Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Jun, 2025

By Gaby Villaluz and Zuhaib Gull

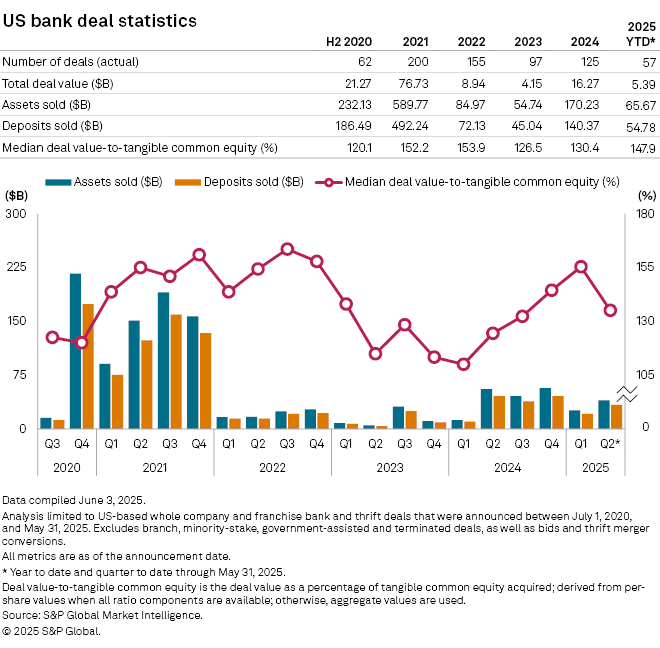

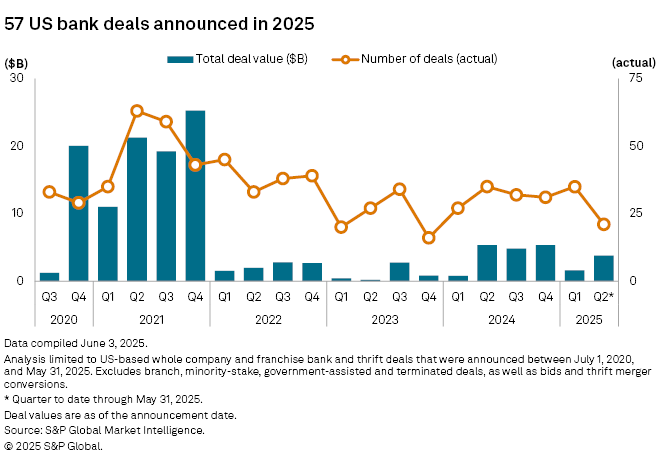

Five months into 2025, year-over-year US bank M&A activity has been flat.

Eleven deals were announced in May, bringing the total for the first five months of 2025 to 57, compared to the 56 deals announced during the same period in 2024, according to S&P Global Market Intelligence data. The total assets of targets have also been similar, with sellers from 2025 transactions having $65.67 billion in assets compared to the $64.95 billion for targets through the 2024 equivalent period.

Coming into the year, hopes were high that bank M&A would accelerate, with President Donald Trump's administration expected to pursue more economic friendly policies and deregulation. Market volatility stemming from tariff announcements has made dealmaking more challenging, but there are signs that the regulatory environment is becoming conducive around M&A.

Deals are getting approved more quickly, and the expedited process can put companies in a better position to execute multiple deals in a year.

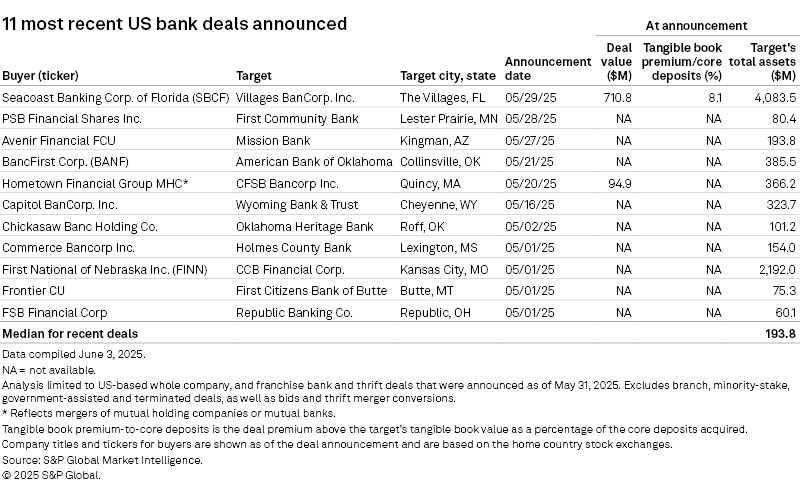

Stuart, Florida-based Seacoast Banking Corp. of Florida, for instance, announced in May its second M&A deal for 2025, agreeing to acquire The Villages, Florida-based Villages Bancorp Inc. Seacoast's first announcement was in February, when it disclosed a $106.3 million deal for Sebring, Florida-based Heartland Bancshares Inc. The 91-day period between the two announcements marks the shortest gap for a bank buyer on consecutive deals since Seacoast's 2022 acquisition announcements of Apollo Bancshares Inc. and Drummond Banking Co. in a span of 36 days.

The Villages Bancorp. deal is Seacoast's largest among its 17 bank purchases since 2014, and the $710.8 million deal value makes it the 10th-largest US bank M&A transaction announced since 2024, according to Market Intelligence data.

Midwest sees most activity

In April, Worthington, Minnesota-based Worthington Federal Savings Bank FSB disclosed a merger of mutuals with in-state peer Jackson Federal Savings And Loan Association, while Prinsburg, Minnesota-based PSB Financial Shares Inc. filed with the Federal Reserve Bank of Minneapolis an application to acquire of Lester Prairie, Minnesota-based First Community Bank on May 28. Community bank M&A has been picking up steam in the Gopher State as smaller banks team up to gain competitive advantage and capitalize on large banks' retreat from the state.

Minnesota ties with Illinois as the most active state with five announced deals so far in 2025.

There were 20 deals announced in the first five months of 2025 targeting banks headquartered in the Midwest, making it the most active region, followed by the Southeast with 11 deals.

Bank deals announced in Oklahoma, Massachusetts

Two bank deals were announced in Oklahoma during the month of May, bringing the state's deal count to four so far in 2025.

Oklahoma City-based Chickasaw Banc Holding Co. on May 2 announced plans to acquire Roff, Oklahoma-based Oklahoma Heritage Bank. The transaction is expected to close late in the second quarter or in the third quarter, subject to regulatory approval.

|

– Access a list of pending and completed M&A deals announced since Jan. 1, 2015. – Access the S&P Capital IQ Pro M&A summary page for US financial institutions – Read more M&A news. |

On May 21, Oklahoma City-based BancFirst Corp. announced its planned acquisition of Collinsville, Oklahoma-based American Bank of Oklahoma. Upon completion of the deal, BancFirst will expand in Oklahoma with an additional six branches, based on Market Intelligence data.

In Massachusetts, Easthampton-based Hometown Financial Group MHC disclosed May 20 that it had agreed to purchase Quincy-based CFSB Bancorp Inc. and its subsidiary Colonial Federal Savings Bank. This brought the number of bank deals in the state to four for the first five months of 2025.

Oklahoma and Massachusetts tied with California and Texas as the second-most targeted states in the US.