Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 Jun, 2025

By John Wu and Uneeb Asim

At-risk loans at major Chinese banks are likely to grow further this year after hitting a four-year peak in the second half of 2024, as the ongoing deterioration in retail credit standing and trade tensions pose risks to the lenders' asset quality.

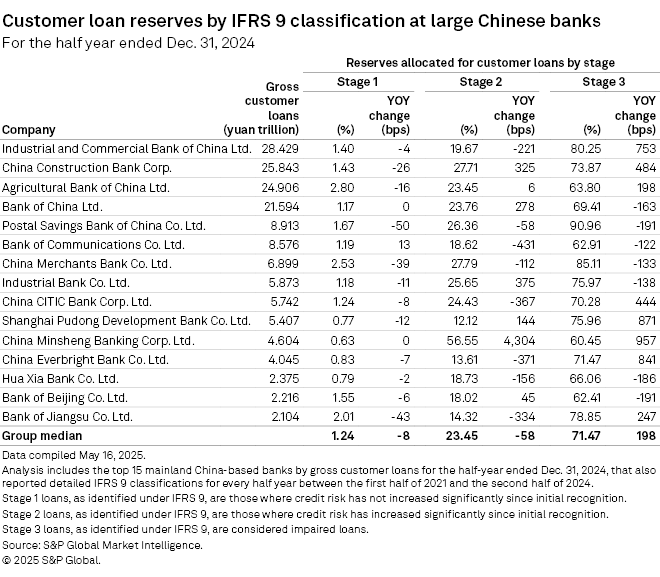

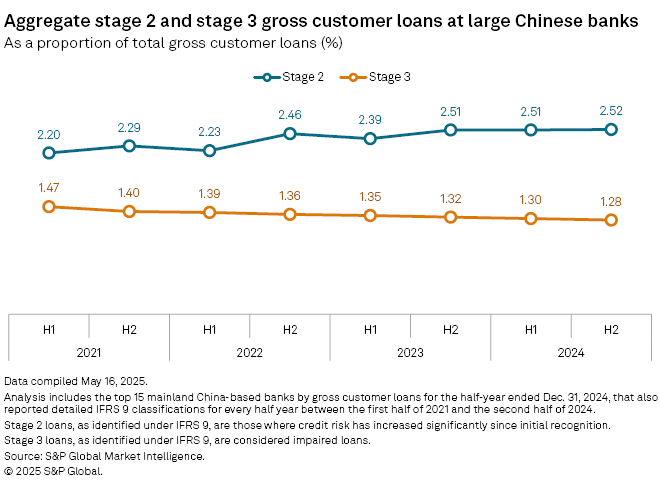

Aggregate stage 2 loans, as a proportion of gross customer loans, at a sample of 15 large Chinese banks rose to 2.52% as of end-2024, from 2.51% as of June 2024 and 2.20% as of June 2021, according to S&P Global Market Intelligence data.

Stage 2 loans are defined under International Financial Reporting Standards (IFRS) 9 as those with a substantially increased credit risk since initial recognition.

"The trend of increasing stage 2 gross loans is likely to continue in 2025 due to the ongoing deterioration of retail credit quality and trade tensions," said Iris Tan, senior equity analyst at Morningstar.

The rise in stage 2 loans indicates banks are reclassifying loans with significant deterioration in credit risk into stage 2 to prepare for potential losses, Tan said. The increase is also due to regulatory mandates in 2024 that enforced stricter application of lifetime expected credit loss models to enhance risk sensitivity, Tan added.

China has set its 2025 GDP growth target at about 5.0%, following a similar pace of expansion in 2024 and 5.2% growth in 2023. As the economy grapples with weak consumption, a prolonged property sector downturn and trade-related uncertainties, banks are expected to not only support the national goal by lowering interest rates and boosting lending, but also keep their asset quality in check.

As part of efforts to bolster growth, the People's Bank of China on May 20 cut its one-year loan prime rate to 3.0% from 3.1%, and the five-year rate to 3.5% from 3.6%. Earlier on May 7, the PBOC had cut its seven-day reverse repo rate to 1.40% from 1.50%, along with a reduction of reserve requirement ratio by 0.5 percentage points to 7.5%.

Stage 3 loans fall

While at-risk loans grew, Chinese banks have seen a steady improvement in aggregate stage 3 loans since at least June 2021. Stage 3 loans, classified as credit-impaired, fell to 1.28% as of Dec. 31, 2024, from 1.47% as of June 2021.

Tan said the amount of stage 2 loans carried into stage 3 is expected to continue to trend down due to the increase in total stage 2 gross loans and accelerated bad debt disposals.

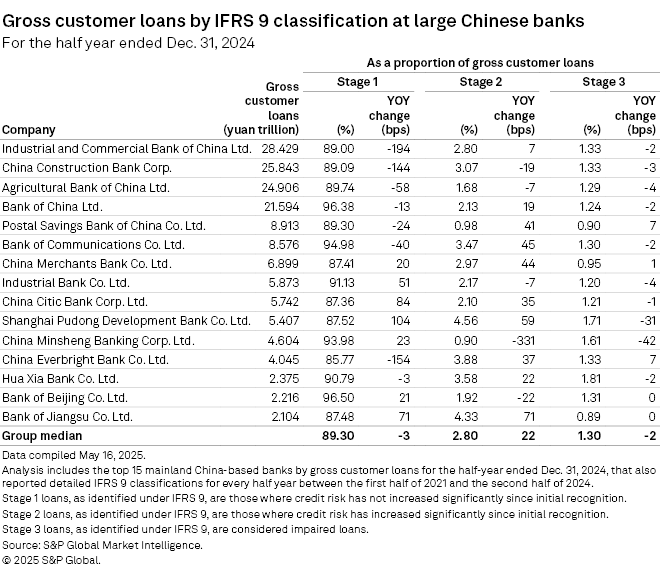

Stage 3 loans as a proportion of gross customer loans at Industrial and Commercial Bank of China Ltd. (ICBC), the world's largest lender by assets, fell 2 basis points year over year to 1.33%, on par with the sample's mean. The bank's stage 2 loans rose 7 bps to 2.80%.

China Minsheng Banking Corp. Ltd. had the largest year-over-year drop in stage 2 and stage 3 loans in the sample, according to the data. The bank's stage 2 loans fell 331 bps to 0.90% as of end-2024, while its stage 3 loans declined 42 bps to 1.61%.

The aggregate nonperforming loan (NPL) ratio of commercial banks in China fell 8 bps year over year to 1.51% in the first quarter, according to the National Financial Regulatory Administration. The ratio was up 1 bps from the fourth quarter of 2024.

Higher reserves

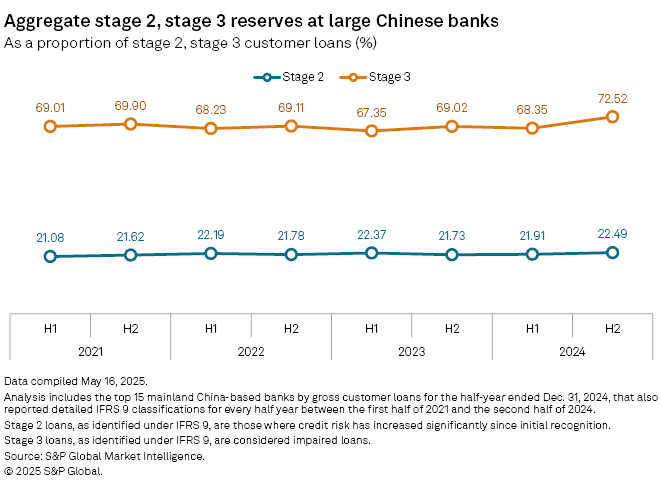

Meanwhile, the banks' reserves for both stage 2 and stage 3 loans rose to the highest levels in at least four years.

Aggregate reserves for stage 2 gross customer loans at the 15 largest Chinese lenders climbed to 22.49% as of end-2024 from 21.73% a year earlier, Market Intelligence data showed, while reserves for stage 3 loans rose to 72.52% from 69.02%.

"As the Stage 3 reserves coverage ratio was partly driven by the loan-to-value ratio and estimated value on collateral liquidation, I suspect the rising trend was driven by increasing unsecured consumption NPLs and credit card NPLs," Morningstar's Tan said.

The increasing trend is also likely to be driven by banks' stricter bad debt classification and accelerated disposal, Tan added.

China Minsheng Banking had the largest year-over-year jump of 957 bps in stage 3 loan reserves to 60.45%, while stage 2 reserves soared by 4,304 bps to 56.55%.

China Minsheng Banking did not respond to an interview request.

Among the country's largest state-owned lenders, ICBC saw the largest year-over-year increase in stage 3 reserves of 753 bps to 80.25%. Postal Savings Bank of China Co. Ltd. had the steepest decline of 191 bps to 90.96%.