Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 May, 2025

Lloyds Banking Group PLC expects tariffs to have "very limited direct impact" on business despite provisions taken out with its first-quarter results.

"Only very modest and highly-rated parts of our commercial business are directly exposed to the US," CFO William Chalmers said during an earnings presentation May 1. "The quality of our UK business protects against any second-order local impact." Lloyds' exposure to US exporters accounts for 1% of group loans and advances, he said.

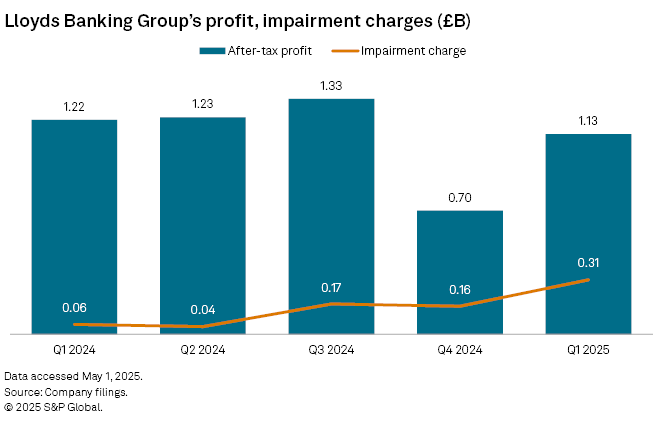

The UK-based bank booked a £309 million impairment charge for the first three months of 2025, compared to a £57 million charge a year ago. This included a £100 million adjustment to the group's expected credit loss (ECL) allowances to reflect potential negative effects related to US tariffs announced in early April.

"To be very clear, this is not addressing any impacts that we're seeing today within our book...This is about getting ahead of what might develop and making sure that we are suitably provisioned," Chalmers said, adding that the tariff-linked provision could be temporary.

"We took this charge at a time when there was maximum volatility related to the tariffs, and there were a lot of fairly adverse cases coming out...If it turns out that the tariff debate goes into a balance or something similar, as has been talked about a little bit since then, a good part of that £100 million may not be necessary," the CFO said.

The charge, coupled with higher operating costs, contributed to Lloyds' first quarter drop in after-tax profit to £1.13 billion from £1.22 billion a year ago.

Lloyds does not envision any change in provisions related to its motor finance business until at least the third quarter of 2025, as it awaits the Financial Conduct Authority's (FCA) decision on a potential compensation scheme which is expected within six weeks after the Supreme Court rules on related cases in July, Chalmers said.

Lloyds, which owns Black Horse Ltd.,

2025 guidance confirmed

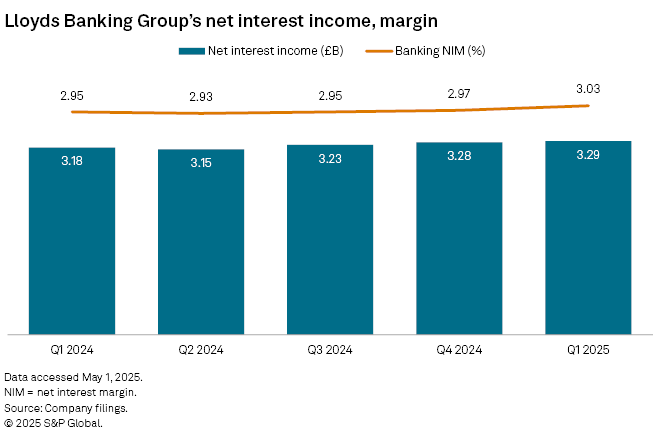

Lloyds' first-quarter net interest income (NII) — a key revenue driver — rose 3% year over year and 1% on the previous quarter to £3.3 billion. Banking net interest margin (NIM) increased to 3.03% from 2.95% a year ago and 2.97% three months prior. Group average interest-earning banking assets grew to £455.5 billion from £449.1 billion a year ago.

Lloyds kept its full-year guidance for £13.5 billion of NII, and expects a further uptick in both NIM and average interest-earning assets in the coming quarters, Chalmers said.

The bank feels "pretty good" about the guidance, although some risks related to the path of Bank of England rate cuts and potential increase in competition for mortgages could affect NII performance later in the year, Chalmers said.

Lloyds grew total loans by £7.1 billion to £466.2 billion and total deposits by £5 billion to £487.7 billion during the period. Mortgages accounted for £4.8 billion of the quarterly loan growth as consumers rushed to purchase property before the introduction of new stamp duty rules, which lower the property value threshold for the tax to £300,000 from £425,000 previously.

"We are seeing a little bit more competition in the context of mortgage spreads in the market for [the second quarter] and potentially beyond," Chalmers said, though this would not "hugely change the picture" for Lloyds.

Lloyds shares were trading down 2.68% at noon London time on May 1.