Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Jun, 2025

By John Wu and Beenish Bashir

US tariffs and the ensuing trade tensions are likely to indirectly impact China's state-owned, global systemically important banks due to their limited overseas exposures.

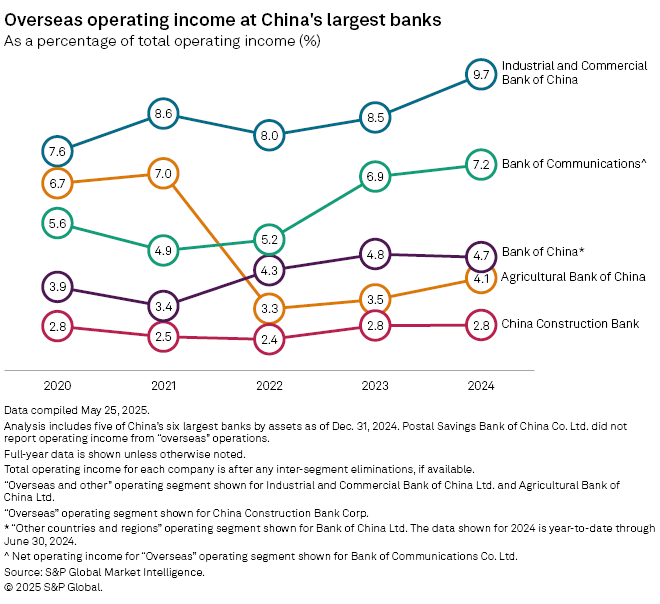

As of the end of 2024, the overseas operating income, as a percentage of total operating income, at Industrial and Commercial Bank of China Ltd. was 9.7%, the highest among major Chinese banks, according to S&P Global Market Intelligence data. This figure was also the highest in at least five years for the lender, increasing from 8.5% in the prior year and 7.6% in 2020, the data showed.

China Construction Bank Corp. recorded the lowest overseas operating income exposure at 2.8%, unchanged from 2023 and 2020, according to Market Intelligence, while that of Agricultural Bank of China Ltd. was 4.1%, compared to 6.7% in 2020.

China is home to five global systemically important banks (G-SIBs), including Bank of China Ltd. and Bank of Communications Co. Ltd.

"The impact of the latest US tariffs on Chinese banks will primarily be indirect, transmitted through the effect on export-related sectors," said Yingrui Wang, China economist at AXA Investment Managers, in a May 29 email interview.

"The impact of tariffs will be uneven across the banking sector. Large state-owned banks are better positioned to absorb the hit, while smaller regional banks and those heavily exposed to manufacturing and export hubs may come under more pressure," Wang said.

China's banking sector is facing profitability pressure as the country maintains an easing bias on monetary policy with a low interest rate environment. Starting in early April, China and the US announced a series of tariff moves on each other, which eventually pushed the world's two biggest economies to declare that they would tax imports by as much as 145%. The announcements caused volatility in equity markets. The share prices of Chinese G-SIBs also tumbled.

On May 12, however, the US and China agreed to de-escalate by delaying the proposed tariffs by 90 days while negotiators worked on a trade deal, allowing the G-SIB shares to recover.

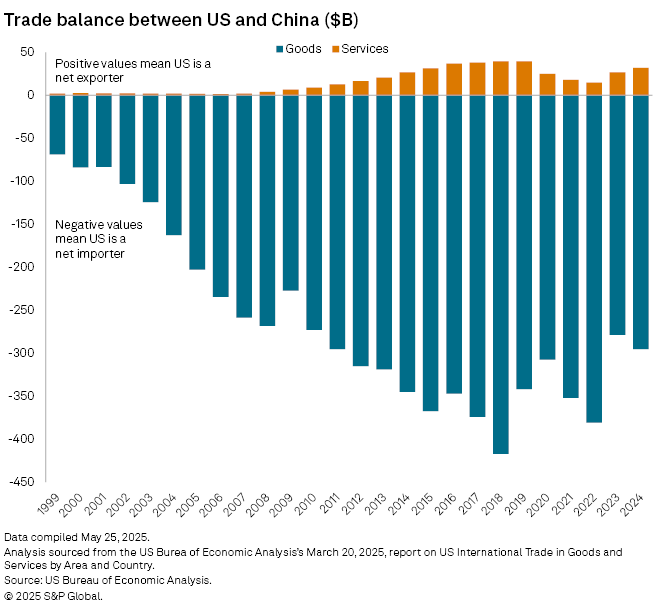

The US has sought to narrow its trade deficit with China in recent years. In 2024, China logged a $295.18 billion surplus from trading goods with the US, from a peak of $417.27 billion in 2018, according to the US Bureau of Economic Analysis.

"As generalized tariff hikes reach their limits, we expect the Trump administration's focus to shift to more targeted sectoral tariffs and nontariff measures to contain China's access to advanced technology and address national security concerns," Nomura said in a May 23 note. "Our US economics team views the current 30% tariff as the baseline scenario," Nomura said.

Uneven Impact

Ivy Ng, Asia-Pacific chief investment officer for DWS, told Market Intelligence in an email that tariffs are expected to impact banks' loan demand, leading to weaker growth.

Tariffs may raise concerns about nonperforming loans, particularly manufacturing loans with high export exposure to the US, even though the nonperforming portion is relatively small compared to banks' loan books, Ng said.

Chinese banks with offshore operations may face heightened regulatory and reputational risks, said AXA's Wang, while domestically, lenders such as joint stock and city commercial banks that have greater exposure to export-oriented businesses — particularly small and medium-sized enterprises — may experience slower loan growth and a deterioration in asset quality.

Under the current circumstances, systemic risks to China's banking system appears limited, and its lenders are relatively better positioned than certain peers in the region as they have lower risks on foreign exchanges and capital flow, Wang said.

According to the Bank for International Settlements, systemic risks may be defined as disruptions to financial services caused by an impairment of all or parts of the financial system. These risks have the potential to cause serious negative consequences for the real economy.

Major Chinese banks onshore are fairly insulated as their books are local, Chinese yuan-denominated and state-supported, according to Steve Alain Lawrence, chief investment officer, Balfour Capital Group. However, offshore stress remains.

But "systemic risk isn't imminent," Lawrence told Market Intelligence via email on April 25.

Any true fallout is unlikely as Beijing won't allow its financial system to show weakness on the world stage, Lawrence said, expecting swift state support, whether through capital infusions, backstopping offshore units or forced restructurings if pressure escalates.