Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 May, 2025

By Dylan Thomas and Annie Sabater

Tariff-related uncertainty appeared to weigh on the outlook of the Big Four private equity firms as they reported first-quarter earnings.

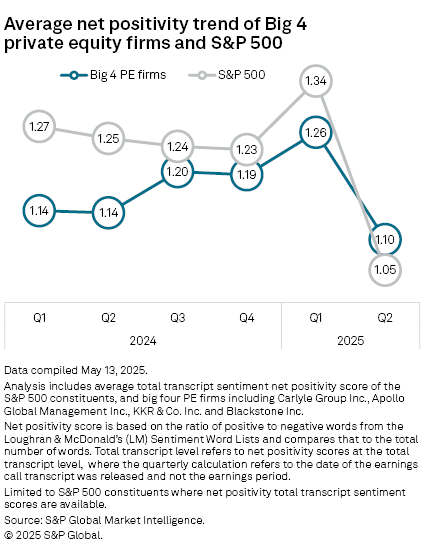

The average net positivity score for the Big Four private equity firms dipped to its lowest level in more than a year, although the decline was less pronounced than the steeper quarter-over-quarter drop in sentiment across the S&P 500, according to an S&P Global Market Intelligence analysis of the language used by executives and analysts on the calls.

The Big Four — Apollo Global Management Inc., Blackstone Inc., The Carlyle Group Inc. and KKR & Co. Inc. — are the largest publicly-traded alternative asset managers by assets under management.

Among peer firms, KKR recorded the most significant drop in its first-quarter sentiment score compared to the prior four-quarter average.

That was despite CFO Robert Lewin reassuring shareholders that 90% of the firm's private equity portfolio was insulated from the immediate repercussions of tariffs and that KKR was taking steps to mitigate tariff impacts on the remainder of the portfolio. Management was also evaluating the potential of tariffs to slow global growth, lead to inflation and delay interest rate cuts, Lewin said.

"We're trying to anticipate what could happen next and be in a position where we can really react to things either proactively or very quickly if things change from our base case," Lewin said.

KKR Co-CEO Scott Nuttall said the firm aimed to "keep investing when others are scared," leaning into the macroeconomic uncertainty.

"In our experience, times like this yield some very attractive investment opportunities," Nuttall said.

Exit impact

The uncertain outlook complicates the exit picture, Blackstone CEO Stephen Schwarzman acknowledged on the firm's first-quarter earnings call. Globally, the value and volume of private equity exits sank to a two-year low in the first quarter.

"More volatile markets do mean we are less likely to sell in the near term, although that can change if conditions improve," Schwarzman said.

A reduction in exits broadly would slow the return of capital to the private equity firms' limited partners, adding to the strain on the private equity investment cycle. Lower levels of distributions in recent years have created liquidity issues for limited partners, restricting their ability to make new fund commitments and contributing to a three-year decline in private equity fundraising.

– Download a file of raw data from this story.

– Catch up on the decline in evergreen fund launches.

– Check out the April totals for PE/VC-backed funding rounds.

AUM growth

All of the Big Four firms added to their total assets under management (AUM) in the first quarter, led by Blackstone, which reported quarterly inflows of $61.6 billion. Already the largest of the four, Blackstone grew its AUM to nearly $1.17 trillion in the first quarter, up 4.6% from $1.13 trillion in the fourth quarter 2024.

KKR led on year-over-year growth, expanding AUM 15% to $664.32 billion as of the end of the first quarter. But Apollo was projected to grow fastest over the next year, increasing its AUM 16.7% to nearly $1.3 trillion by the first quarter of 2026, according to consensus forecast data from Visible Alpha, a part of Market Intelligence.

Carlyle, by contrast, was expected to lag its peer firms, expanding AUM 6.2% to $480.8 billion by the first quarter of 2026, according to Visible Alpha.

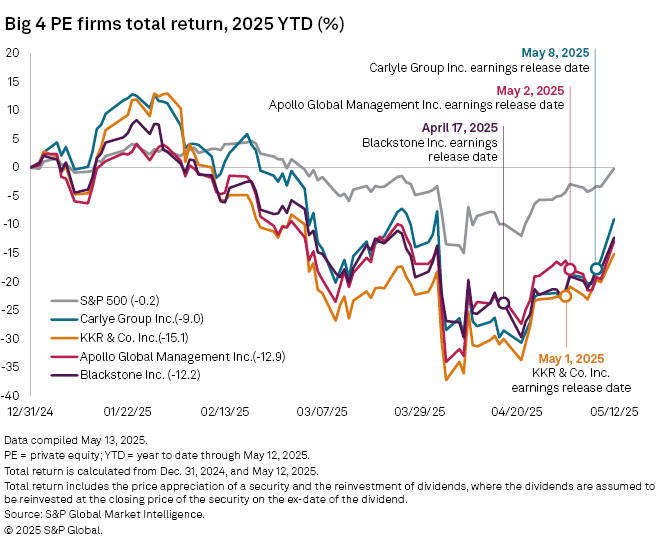

Total return performance

The total return performance of the Big Four firms was negative between the start of the year and the end of first-quarter earnings season, with all four firms experiencing stock price declines between Jan. 1 and mid-May. The most significant drops coincided with President Donald Trump's April 2 tariff announcement.

All four also lagged the total return performance of the S&P 500 over Jan. 1–May 12.

Blackstone paid out the largest dividend in the first quarter. The firm's 93-cent dividend is projected to rise to $1.25 by the first quarter of 2026, according to Eclipse, an S&P Global dividend forecasting service.

Products & Offerings

Segment