Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 May, 2025

By Brian Scheid

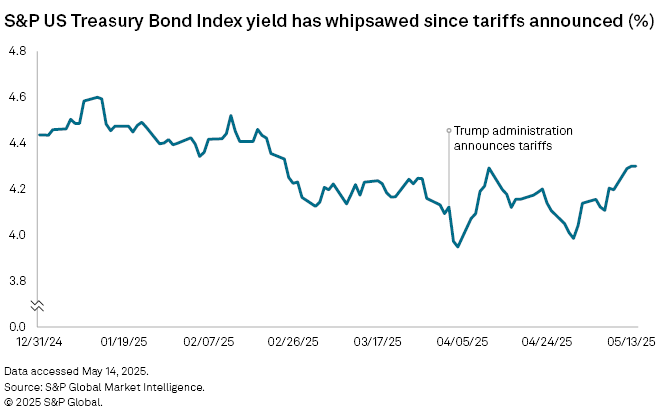

The benchmark 10-year US Treasury yield climbed above 4.5% this week for the first time in nearly three months, as tariff threats, inflation fears and higher-for-longer interest rates triggered another sell-off in US government bonds.

The Treasury 10-year yield, which moves opposite prices, has risen about 50 basis points since President Donald Trump's April 2 announcement revealing steep tariffs on goods from nearly all the country's trading partners.

Government bond yields since early April have been on "the tariff roller coaster," said Padhraic Garvey, head of global rates and debt strategy at ING, as tariffs have been delayed, threats by Trump have been walked back and some details of preliminary trade talks have bolstered hopes of a trade policy reprieve.

But with the Federal Reserve unlikely to move on rates until the tariff impact starts showing up in government data, the bond market is largely anticipating the sell-off to continue amidst heightened fears of higher inflation and interest rates. The 10-year yield could soon near 5% for the first time since October 2023.

"I'd suggest there is a general tolerance this side of 5%," Garvey said in an interview. "We've been at 5% before in this cycle, so getting back there would not be a dramatic move. That said, shooting above 5% could indeed be problematic, and likely only tolerable if the economy is doing really well."

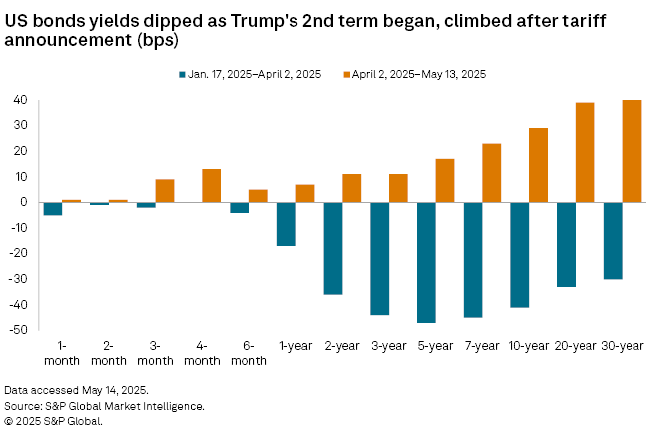

Much of the ongoing sell-off in government bonds has taken place in longer term yields. The 30-year yield, for example, fell by about 30 basis points from the start of Trump's second presidential term in January to his April 2 tariff announcement, but has climbed by about 40 bps since. The 20-year yield, which initially fell 33 bps, has climbed 42 bps since April 2.

Tariffs may not ultimately prove as inflationary as markets currently fear, according to John Luke Tyner, head of fixed income and portfolio manager at Aptus Capital Advisors. Yields will ultimately be driven by economic growth, with rate likely pushing higher if the US does not appear to be imminently entering a recession, and inflation expectations as the market adjusts for future inflation risks.

"I would think this generally should keep term premiums elevated," Tyner said in an interview.

Where the bond market is headed will hinge on how much the tariffs actually stick and for how long, as this will impact the future direction of inflation, the labor market and the Fed's decision on when to cut rates and by how much, said Patrick Leary, managing director with Loop Capital Markets.

"We will need to wait and see what develops, but in the meantime, fixed income investors are favoring the front end and belly of the yield curve and avoiding the long end," Leary said in an interview. "This is a sharp contrast to previous recession fear trades."