Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 May, 2025

Standard Chartered PLC is reaffirming its guidance for the full year despite increased economic complexities created by US tariff policies.

The lender, which is headquartered in the UK but operates primarily in Asian, African and Middle Eastern markets, booked a 14% increase in its net profit to $1.59 billion in the first quarter, beating the analyst consensus of $1.33 billion. Return on tangible equity rose 1.3 percentage points year over year to 14.8%.

Potential impact from US tariffs on StanChart's business segments is also limited as US clients represent a small number of its customer base. As of 2024, US-related corporates income represented 7%, or around $900 million, of the total revenue of StanChart's corporate and investment banking segment.

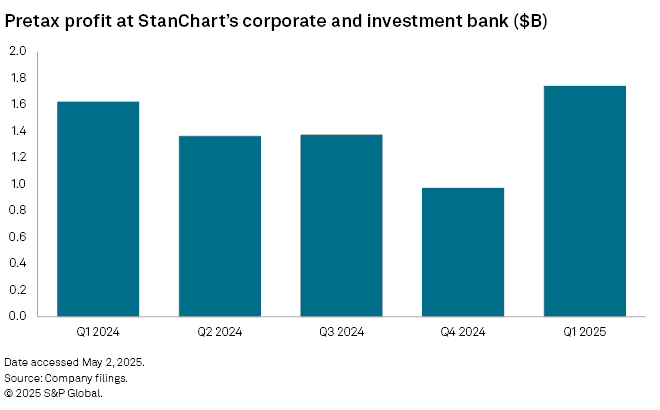

In the first quarter, the division's pretax profit stood at $1.74 billion, up 7% on a yearly basis and 79% from three months prior.

"While the US is an important contributor for us, the large majority of our income sits outside of the US, and despite potential headwinds, we think we are well-positioned to capture opportunities across our footprint," CEO Bill Winters said on a first-quarter earnings call. "It's very likely that our clients will continue to diversify their supply chains, creating growing opportunities for us to serve those clients profitably."

The bank also expects its China portfolio to remain resilient amid market turbulence as 75% of its corporate and investment banking exposures are investment grade, with strong credit quality.

Pretax revenue in StanChart's wealth banking segment grew 9% to $746 million. The bank entered the second quarter with strong revenue and net new money in its wealth solutions line, CFO Diego De Giorgi said, but it is too soon to predict how the recent market volatility could impact customer behavior going forward.

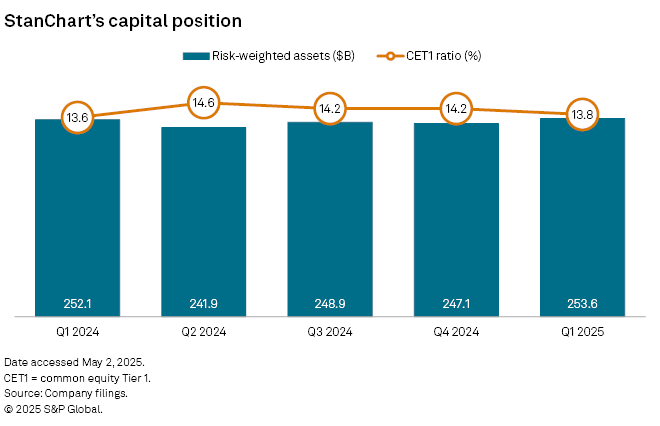

The group retained its 2025 guidance of revenue growth below the medium-term 5% to 7% target due to an expected "challenging" year for net interest income growth. The bank also retained its common equity Tier 1 (CET1) ratio outlook of between 13% and 14% and low single-digit percentage growth in underlying loans and advances to customers and risk-weighted assets.

"We're confident in our trajectory and in the long-term prospects for the group, whilst remaining watchful of the external environment," Winters said.

Capital cushion

StanChart incurred a 39 basis-point deterioration in its first-quarter CET1 ratio to 13.8%, still well above the minimum required ratio of 10.5% and near the upper end of its target range.

A 61-bps increase in capital derived from its $1.5 million share buyback announced in February, which is nearly halfway completed, was offset by a 3% year-over-year increase in risk-weighted assets (RWAs) to $253.6 billion.

The rise in total RWAs was due to a 30% rise in market risk RWAs. De Giorgi, however, said market risk RWAs are expected to decline in the second quarter.