Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Jun, 2025

By Tim Siccion and Shambhavi Gupta

Global private equity and venture capital-backed rounds of funding and transaction value in May decreased month over month.

The total transaction value in May amounted to $22.54 billion, down from $25.80 billion in the previous month, according to S&P Global Market Intelligence data. The number of rounds also ticked down month over month to 1,117 from 1,196.

The deal value also declined annually from $28.54 billion.

However, in the first five months of 2025, deal value increased to $161.48 billion compared with $129.54 billion for the same period in 2024.

Aggregate transaction values and volume may not match figures reported for preceding periods due to subsequently acquired disclosures and updates.

– Download a spreadsheet with data featured in this story.

– Read our latest In Play reports featuring rumored deals.

– Explore more private equity coverage.

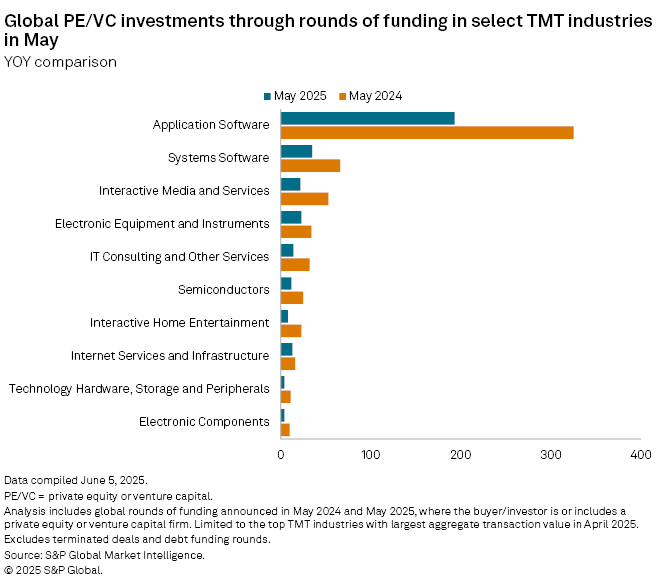

The technology, media and telecommunications (TMT) sector had the highest transaction value in May, accounting for 32.9% of total investments. The sector raised $7.42 billion across 373 rounds of funding. The financial sector followed, pulling in $4.62 billion.

Application software remained the most favored subsector within TMT, recording 193 deals, followed by system software with 35 deals. Deal volume across the 10 TMT subsectors was down compared with May 2024.

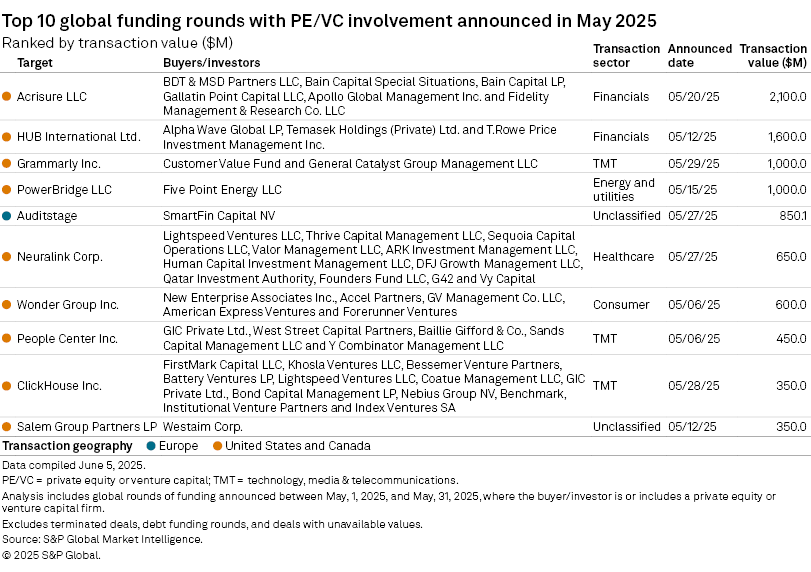

Largest rounds of funding

The largest funding round in May was a Bain Capital LP-led $2.1 billion investment in Michigan-based insurance broker Acrisure LLC, with participation from Apollo Global Management Inc. and Gallatin Point Capital LLC. Acrisure will use the proceeds to develop its tech-enabled financial services platform, among other functions.

The second-largest round was a $1.6 billion round of funding led by Temasek Holdings (Pvt.) Ltd., T.Rowe Price Investment Management Inc. and Alpha Wave Global LP for Chicago-based insurance company Hub International Ltd. Hub will use the proceeds for acquisitions, debt reduction and corporate initiatives.

Third was General Catalyst Group Management LLC's $1 billion investment in San Francisco-based digital writing assistant platform Grammarly Inc. Grammarly will use the funds to scale sales and marketing, among other efforts. Tied with the Grammarly investment was Five Point Energy LLC's $1 billion round for Connecticut-based datacenter and power infrastructure company PowerBridge.