in three of the last four quarters, including net income of $40.0 million in the most recent quarter. Earnings are up from margin expansion and expense control.

While some banks might have reversed their earnings trend as of the first quarter of 2025, others have well above-average capital ratios to absorb losses. Forty-nine of the 235 banks, including 34 with a first-quarter loss, disclosed a leverage ratio above 15%. Tampa, Florida-based MEMBERS Trust Co., which is in a mutual insurance holding company structure, led the group at 85.39%, followed by East Greenwich, Rhode Island-based Independence Bank at 75.13%. Vermont State Bank and Neighbors Bank also had high leverage ratios as of March 31, at 24.56% and 19.18%, respectively.

Getting help

Institutions saddled with losses sometimes turn to a new management team and changing the board composition. Stamford, Connecticut-based Patriot National Bancorp Inc., whose subsidiary Patriot Bank NA has lost $41.5 million over the last eight quarters, hopes a change in leadership can help restore investor confidence.

Perhaps the quickest solution for companies losing money is to seek a merger with a stronger financial partner.

Four of the 235 banks with four or more losses in the last eight quarters have merged or were acquired in the second quarter through May 28, and those are Honolulu-based

Seventeen other banks with at least four quarterly losses over the last two years are merger targets or direct subsidiaries of a merger target, including 10 with an active severe enforcement action (SEA). Two of 17 banks — Alva, Oklahoma-based BancCentral NA and Beverly Hills, California-based EH National Bank — have an outstanding SEA and have lost money for 10 quarters in a row.

Seattle-based HomeStreet Bank, which is a unit of merger target HomeStreet Inc., turned a profit in the first quarter following a five-quarter losing streak. The company announced a sale March 31 to Walnut Creek, California-based Mechanics Bank after regulators blocked its attempted deal with Denver-based FirstSun Capital Bancorp in 2024.

The regulatory environment for bank M&A has become more accommodating in 2025, as reflected by faster deal approvals and an increasing percentage of announced deals where the merger target has an active SEA.

The loss list is littered with banks operating with an SEA, including Vermont State Bank; USAA; Independence Bank, Patriot Bank; Martinsville, Virginia-based Blue Ridge Bank NA, which saw its parent Blue Ridge Bankshares Inc. complete a recapitalization in 2024; Greenwich, Connecticut-based Fieldpoint Private Bank & Trust, which reported negative operating revenue in the first quarter and was issued a "needs to improve" Community Reinvestment Act rating last year; and Elizabeth, New Jersey-based Union County Savings Bank,

|

– Download a template to compare a bank's financials to industry aggregate totals. – Set email alerts for future Data Dispatch articles. |

Credit unions with persistent losses

Many credit unions with frequent losses also have struck a merger. Eighteen of the 612 institutions with at least four quarterly losses in the last two years have completed a merger as of May 28. Another 16 credit unions in the group are merger targets, including Metairie, Louisiana-based Jefferson Financial FCU.

Like the bank group, a high percentage of credit unions with persistent losses recently reported a profit and/or carry a high level of capital. Of those 612 credit unions, 184 were profitable in the first quarter, including 75 with two quarterly profits in a row. And 174 credit unions reported a net worth ratio in excess of 15%, including 123 that lost money in the first quarter.

Management changes may have contributed to reversing the loss pattern at a few credit unions. Albuquerque, New Mexico-based Rio Grande CU announced a new CEO in September 2024 and has registered a profit in the last two quarters after seven quarters of red ink. GreenState, which appointed a new CEO in February 2024, has been profitable in three of the last five quarters, including net income of $8.5 million in the most recent quarter.

In addition to expansion through bank M&A, Michigan State University FCU has made a sizable investment in banking-as-a-service. The East Lansing, Michigan-based credit union has recorded negative net income for five quarters in a row.