Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 May, 2025

By Brian Scheid

Uncertainty about the timing and impact of US President Donald Trump's tariffs led Federal Reserve officials to hold interest rates steady for a potentially longer-than-expected period.

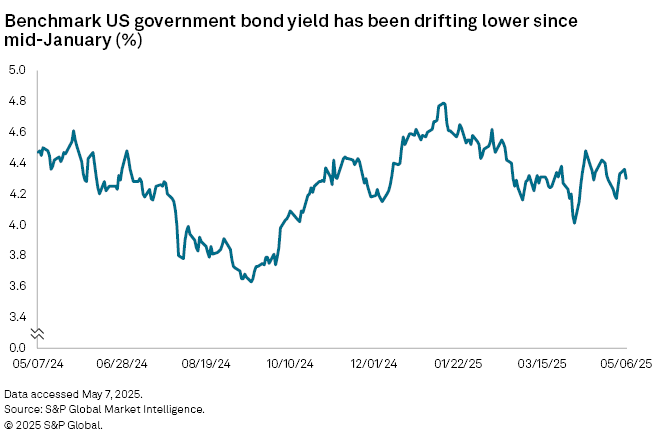

The Fed's rate-setting Federal Open Market Committee voted May 7 to maintain the central bank's benchmark rate within its current target of 4.25% to 4.5%, where it has been since the Fed last cut rates by 25 basis points in December 2024.

Previously, Fed officials anticipated rate cuts throughout the year. But Trump's plan to impose tariffs on nearly all US trading partners has altered that outlook. The Fed is unlikely to adjust rates until the economic effects of the tariffs become evident in data, particularly concerning inflation and the domestic job market.

"It's really appropriate, we think, for us to be patient and wait for things to unfold as we get more clarity about what we should do," Fed Chairman Jerome Powell said during a press conference following the announcement that the Fed would keep rates unchanged.

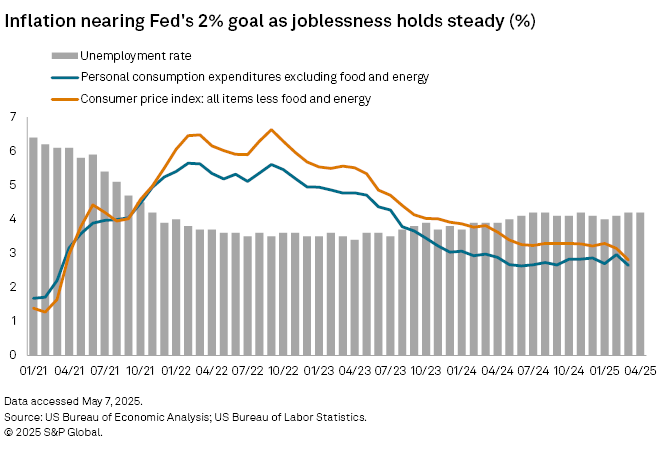

Powell said the US economy's relative health allows for patience on rates. The unemployment rate has hovered around 4% over the past year and inflation has moderated, showing progress toward the Fed's 2% target.

However, Trump's tariffs are the key unknown factor, Powell said. The Fed's future actions and timing depend almost entirely on the tariffs' scale, scope, timing and duration.

"The right thing to do is to await further clarity," Powell said.

Wait and see

Given the timing of Fed meetings, government data releases and a 90-day pause on reciprocal tariffs expected to last until early July, the full impact of tariffs on inflation and jobs may not appear in data until the fall, indicating that clarity could still be months away.

Scott Anderson, chief US economist and managing director at BMO Capital Markets, said the Fed's "wait and see" approach is likely the best option due to the increased uncertainty surrounding future inflation and the labor market.

"Move too early in the wrong direction on rates and you create a serious monetary policy error that could put the financial markets into a tailspin," Anderson said.

Following Powell's press conference, about 73% of the futures market predicted the Fed would cut rates by at least 0.25 percentage point by July, according to CME FedWatch. A month prior, nearly 100% of the market anticipated at least one cut by July.

Now, almost all the market expects at least one cut by September. But Powell said the Fed's next move will likely depend on how tariffs affect inflation, economic growth and unemployment.

"The Fed is acknowledging that uncertainty has increased with more upside risk for both inflation and unemployment," said James Knightley, chief international economist at ING. "This suggests little inclination to move until they are confident of the direction the data is heading, meaning rate cuts could be delayed but risk being sharper when they come."

Powell did not exclude the possibility that the first rate move after the tariffs could be an increase if inflation rises significantly. Core personal consumption expenditures, excluding food and energy, could rise to 4% by the fourth quarter due to tariffs, up from 2.6% in March, BMO's Anderson said.

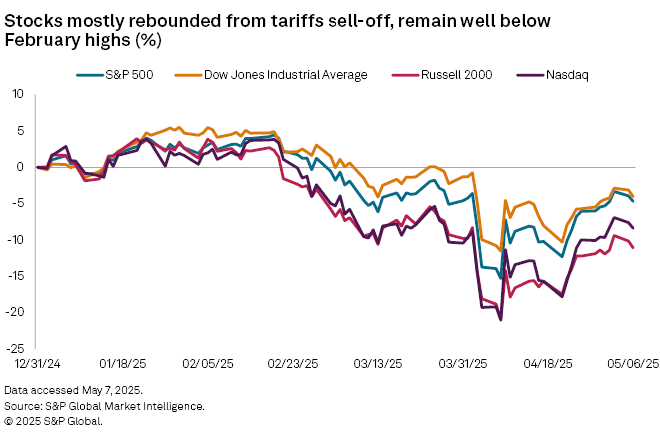

Tariffs have increased uncertainty in financial markets, which could continue for months as the Fed maintains its monetary policy, said Bill Zox, a portfolio manager at Brandywine Global.

"If the financial markets don't push for more clarity, it could take some time to flesh out the tariffs and the impact on the real economy," Zox said. "If a recession becomes imminent, the Fed may be late and may have to catch up with large rate cuts."