Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jun, 2025

By Nick Lazzaro

Pedestrians walk past the Bombay Stock Exchange in Mumbai, India, on April 3 while a broadcast screen shows news of US President Donald Trump's April 2 reciprocal tariff announcement. Emerging markets such as India may be better positioned than others to benefit from changing global trade dynamics as companies reshuffle supply chains and as governments pursue trade negotiations with the US. Source: Punit Paranjpe/AFP via Getty Images. |

Investors are showing interest in certain emerging markets in Latin America, Southeast Asia and India, which could potentially benefit from supply chain rearrangements influenced by changes in global trade dynamics.

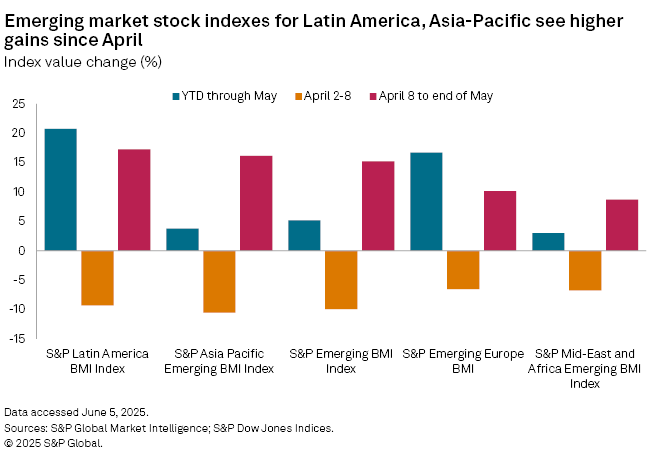

Emerging markets rebounded in May despite concerns that pending US tariffs might pressure their economies, especially for export-reliant countries. The S&P Emerging BMI index, which covers nearly 7,000 companies domiciled in emerging markets, surged over 15% by the end of May from its most recent low point on April 8, the day before US President Donald Trump issued a pause on a global reciprocal tariff plan, according to S&P Global Market Intelligence. This gain has been outpaced by regional versions of the index focused on Latin America and the Asia-Pacific region.

Although the US imposed a 25% tariff on Mexico earlier this year, most Latin American countries were not assigned a pending reciprocal tariff rate in April, potentially providing them a trade advantage with the US should the broader slate of tariffs on other countries go into effect in July. In contrast, key manufacturing countries in Asia, such as India and Vietnam, are facing potential reciprocal tariff rates of 26% and 46%, respectively, but have been proactive in engaging the Trump administration in trade negotiations.

"Emerging markets, particularly in Asia, are attracting attention as potential beneficiaries of tariff-induced supply chain shifts," Ambarish Srivastava, associate director of private markets at Acuity Knowledge Partners, told Market Intelligence. "Countries like Vietnam and India are being considered as alternative manufacturing hubs as businesses seek to avoid US-imposed tariffs on Chinese goods."

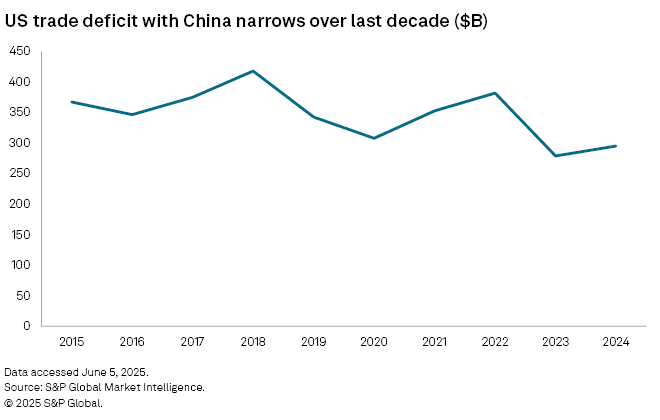

Companies with substantial supply chain exposure in China began the process of diversifying their global operations over the last decade, prompted by US-China trade tensions during Trump's first presidential term and logistical bottlenecks that emerged from the COVID-19 pandemic. This year, Trump has proposed potential tariff rates of over 100% on imports from China since April.

However, other developing countries that have significant trade relationships with the US may also be at risk of future trade policy moves, necessitating that investors lean into active management when diversifying capital across emerging markets.

"If you're a big exporter from an emerging market standpoint, it might be a little uneasy," said Paul Cavazos, senior vice president and chief investment officer at American Beacon Advisors, in an interview. "Certainly, the weakening of the US dollar has been helpful for markets overseas, including a lot of the emerging markets.”

Markets in focus

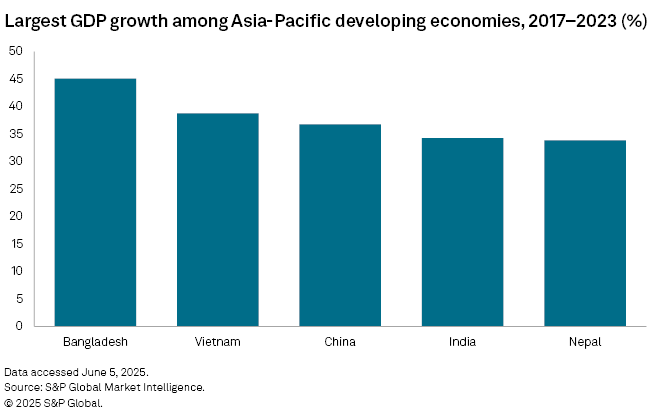

Since trade patterns began shifting after the start of Trump's first presidency in 2017, Vietnam and India have experienced some of the strongest economic growth among developing countries in the Asia-Pacific region. This positions the two economies, particularly India, to better capitalize on the evolving trade environment.

"India is gaining prominence as a global investment destination, but smaller and less developed nations have missed out on investment opportunities and become marginalized," Srivastava said. "By capitalizing on the services sector boom, larger developing economies are leaving smaller nations behind."

India's gross foreign direct investment inflows reached $84.84 billion in the country's fiscal year ended March 2021, up from $60.22 billion in the fiscal year ended March 2017, according to data from the India Brand Equity Foundation. Inflows dipped to $71.35 billion in the fiscal year ending March 2024 but rebounded to over $81 billion in the comparable period through March 2025, according to a May report from the Reserve Bank of India. Capital for fiscal 2025 was concentrated in manufacturing, financial services, energy and communication services, the report said.

Economic dynamics in Japan, one of Asia's biggest markets, have also contributed to rising investment flows into the continent's key emerging markets, according to John Bohan, head of business development at Apex Group.

"Mature markets such as Japan, where the savings market and the pension markets there are at a peak, they're looking for external investments into other economies because the Japanese market has had equally phenomenal growth and has begun to slow down a little bit," Bohan said in an interview. "Therefore, they're looking to opportunities outside of Japan and into neighboring Asian countries such as Vietnam and South Korea."

Latin American countries that have so far been spared the brunt of recent US tariffs may also present opportunities for investment capital.

"Latin America does not have quite as extreme trade surpluses with the US, and that might be an opportunity where you see a little picking up of the slack to the degree that you do have some reduced trade flows with China," said Garrett Melson, portfolio strategist with Natixis Investment Managers, in an interview.

Mixed outlook on China

China, the world's largest emerging economy, has been at odds with the US for several years over trade, intellectual property rights, economic competition and other matters.

"Consecutive US administrations have identified China as a political, economic and military threat, so investor confidence in China is likely to remain subdued for the foreseeable future," Richard Surrency, group chief commercial officer at IQ-EQ, told Market Intelligence.

Yet hints of optimism for China remain as its government has the flexibility to support its domestic economy and possibly reach a trade deal with the US this year.

"You are seeing China try to work to strengthen trading relationships abroad," Melson with Natixis said. "But more importantly, you've seen a shift in terms of domestic policy dialing back the pressure on some of their key industries like technology, and you can see that they certainly have the flexibility in the near term for more outright support of their economy from both a monetary and a fiscal perspective."