Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jun, 2025

By Brian Scheid and Annie Sabater

After stumbling to its lowest point in nearly a year this April, the S&P 500 has recovered nearly all its losses in roughly two months. However, the outsized returns of tech stocks have driven fresh concerns over a lack of market breadth that could undermine the rally's lasting power.

"I would not describe this rally as healthy," Michael O'Rourke, chief market strategist at JonesTrading, said in an interview.

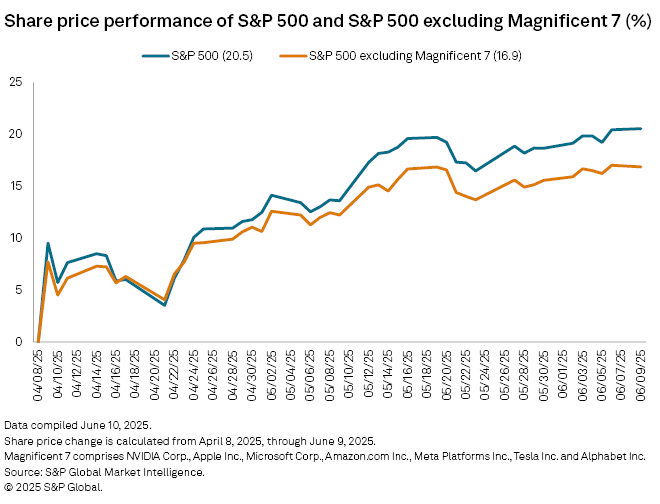

After reaching an all-time high on Feb. 19, the S&P 500 tumbled 18.9%, reaching bottom on April 8 after US President Donald Trump's announcement of tariffs on nearly all trading partners rattled investors. The large-cap index has since risen more than 20.5% through June 9, and as of June 10, was less than 2% from matching that all-time high again.

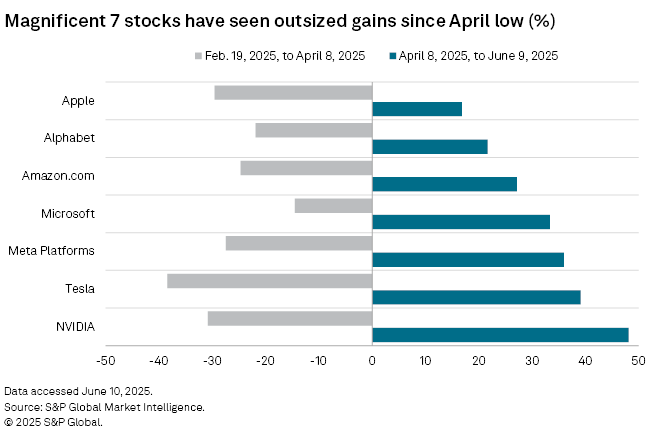

However, the rally is less impressive when excluding the mega-cap technology stocks, known as the Magnificent Seven, which have weighed heavily on the S&P 500's performance over roughly the past five years. As of June 9, these stocks — NVIDIA Corp., Tesla Inc., Meta Platforms Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc. and Apple Inc. — were up by an average of 31.7% from April 8, after declining by an average of 26.8% from Feb. 19 through April 8.

While the S&P 500 has rallied 20.5% since April 8, that gain is 16.9% if those seven mega-cap stocks are removed.

"They are the largest and most liquid names, as well as respected companies, so they attracted significant flows over the short period of time and fueled index performance," said O'Rourke.

The ongoing broader market rally has been driven by investors and speculators chasing market exposure amid expectations that the worst of the Trump trade policy headwinds may be over and has pushed US equities back to historically expensive levels, according to O'Rourke.

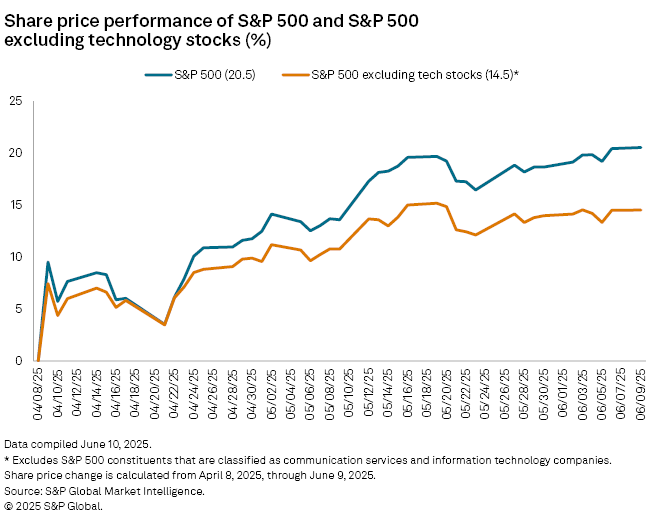

The S&P 500's IT and communication services sectors fared the best during this rally, gaining 33.7% and 25%, respectively, since April 8.

Without these two tech sectors, the S&P 500 ended June 9 up 14.5% from April 8.

Market breadth has deteriorated, with 49% of S&P 500 stocks trading above their 200-day moving averages, compared to 59% trading above those averages in February, according to Tom Essaye, founder of Sevens Report Research.

"If the rally were sustainable, we would hope to see better participation," Essaye wrote in a June 9 note.

The concentration may not ultimately doom this rally, however, said George Pearkes, a macro strategist at Bespoke Investment Group.

"On the one hand, those are the stocks that are generating earnings growth; it would be more concerning if they were showing some sort of weakness in their actual results while valuations expanded," Pearkes said in an interview. "But that isn't really what we're seeing. It's unprecedented to see this kind of top-heavy earnings growth, but markets reflecting that isn't a sign of the price action being unhealthy."

Ultimately, lack of breadth may not matter as much as complacency in trading, said O'Rourke with JonesTrading.

"Markets have rallied on trade optimism, but employment is exhibiting signs of slowing," O'Rourke said. "If an economic slowdown materializes as I expect this summer, then investors who chased this rally are likely to be disappointed."