Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jun, 2025

By Brian Scheid

US Federal Reserve officials are becoming a bit more divided on interest rate policy as calls for cuts from some governors contrast with Chairman Jerome Powell's ease with keeping rates steady as the central bank navigates the effects of tariffs on inflation and the broader economy.

During recent testimony on Capitol Hill, Powell said he is content with holding off on rate changes, potentially for the rest of the year, despite pressure from President Donald Trump and other members of the Fed board to lower rates now.

"We're going to continue to adapt as the data adapts," Powell told a US House of Representatives committee June 24. "As long as the economy is strong, we can take a little bit of a pause here."

The remarks came less than a week after officials with the rate-setting Federal Open Market Committee (FOMC) unanimously agreed to keep the benchmark federal funds rate within a range of 4.25% to 4.5%, where it has been since the Fed last cut rates in December 2024. In the days following that meeting, Fed governors Christopher Waller and Michelle Bowman said they were open to cuts at the July meeting, showing some cracks in what had been a unified front.

"It's clear that the Fed is not united right now on the longer-term outlook on monetary policy," said David Russell, global head of market strategy at TradeStation.

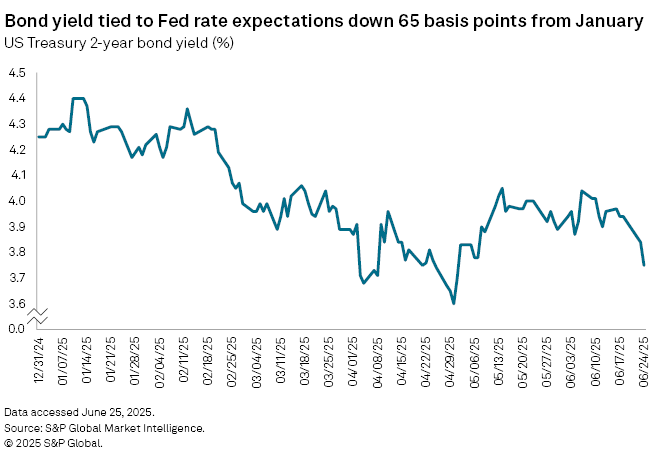

The US Treasury 2-year bond yield, which most closely tracks Fed interest rate expectations, settled at 3.75% on June 24, its lowest close since May 1 and a 65-basis-point drop from this year's high point in mid-January. While some Fed officials speaking about their openness to rate cuts could be a bit of political appeasement, it also boils down to divergent views on the impacts of tariffs, Russell said.

"There are members of the Fed who want to view the glass as half full, but the majority seem to be far more cautious," he said.

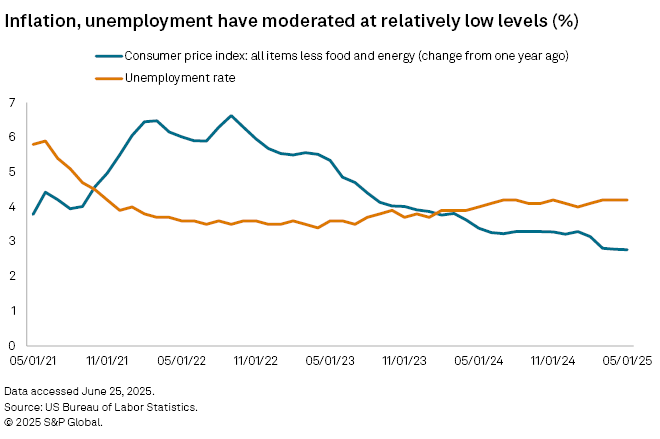

There is a "growing split" between Fed officials focused on the threat that Trump's tariffs on nearly all global trading partners pose to inflation and those focused on some weakening in the labor market, said James Knightley, chief international economist with ING.

"The former argues for a wait-and-see stance, the latter suggests that the case for a preemptive rate cut may be building," Knightley said. "I think the hurdle for a July rate cut remains high."

The Trump administration's 90-day pause on tariffs ends July 9, about three weeks before the Fed's July meeting. However, that is not enough time for trade policy impacts to show up in inflation or jobs data.

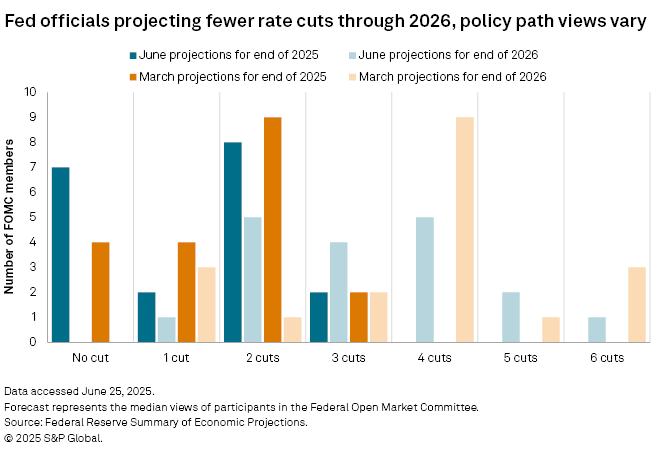

In their latest quarterly economic projections, released June 18, eight of the 19 FOMC officials said they expect two rate cuts by year-end, with seven forecasting no cuts at all. Three months earlier, nine expected two cuts in 2025 and four expected no cuts.

Rate expectations among top Fed officials are even more disparate for the longer term, ranging from just one cut until the end of 2027 to as many as seven by that time.

"The dispersion of the dots ... show there is a growing divergence of opinions within the FOMC," said Oren Klachkin, a financial market economist with Nationwide. "This isn't too surprising given how many open-ended questions there still are about inflation and the economic outlook."

Different approaches

The arguments for cuts or holding steady also differ among officials, even if they forecast rates to end up at the same place, said Garrett Melson, portfolio strategist at Natixis Investment Manager. Bowman's and Waller's cases for potential July cuts, for example, appear to be based on different arguments.

"Waller advocates for looking through tariff-induced inflation to the encouraging underlying trend clearing the way for 'good news rate cuts' even if labor market conditions remain benign," Melson said. "Bowman's willingness to restart cutting toward neutral, on the other hand, is somewhat conditional in upcoming inflation prints, although she does seem to fall into Waller's camp that tariffs are unlikely to fuel a persistent inflationary impulse given her expectation of rising labor market slack."

Divisions within the Fed appear to be larger than they have been for several years as some committee members are basing their policy outlooks on potential inflation risks that might not materialize while others want to adapt based on data as it comes in, Melson said.

While there could be some dissenting votes at the Fed's July meeting, a majority of FOMC members will likely continue to favor keeping rates unmoved, Klachkin with Nationwide said.

Powell "holds major sway over the outcome of each meeting, and he has clearly indicated he's in no rush to ease," Klachkin said.