Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2025

BNP Paribas SA believes a strong recovery in lending income growth in the coming years can deliver a profitability surge at its French commercial and personal banking business by 2028.

Growth in net interest income — the difference between what banks earn from loans and other assets and what they pay for deposits — at French retail banks recently stalled or reversed due to the peculiarities of the French market. The banks' struggles coincided with a surge in lending income and profitability at many other European banks due to higher interest rates.

BNP set out a new strategic plan on June 26, under which it expects a more favorable monetary policy environment and the investment of billions of euros of deposits in bonds at relatively high yields will drive the business' return on notional equity (RONE) — a measure of profitability — to more than 17% by 2028 from 9.8% last year.

"We anticipate for the 2024 to 2028 period a sharp rebound in revenues — not necessarily linear, but strong every year starting in 2025," Isabelle Loc, head of commercial and personal banking in France, said during the bank's presentation. "NII will overtake fees as the main source of revenue growth."

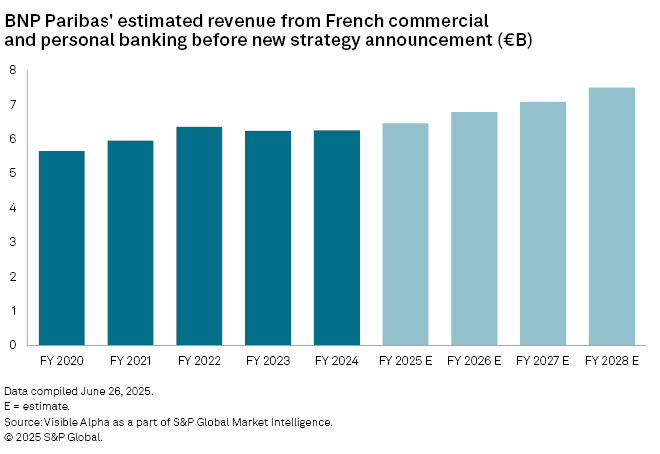

Revenues are expected to grow more than 5% per year from €6.6 billion in 2024 through to 2028. At a 5% compound annual growth rate, the business would be expected to post revenues of more than €8 billion in 2028, based on S&P Global Market Intelligence calculations.

Current analyst estimates project revenues of slightly more than €7.5 billion by 2028, according to consensus estimates data from Visible Alpha, a Market Intelligence company.

The main driver for BNP's increase in NII will be the investment of non-interest bearing deposits in bonds at relatively high yields. Non-interest bearing, or sight, deposits make up around half of the business' deposits, which totaled around €200 billion at the end of the first quarter.

Steepening yield curve

Falling short-term interest rates in the eurozone are driving an increase in sight deposits, while the long-term interest rates bonds and other fixed income instruments offer remain significantly higher.

"Between €1 billion to €1.5 billion of additional revenues seems realistic" from the investment of the deposits, said Maryline Anglaret, CFO of BNP's commercial and personal banking in France.

Among the factors that weighed on French banks' NII in recent years are their largely fixed-rate loan books, limits on the pace at which higher interest rates could be passed onto new lending and regulated savings schemes that passed higher interest rates on quickly to depositors.

BNP hopes that a slower growth in costs than revenues over the period of the plan, lower cost of risk — provisions for losses on bad loans — and limited growth in risk-weighted assets will further boost profitability at its French commercial and personal banking business. The bank forecasts revenues to grow 3 to 4 basis points more than costs, which stood at €4.6 billion in 2024, over the period.

Costs

A 2.2% to 2.5% reduction in the business' full-time employees on average each year from 2026 to 2030 will contribute to BNP's attempts to manage costs. Most of the reduction will be through natural attrition such as retirements and employees leaving voluntarily, Loc said.

A streamlining of the business' central functions, a reduction of its real estate footprint and greater control of external expenses will also contribute to the cost performance.

BNP does not have a target for branch closures as part of the plan, said Loc. The bank has told employee representatives that it plans to close around 500 branches by 2030, according to French business daily Les Echos.

BNP already operates one of the smallest branch networks in France relative to its size. The bank has 1,740 branches in France, according to Market Intelligence data. Rivals Société Générale SA and Crédit Agricole SA have around 3,000 and 6,000, respectively.

Cost of risk

Cost of risk at the business is expected to fall to less than 25 bps of total outstanding loans from the 29 bps recorded in 2024. BNP's French commercial and retail bank tends to enjoy a lower cost of risk than domestic peers due to the risk profile of its clients.

"The low level is due on the one hand to the fact that mortgages and private banking customers base have a cost of risk of around 5 bps or less, but also, on the other hand, thanks to our positioning on clients with stronger growth prospects," said Anglaret.