Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Jun, 2025

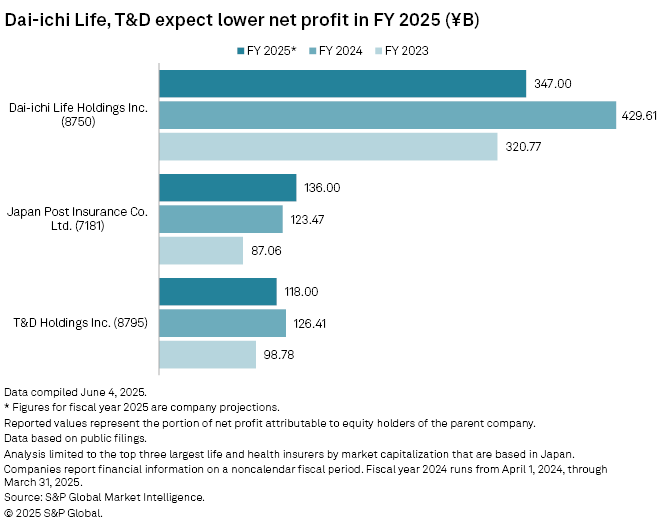

Dai-ichi Life Holdings Inc. and T&D Holdings Inc. are tempering their net profit outlook for this fiscal year despite reporting solid financial results in fiscal 2024.

Dai-ichi Life expects net profit of ¥347.0 billion for fiscal 2025, down from the ¥429.61 billion of net profit it recorded in the prior fiscal year. A strategic reinsurance transaction involving its Protective Life Corp. subsidiary affected Dai-ichi Life's forecast, according to an earnings presentation. Under the deal, Dai-ichi Life ceded about $9.7 billion in policy reserves of in-force blocks that are mainly involved in structured settlement annuities and universal life insurance.

CEO Tetsuya Kikuta said during a conference call that the insurer's conservative outlook reflects expectations of an uncertain business environment amid potential rate hikes from the Bank of Japan and new economic policies in the US under President Donald Trump.

Dai-ichi Life also projects group adjusted profit to drop year over year as it anticipates interest and dividend income weakening and a decline in gains from core insurance activities. The adjusted profit outlook, which excludes the impact of the reinsurance deal, is ¥410.0 billion, compared with ¥439.5 billion of adjusted profit for the prior fiscal year.

T&D forecasts net profit for fiscal year 2025 at ¥118.0 billion, compared with ¥126.41 billion for the previous fiscal year. However, group adjusted profit is expected to increase year over year to ¥146.0 billion from what was a record high of ¥141.5 billion in fiscal year 2024.

Japan Post Insurance Co. Ltd. anticipates net profit to grow by ¥12.5 billion to ¥136 billion, partly due to higher core profit attributable to life insurance activities and a positive spread, according to an investor presentation. Its adjusted profit for the current fiscal year, however, is projected to decline year over year to ¥142.0 billion, from ¥145.7 billion in fiscal year 2024.

– Use the screener to access financial results on the S&P Capital IQ Pro platform.

– Read about Australian insurers' bid for motor club insurance operations.

– Read about potential M&A activity in the global insurance sector on In Play Today and a summary of recently announced deals on M&A Replay.

A strong 2024

Last year was a banner one for the big three Japanese life insurers.

Dai-ichi Life achieved double-digit percentage growth in earnings due to favorable market conditions as net profit grew 34% to ¥429.61 billion and adjusted profit jumped 38% to ¥439.5 billion. Strong sales activity contributed to the results, with annualized premiums from new policies increasing to ¥546.4 billion from ¥503.0 billion.

In addition to its record-high group adjusted profit, T&D's net profit for fiscal year 2024 increased year over year to ¥126.41 billion from ¥98.78 billion. Three of T&D's domestic life insurance subsidiaries contributed to the earnings growth as sales results of new policies exceeded expectations. The group's annualized premiums from new policies increased to ¥213.20 billion from ¥198.30 billion.

Japan Post Insurance's net profit swelled to ¥123.47 billion from ¥87.06 billion, and adjusted profit rose 49% to ¥145.7 billion. Japan Post had the largest increase in annualized premiums from new policies among the three largest Japanese insurers by market cap, rising year over year to ¥175 billion in fiscal year 2024 from ¥116.8 billion.

President and CEO Kunio Tanigaki, on a conference call, partly attributed the revitalized sales activity to a new lump-sum payment whole life insurance product launched in January 2024.

An eye on investments

The three life insurers are strategically repositioning their businesses and portfolios to balance caution with growth targets in a changing economic landscape.

Dai-ichi Life's plan for its domestic business involves actively divesting domestic shares to reduce equity risk, Kikuta said. The insurer aims to accelerate growth in both overseas and non-insurance businesses through organic and inorganic means, according to the CEO.

T&D aims to reduce its equity risk by improving its portfolio, CEO Masahiko Moriyama said during a conference call. Through asset liability management, the insurer intends to reduce domestic interest rate risk and increase the proportion of yen interest assets in its investment portfolio to about 70%.

Improving portfolio and investment income is also one of Japan Post's goals, Senior Managing Executive Officer Atsushi Tachibana said. The insurer will monitor the impact of a rising interest rate environment on capital gains and losses while continuing to invest in real estate and credit assets to improve its overall risk-adjusted returns, according to the executive. Japan Post also plans to grow its market capitalization to ¥2 trillion by focusing on customer-centric insurance services, leveraging its substantial asset base for asset management and diversifying revenue streams, Tanigaki said.