Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 May, 2025

By Audrey Elsberry and Annie Sabater

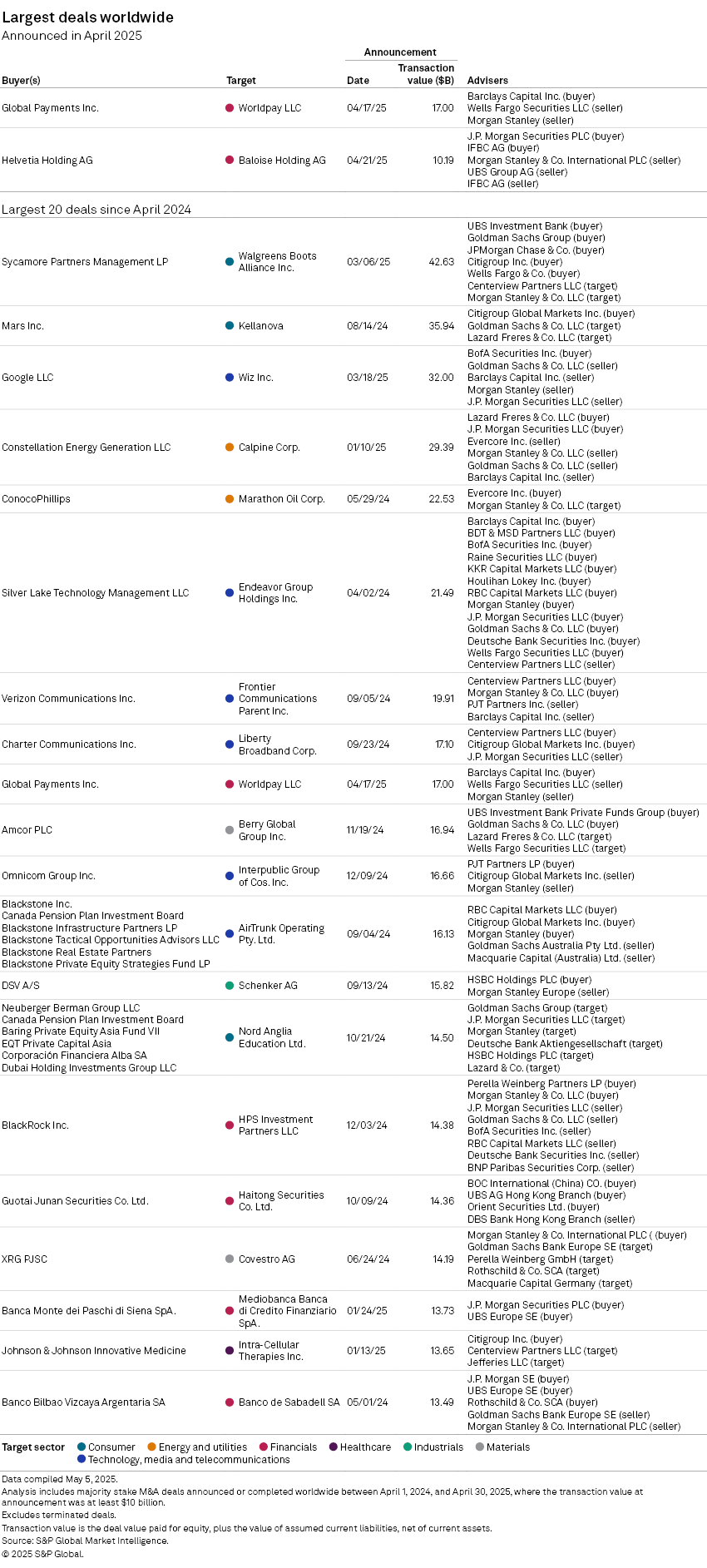

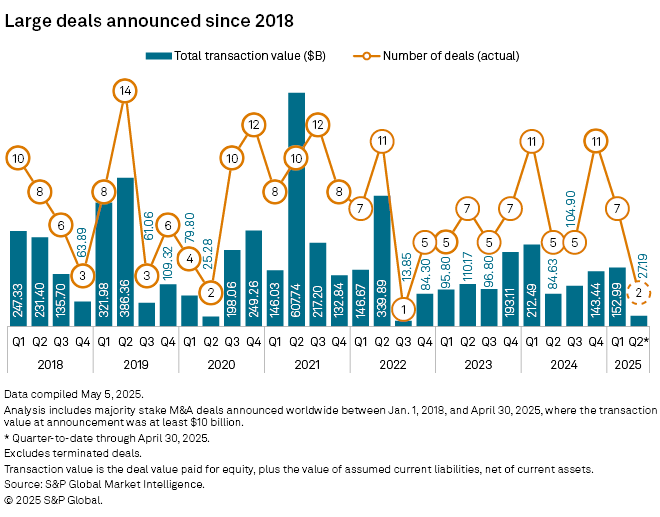

Two financial services M&A deals valued at more than $10 billion were announced in April, demonstrating that large deals are still possible in an uncertain market environment.

Both deals, with a combined transaction value of $27.19 billion, were announced in the second half of the month, avoiding the market turmoil associated with US tariff announcements in early April.

Atlanta-based Global Payments Inc. announced plans to buy Cincinnati-based Worldpay LLC on April 17 in a deal with a transaction value of $17.00 billion. A few days later, on April 21, Switzerland-based Helvetia Holding AG announced its planned acquisition of Switzerland-based Baloise Holding AG with a transaction value of $10.19 billion.

Morgan Stanley CEO Ted Pick said during an April 11 earnings call that market uncertainty made the path to announcement "bumpier" for some clients, and could cause some deals to be paused. The firm was among the sellers' advisers on both of the April transactions.

In one of the April deals, the financial services company Worldpay is expected to be sold to Global Payments by private equity firm GTCR LLC, which owns a 55% stake in Worldpay and payments company Fidelity National Information Services Inc., which owns a 45% stake.

Global Payments will purchase Worldpay from both GTCR and Fidelity National Information Services, according to the companies' merger announcement.

GTCR will receive 59% cash and 41% stock consideration as part of the sale agreement, as well as 15% of Global Payments' outstanding shares at deal close. As a part of the sale agreement, Fidelity National Information Services will acquire Global Payments' issuer solutions business for an enterprise value of $13.5 billion.

The sale of Worldpay and Global Payments' issuer solutions business is cross-conditioned upon one another, according to the merger announcement. Both deals are expected to close at the same time, in the first half of 2026.

|

– – Read the M&A and equity offerings research paper. – Read more |

In the merger of equals between Helvetia and Baloise, two Swiss insurers plan to combine to create the second-largest insurance group in Switzerland. The combined market share of the two companies is expected to be roughly 20% of the Swiss market, according to the merger announcement.

The name of the combined organization is planned to be Helvetia Baloise Holding Ltd. The combined company is expected to have $24.39 billion in business volume across eight countries. The board of the combined company will consist of seven directors from Helvetia Holding and seven directors from Baloise Holding.

The exchange ratio of the two public companies is 1.0119 Helvetia Holding shares for each Baloise Holding share. The deal is expected to close in the fourth quarter of 2025.

"We as two medium-sized listed insurance groups can tackle future challenges together supported by increased scale, improved profitability and a highly attractive value proposition for all our stakeholders," Thomas Schmuckli, Helvetia Holding Chairman, said in the merger announcement.