Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 May, 2025

By Yuzo Yamaguchi and Marissa Ramos

Global green bond issuance will likely remain slow for the rest of 2025 after it fell to a three-year low in the January-April period amid global economic uncertainties triggered by US President Donald Trump's policies.

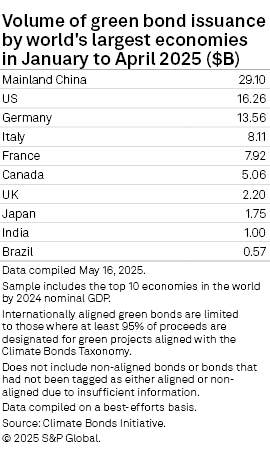

The global sales of green bonds in the first four months of 2025 totaled $132.37 billion, the lowest since the same period in 2022, according to the Climate Bonds Initiative, an organization that tracks global capital for climate action.

"Trump's policy is running counter to the moves toward decarbonization and is creating a headwind for the green bond market," said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management, in a phone interview with S&P Global Market Intelligence on May 21. "Bond yields will likely remain volatile, negatively affecting issuance."

The sweeping tariffs imposed by Trump in early April sent global stocks and bonds plummeting, heightening fears of an economic downturn and renewed inflation that could halt investment in new decarbonization projects. Although most of the duties were placed on a 90-day pause soon after, the extent of levy reductions after negotiations remains uncertain.

Trump announced soon after starting his second term in January that the US would withdraw from the Paris Agreement aimed at tackling global warming. Trump also said his administration would boost oil and gas production to revitalize the world's largest economy. Trump's energy priorities include becoming a global energy leader, increasing mineral production and processing, and easing restraints on emissions and efficiency of cars and appliances.

"Companies are unlikely to accelerate decarbonization efforts, following Trump's moves," said Takahide Kiuchi, executive economist at Nomura Research Institute. "Fundraising is also unlikely amid growing economic unpredictability," Kiuchi said.

Global financial markets have been volatile so far this year amid rapid developments on tariff policies that sent yields on US Treasury and Japanese government bonds surging. Rising yields would increase the cost for issuers to raise funds and risks for investors to bet on the bonds. Bond yields move inversely to prices.

"There have been fewer new issuers [of green bonds] in the global market since the start of the year," said Yasunobu Katsuki, senior sustainability strategist at Mizuho Securities Co. "The momentum for issuing green bonds has receded."

The US ranked second as the largest issuer in the global market, selling $16.26 billion of green bonds in the January-April period. Chinese issuers sold $29.10 billion, according to the Climate Bonds Initiative data. Germany ranked third with $13.56 billion.

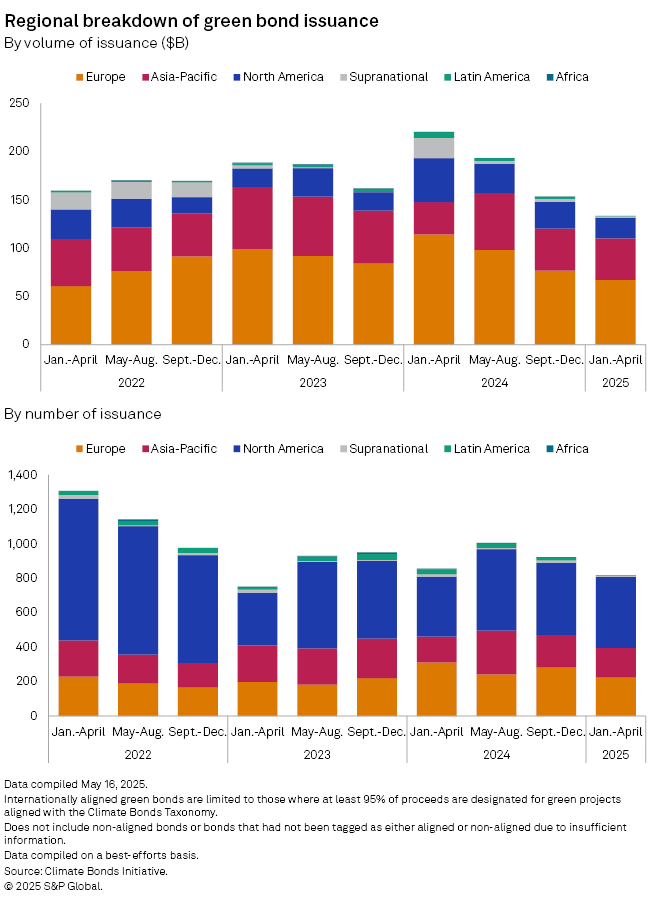

By region, Europe was the top green bond issuer with $66.13 billion, followed by $42.90 billion for Asia-Pacific and $21.31 billion for North America.

China's issuance of internationally aligned green bonds over the four-month period increased to $29.10 billion from $22.39 billion in the previous four months. The momentum for issuing green bonds in the second-largest economy may continue as China transitions to a low-carbon economy, said Rui Li, fixed income portfolio manager at AXA Investment Managers.