Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jun, 2025

By Tyler Hammel and Noor Ul Ain Adeel

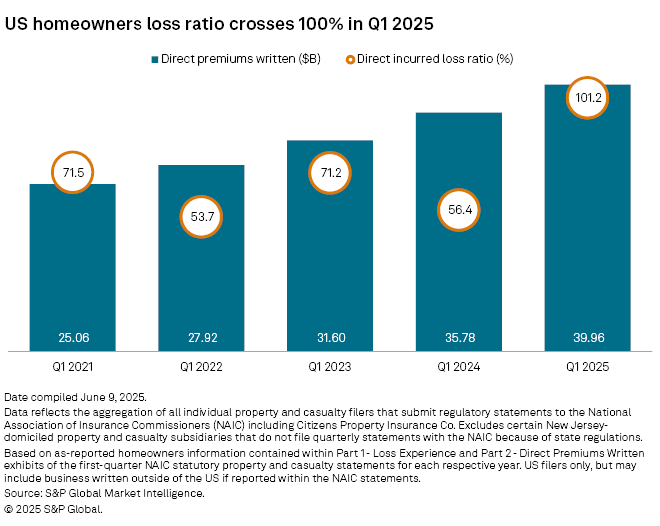

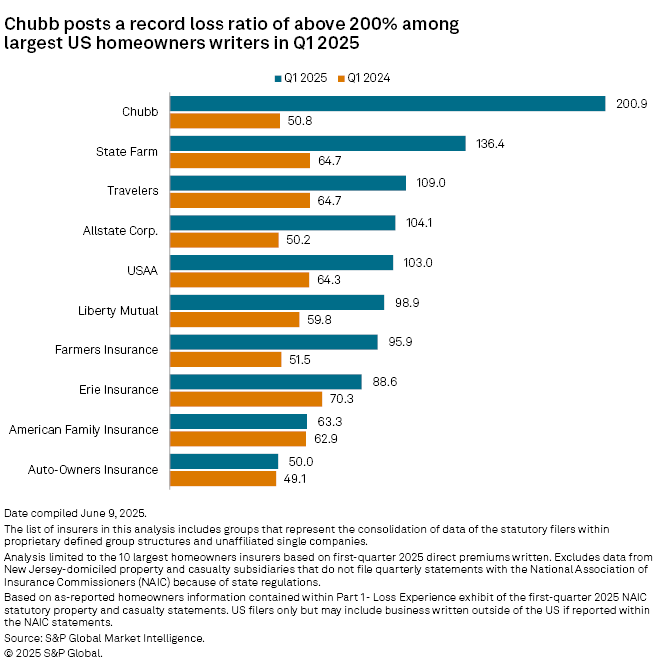

Chubb Ltd. and State Farm Mutual Automobile Insurance Co. posted record homeowners insurance loss ratios as the industry ratio crossed 100% during the first quarter amid fallout from the Los Angeles fires.

The direct incurred loss ratio for the homeowners insurance sector hit 101.2% during the first quarter, up significantly from 56.4% in the prior-year period, according to an analysis by S&P Global Market Intelligence. A loss ratio above 100% means an insurer is paying out more in claims and expenses than it is collecting in premiums.

Direct premiums written also rose in the first quarter, rising to $39.96 billion from $35.78 billion during the same period in 2024.

The sharp rise in the direct incurred loss ratio follows a quarter in which wildfires ravaged Los Angeles, leading to significant losses and efforts to raise rates further amid a changing market.

Chubb hits unwelcome heights

Among the largest US homeowners insurance writers, Chubb posted by far the highest loss ratio, hitting a new record for the company since at least 2001.

The insurer's loss ratio hit 200.9% during the first quarter, up dramatically from 50.8% during the prior-year quarter.

Chubb CEO Evan Greenberg discussed the then-ongoing wildfires during a January fourth-quarter earnings call, estimating the impact to be about $1.5 billion in net pretax losses.

"The question is, what is the ultimate size of loss, and where does it end up? ... That will determine whether it has a broader impact on overall property pricing, which in my judgement, overall is adequate," Greenberg said.

However, during a first-quarter call in April, Greenberg downplayed the impact on the insurer, pointing to the company's "excellent underlying underwriting results, double-digit growth in investment income and growing life insurance income."

Nevertheless, Chubb reported total pretax net catastrophe losses of $1.64 billion for the first quarter, including $1.47 billion from the California wildfires, a significant increase from $435 million in the first quarter of 2024.

Chubb did not respond to a request for comment.

State Farm looking to raise rates

State Farm incurred the second-highest loss ratio for the quarter among the nation's largest homeowners insurers, hitting 136.4%, up from 64.7% in the prior-year period.

The insurer's California subsidiary, State Farm General Insurance Co., bore the brunt of catastrophe losses from the Southern California wildfires, putting the unit on track to record the highest single-year direct incurred losses in the company's history.

The subsidiary incurred an estimated $7.6 billion in cat losses from the fires that broke out Jan. 7, according to a Market Intelligence analysis. This amount nearly doubled the previous full-year record loss of $3.94 billion in State Farm General's homeowners line of business in 2017.

State Farm did not respond to a request for comment.

Even with the high losses, State Farm wrote the largest number of direct premiums in the first quarter, rising 16.1% year over year to $7.47 billion, representing 19% of market share and continuing its trend of dominance.

Premiums growing at speed

The first-quarter rise follows a trend from 2024 in which the insurer's direct homeowners premiums grew at their fastest pace in more than two decades.

The Illinois-based insurer's direct homeowners premiums written rose to $31.46 billion in 2024, a 16.4% year-over-year increase compared with historical data from Market Intelligence's consolidation of combined annual statement data. This marked State Farm's strongest yearly increase since 2002, when it also reported a 16.4% rise from the prior year.

The second-largest homeowners insurer in the first quarter was The Allstate Corp., which saw its premiums grow 18.4% year over year to $3.64 billion in direct premiums, representing 9% of market share.

United Services Automobile Association came in third with $2.73 billion in direct premiums and 7% market share. Farmers Insurance Group of Cos. and Liberty Mutual Holding Co. Inc. followed, writing $2.36 billion and $2.21 billion in direct premiums, respectively, each representing 6% of the market share.