Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jun, 2025

|

A wind farm under construction in Germany. Developers in Europe are grappling with a new reality of higher rates after years of low-cost debt. |

Higher interest rates are shifting the financing dynamics in Europe's renewable energy sector, with developers and banks forced to navigate challenging market conditions to finalize deals, industry players told Platts, part of S&P Global Commodity Insights.

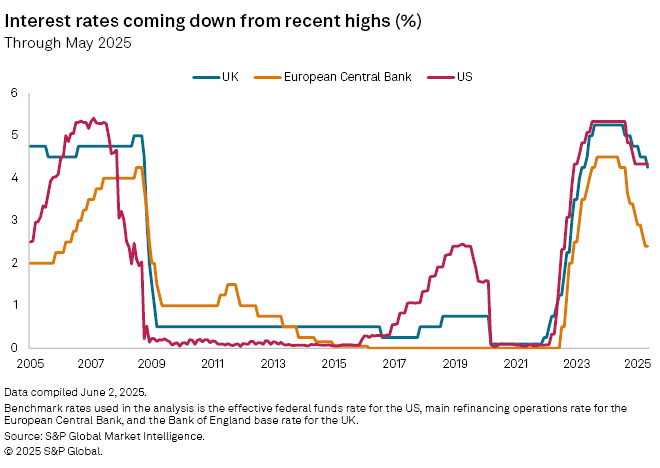

While rates have stepped down since the end of 2024, they remain far higher than the near-zero levels during the 2010s. Combined with rising equipment costs and supply chain volatility, this has put pressure on project economics.

"Projects are having to manage and wrestle with more risk and uncertainty, but nonetheless, the good projects are still getting financed," Robert Marsh, global co-head of energy at law firm Norton Rose Fulbright, said in an interview.

The volatility has led to a reconfiguration in the development landscape. Major European clean energy companies such as Ørsted A/S and RWE AG have scaled back capital expenditure, while oil and gas supermajors BP PLC and Shell PLC have watered down their renewables activities.

For those developers still in the game, the focus has been prioritizing value over volume. Luis Sabaté, CEO of Spanish power producer Matrix Renewables, described a "flight to quality" among financiers, with strong liquidity for attractive projects.

"Lack of capital is not the problem we have in the industry. The problem we have is a lack of [good] developers and a lack of good projects," Sabaté told Platts.

Banks in the sector regard a project's offtake structure as a critical element when evaluating opportunities. Amid the volatility, the renewables industry is calling for using long-term contracts for difference (CFDs), which can offer price stability and better attract finance.

"You need to have ... a well-prepared structure," said Udo Schneider, managing director at Green Giraffe Advisory. "It's not a tighter market or anything. [Banks are] just becoming a bit more prudent and don't accept everything."

No return to near-zero rates

Interest rates in the EU and UK have decreased since the end of 2024. But today's environment is still a stark contrast to the years of near-zero rates and low-cost debt that developers in Europe benefited from during the 2010s.

"It was a moment in history that is not coming back anytime soon," Stefan Vatchev, executive director and head of renewables at Canadian bank CIBC, said on a panel at the Aurora Spring Forum in London on May 22.

Industry observers said the higher rates are squeezing project margins, forcing some developers to increase their return hurdles. Recently, major players such as Germany's RWE, Britain's SSE PLC and Spain's EDP Renováveis SA have ratcheted up their required returns.

For some investors, the higher hurdle rates mean an increased tolerance to risk.

Especially in emerging European markets, renewable power producers are more willing today to accept merchant power price risk or shorter-term power purchase agreements, according to Anna Chmielewska, associate director at the European Bank for Reconstruction and Development.

Meanwhile, infrastructure funds are going into what used to be considered "no-go zones," such as taking development risk on projects or investing in areas like electric vehicle charging infrastructure.

"We are seeing an upward adjustment in terms of the risk profile," Chmielewska said at the Aurora conference, which was organized by consultancy Aurora Energy Research.

In the project finance space, the higher rates are spurring creativity. Sponsors and banks are coming up with alternative financing structures for deals, going beyond the typical approach of combining equity with long-term nonrecourse debt.

"There is no such thing as a pure project financing anymore," said Sindhura Swaminathan, Paris-based partner at Norton Rose Fulbright.

Swaminathan pointed to the rise of equity bridge loans, which cover costs until equity financing is secured, giving sponsors "more time to get things into place."

Holdco financings, where debt is raised by a parent company to finance projects, and warehouse facilities, which provide interim financing for multiple projects before securing long-term financing at more favorable rates, are also increasingly common, according to Matrix's Sabaté.

Elsewhere, CIBC's Vatchev said construction bridge facilities — loans that cover the construction phase — are also being used more frequently.

"We see more and more developers [and independent power producers] that need bespoke solutions," Vatchev said.

Bigger projects in offshore wind

Amid challenging financing conditions, Europe's renewables sector is also moving toward larger projects.

This shift is particularly evident in offshore wind, where projects now regularly breach the 1-GW mark.

Some 5.6 GW of new offshore wind capacity has already been financed in Europe in 2025, more than double the amount financed in all of 2024. Two of this year's projects — Inch Cape in the UK and Baltica 2 in Poland — are each more than 1 GW in size.

The increasing scale requires more capex, compelling even the largest developers to form partnerships with other players or tap into the debt market.

RWE, for instance, has teamed up with French oil major TotalEnergies SE on developments in Germany and the Netherlands and recently sold 49% stakes in two gigawatt-scale projects in Germany and Denmark to Norges Bank Investment Management.

Meanwhile, the group announced in March a plan to use project finance debt to fund its Norfolk projects in the UK and offload a 50% stake in the wind farms.

The project finance community expects a wave of offshore wind deals in Europe over the coming years.

That includes several giant developments in the UK, such as BP and EnBW Energie Baden-Württemberg AG's 3-GW Mona and Morgan projects; SSE's 4-GW Berwick Bank wind farm; and Ocean Winds' 2-GW Caledonia project.

Still, none of those have secured CFD support yet, and the higher cost of financing was a significant factor in derailing two major UK projects in recent years.

BP and TotalEnergies may also opt to raise debt for four offshore wind projects in Germany totaling 7 GW, industry players said.

"These are big projects where you need to tap a lot of lenders to get it done," Green Giraffe's Schneider said.

In the Netherlands, the latest offshore wind auction in 2024 awarded two 2-GW wind farms to consortia led by SSE and Sweden's Vattenfall AB.

"That's billions of euros for a single project," Wouter Hertzberger, Amsterdam-based partner at Norton Rose Fulbright, said in an interview. "There's actually a need for project finance to come in because the projects now are being so big, and for utilities, it's harder to do it themselves."