Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 May, 2025

By Bea Laforga and Marissa Ramos

Société Générale SA

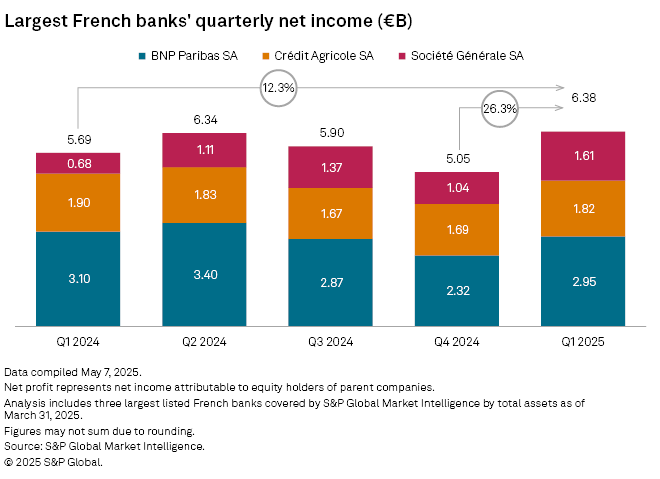

SocGen's quarterly net profit jumped to €1.61 billion from €680 million a year ago, while the net profits of Crédit Agricole SA and BNP Paribas SA declined 4.2% and 4.9%, respectively, according to S&P Global Market Intelligence data. Overall, the combined net income of France's three biggest banks rose 12.3% year over year to €6.38 billion.

The surge in SocGen's net profit was largely driven by a more than tenfold jump in profit from its French retail, private banking and insurance business to €421 million, coupled with better cost-to-income ratios across all business segments.

The strong results meant SocGen is well-placed to surpass its financial targets for 2025 despite the risks brought about by extreme market volatility and uncertainty, according to CEO Slawomir Krupa.

"Our strategy is paying off," Krupa said during an April 30 earnings call, noting that the bank has already surpassed its full-year targets in terms of revenue growth and cost reduction.

SocGen's return on tangible equity reached 11% in the first quarter compared with the annual target of 9%-10% by 2026, while its cost-to-income ratio declined to 65% against the target of below 60% by 2026.

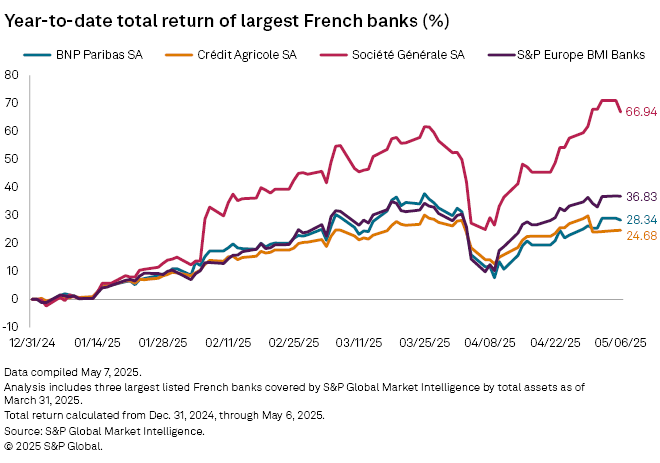

The result led analysts at RBC Capital Markets to lift their share price target for SocGen. This stands in contrast to the market's initial reaction to Krupa's new strategy in September 2023, when its shares plummeted following the announcement.

SocGen's shares have risen by roughly two-thirds since the start of the year, outpacing the 37% year-to-date growth of the broader S&P Europe BMI Banks index.

Shares of both BNP and Crédit Agricole have trailed the index.

French retail rebound

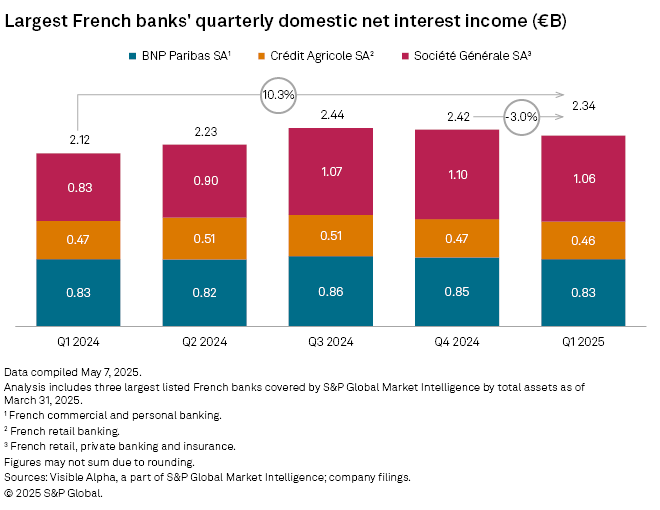

Despite declining interest rates, the banks' combined domestic net interest income (NII) still rose 10% year over year to €2.34 billion in the first quarter, mainly driven by a 28% surge in SocGen's French NII, Market Intelligence data shows.

Higher revenue and lower expenses helped boost profit in its French retail, private banking and insurance business, SocGen CFO Leopoldo Alvear said during the bank's earnings call. The combination of "cost action and revenue action" will continue to drive profitability in this business segment, Krupa said.

Meanwhile, Crédit Agricole, which sources more than half of its total revenue from retail banking, reported a 1.7% dip in domestic NII dip, which hit its lowest level in nearly five years.

Deputy CEO Jerome Grivet said domestic NII will stabilize over the course of 2025, but risks will remain, especially given the fierce competition in the French mortgage market.

BNP CEO Jean-Laurent Bonnafé expects NII to rebound materially in the second half as the yield curve normalizes in a lower rate environment. The bank's domestic NII dipped to €827.0 million from €827.9 million the year before.

NII is the difference between interest earned on loans and that paid out on deposits. French banks' domestic NII has been weighed down by higher deposit costs and their large fixed-rate mortgage portfolio. The unique characteristics of French lending and savings schemes mean their balance sheets tend to reprice more slowly than European peers.

CIB takes the spotlight

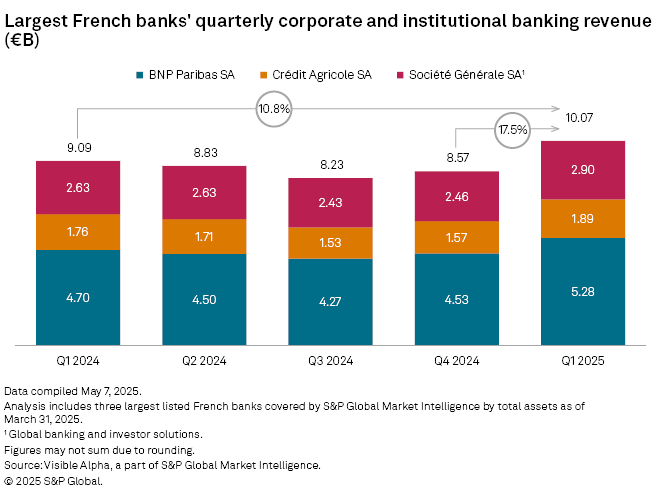

All three banks recorded higher corporate and institutional banking (CIB) income in the face of heightened market volatility.

The aggregate CIB operating income hit €10.07 billion, up 11% year over year, with BNP and SocGen logging double-digit growth and Crédit Agricole registering a 7% increase.

BNP said the first three months of 2025 were a record-breaking quarter for its CIB unit, with its trading unit benefiting from a spike in market volatility. Its global and diversified business model puts the group in a position to take on opportunities that will open when firms, especially those in Europe, adapt to the ongoing geopolitical shifts and a lower rate environment.

"There is a lot to come, especially in Europe because Europe is going to reinvest massively. Basically, Europe has no choice but to reinvest," Bonnafé said during the bank's April 24 earnings call. "So it's rather a positive situation for us. We can support those companies in so many different dimensions, including financial markets."