Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Jun, 2025

By Sean Longoria and Umer Khan

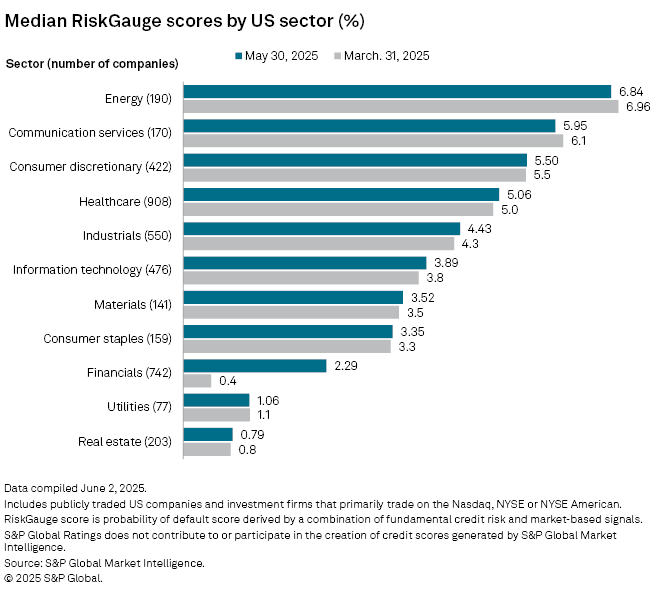

The median risk of default for publicly traded US companies rose across most sectors from the end of March through the end of May, a tumultuous two months for markets as investors digested potential impacts from newly announced tariffs on US imports and subsequent developments in global trade.

Financial stocks led the group of eight market sectors that recorded higher median probability of default scores at the end of May compared to the end of March, with the sector's score jumping to 2.3% from 0.4%, according to S&P Global Market Intelligence's RiskGauge model. The scores represent the median odds of default on debt within a year, based on financial reports and the volatility of share prices for public companies on major US exchanges, accounting for country- and industry-related risks and other macroeconomic factors.

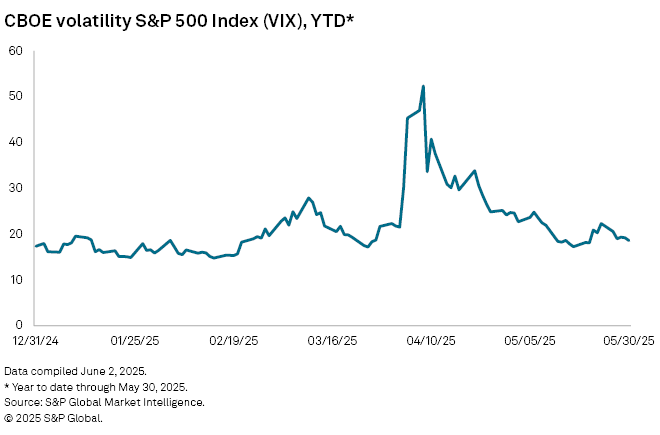

Wild swings in US stocks followed President Donald Trump's April 2 announcements of tariffs on all US trading partners, with the S&P 500 dropping more than 11% from the end of the first quarter before recovering to a 5.3% increase at the end of May versus March-end.

The market jumps also spiked the CBOE Volatility S&P 500 Index, which more than doubled during the period but has since retreated to near pre-April 2 levels.

Corporate defaults are falling despite market volatility and tariff uncertainty, according to S&P Global Ratings. In the US, 21 companies have defaulted in 2025 through April, down from 32 year over year. Ratings does not contribute to or participate in the generation of Market Intelligence's RiskGauge scores.

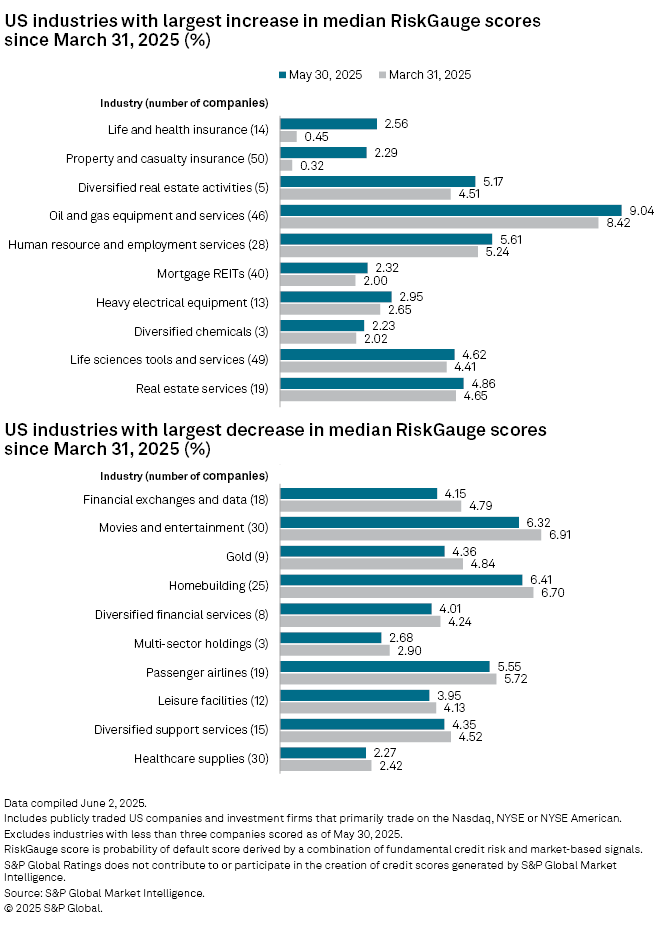

Biggest increases, decreases

Two groups of insurance companies registered the largest upticks in median probability of default scores at the end of May compared to the end of March. Life and health insurance companies logged an increase of 2.1 percentage points in their score, while property and casualty insurers saw a rise of 2.0 percentage points, according to Market Intelligence data.

Meanwhile, financial exchange and data companies and movies and entertainment companies recorded the biggest drops in median probability of default scores, with each seeing a decrease of 0.6 percentage point.

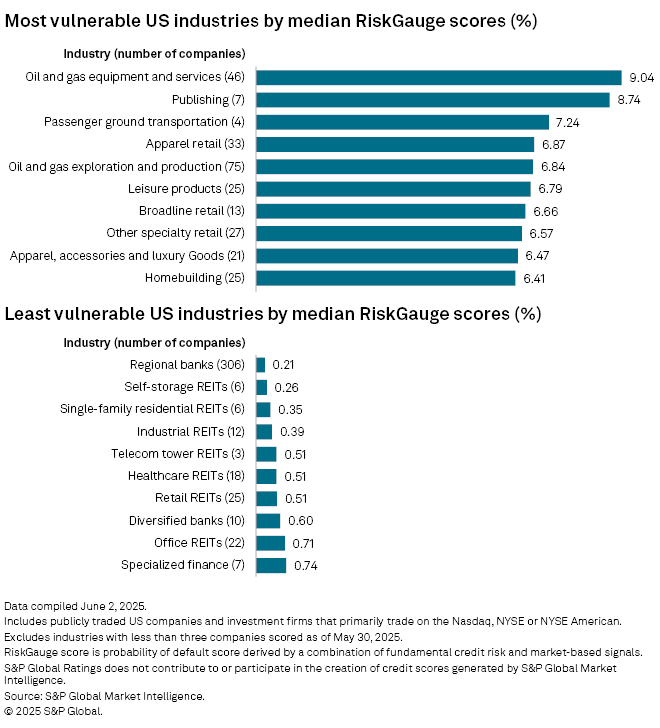

Most, least vulnerable

At the end of May, oil and gas equipment and services companies and publishers were the most vulnerable industries among publicly traded US companies as measured by median probability of default scores. Regional banks and self-storage real estate investment trusts were the least vulnerable industries.

The two most vulnerable industries based on RiskGauge scores held constant from the end of 2024. Regional banks likewise continued to be the least vulnerable industry.