Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2025

By Matt Smith and Beenish Bashir

| South African President Cyril Ramaphosa meets with US President Donald Trump on May 21. |

South Africa's banks are bracing for further economic turmoil, which could dent their trade finance revenues and expose their overdependence on sovereign bond holdings.

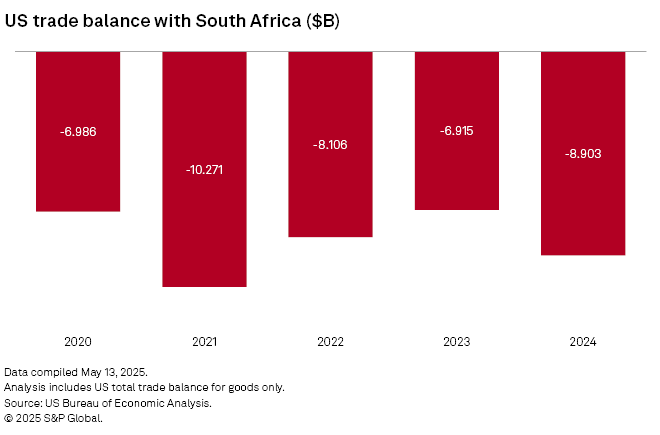

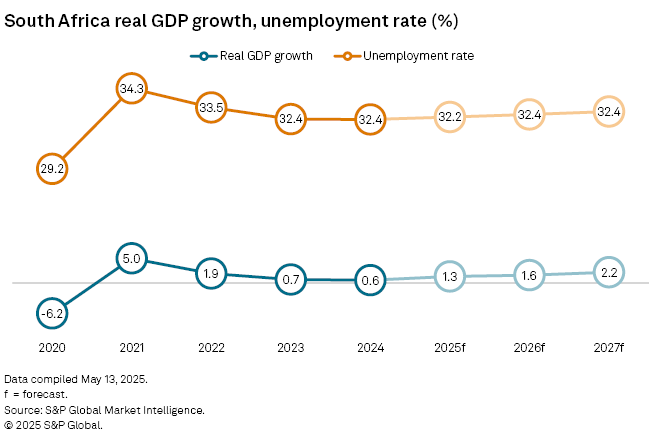

The country's debt-to-GDP ratio is expected to climb to 77% this year. Meanwhile, real GDP growth is lackluster, at 0.6% in 2024 and projected at 1.3% in 2025, according to S&P Global Market Intelligence forecasts.

A frosty relationship with the US, starkly illustrated by a confrontational White House meeting between South African President Cyril Ramaphosa and US President Donald Trump on May 21, shows no sign of thawing and could have significant economic repercussions.

The probable loss of South Africa's privileges under the Africa Growth and Opportunity Act (AGOA), which allows eligible sub-Saharan African countries to export products duty-free to the US, will hurt trade finance activities at the country's major banks.

Africa Growth and Opportunity Act

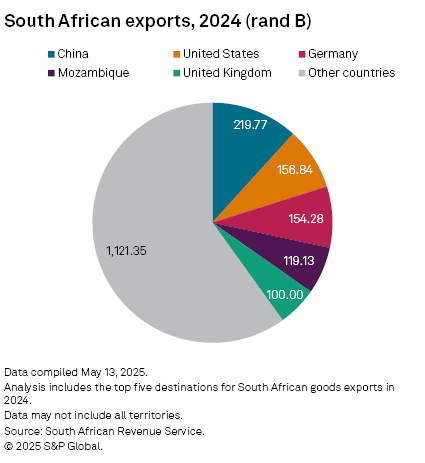

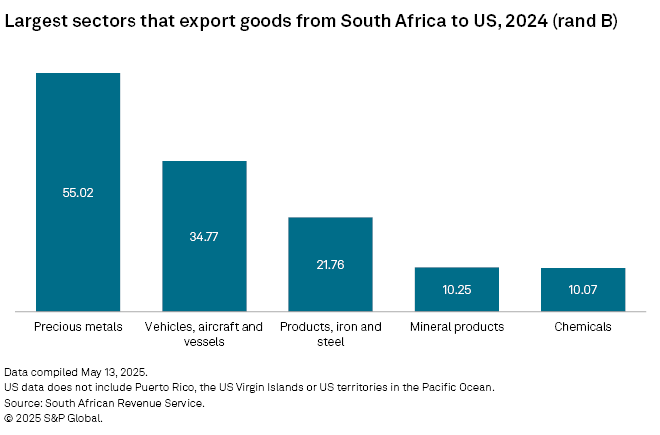

South Africa exported 156.9 billion rand of goods to the US in 2024, second only to the 219.8 billion rand exported to China, S&P Global data shows. Its major export sectors include minerals and metals — although only a small fraction of these qualify under AGOA — and vehicles.

The country's economy is supported by banks, including Standard Bank Group Ltd., FirstRand Ltd., Absa Group Ltd., Nedbank Group Ltd., Investec Group and Capitec Bank Holdings Ltd.

It is pretty much a given that South Africa's AGOA eligibility will end, Dawie Roodt, chief economist and founding member of Pretoria-based financial services company Efficient Group, told

Non-oil AGOA exports to the US totaled $3.76 billion in 2024, of which 64% were automobiles and vehicle components; total South African vehicle exports were $9.46 billion in 2023, according to the Observatory of Economic Complexity.

"The country will attempt to redirect more vehicle exports to Europe, but it won't be easy — many built in the country are manufactured especially for the US," Roodt said.

The termination of South Africa's AGOA privileges will lower the country's GDP growth this year by 0.1-0.2 percentage point, which, in an economy that is hardly growing, is "a big deal," he said.

South African banks do not disclose their trade finance revenues, although a 2017 pan-African survey found that trade finance generated about 15% of banks' total income. Absa and Nedbank declined to comment when contacted by Market Intelligence; FirstRand, Standard Bank, Capitec and Investec did not respond to requests for comment.

Standard Bank supports AGOA exporters by providing cross-border payment capabilities and trade finance, according to its website.

"Banks' trade financing deals will be affected, which will negatively impact earnings," Roodt said.

Sovereign debt holdings

Nevertheless, the banking industry faces other issues of greater concern, such as growing fears that the new government of national unity could fall apart, the country's state budget and the banks' large holdings of government debt.

"South African sovereign debt is already too big for the size of the economy, and its debts are increasing," said Roodt. "Banks are a major funder of the state, which is a worry. Banks are well run and well capitalized, but if they keep on taking on more debt that's of low quality — as is the case with government debt — eventually they'll run into trouble."

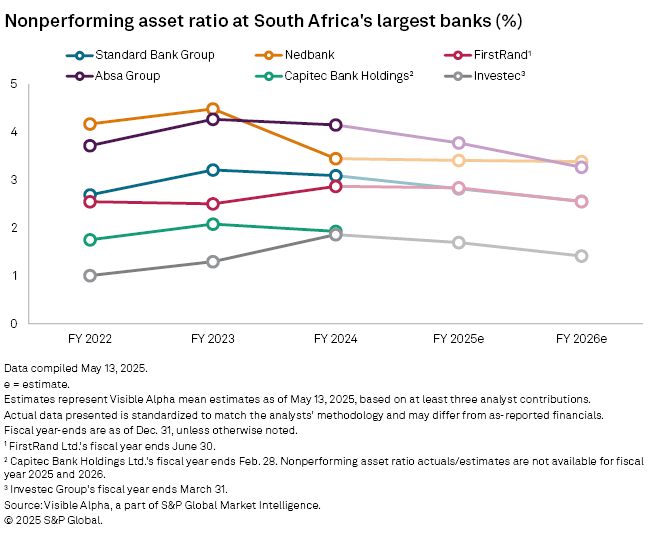

The banks' exposure to government bonds increased to 16.4% of total assets by September 2024, from 11.2% in March 2020. This compares to banks in other countries, but South Africa's high levels of public debt "add an extra layer of risk," Thandeka Nyathi, economist at Market Intelligence, wrote in a Feb. 24 report.

"The financial sector's vulnerability could grow if the bank-sovereign nexus becomes more entrenched and there is a decline in demand for sovereign credit," Nyathi wrote.

In addition to the probable loss of AGOA privileges, South African policymakers are reeling from a February executive order by Trump halting aid to South Africa that he said was partly due to Johannesburg's accusations of genocide against Israel. In April, Trump said he would impose a 30% tariff on South African imports — since paused, although a 10% baseline levy remains in place — and a 25% duty on automobile imports.

"The US may (also) impose financial sanctions on South Africa, which would really hurt due to the country's large fiscal deficit, of which much is currently funded by Americans and Europeans," said Roodt. "Sanctions would end that and so put even more pressure on local banks to fund the fiscal deficit."

Donald MacKay, director at XA Global Trade Advisors in Johannesburg, also highlighted the risk of US sanctions on South Africa.

"Trump appears to be picking on South Africa in a way that he isn't with any other country, including even countries that are proper enemies of the US," MacKay said.

About half of South Africa's US exports are minerals and so are not part of the AGOA.

"Banks' trade financing arrangements on these would be unaffected," MacKay said.

For trade financing arrangements that facilitate exports of AGOA-eligible products, trade typically is quite fungible, so exporters will seek countries to sell to, he said.

"Maybe they don't sell at quite as high a price, but companies won't be passive and accept they've lost the US market and close shop," MacKay said.

Banks will likely not face notable long-term damage to their trade finance business, but it will be "very disruptive" in the short and possibly medium term, he said.