Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 May, 2025

By Gaurav Raghuvanshi and Uneeb Asim

Singapore banks face falling net interest margins as they prepare for a further reduction in interest rates amid global economic uncertainties.

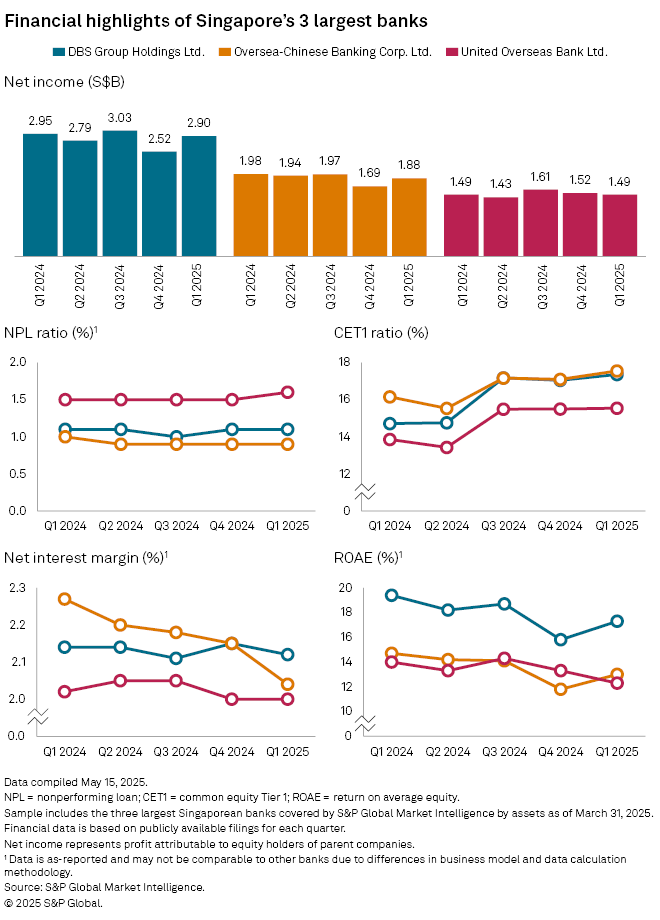

Net interest margins (NIMs) at each of the three biggest Singapore-headquartered lenders — DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd. (OCBC) and United Overseas Bank Ltd. (UOB) — declined in the January-to-March quarter. OCBC posted the steepest decline in its NIM, to 2.04% from 2.27% a year ago, according to data compiled by S&P Global Market Intelligence. The NIMs of the other two lenders fell 2 basis points each, to 2.12% at DBS and 2.00% at UOB.

Global central banks are likely to reduce interest rates further in 2025 amid a slowing world economy. The US Federal Reserve has kept rates unchanged in 2025, but markets expect at least one cut by September. Singapore banks, with their high overseas exposure, are susceptible to global interest-rate movements and trade policy uncertainties.

Watching for risks

Singapore banks said they will watch for potential risks to their asset quality and earnings in a slow global growth environment.

"We remain watchful of asset quality risks in a slower global growth environment amidst concerns of accelerating Fed cuts, on top of the weak commercial real estate sector," DBS said in a research note on OCBC. Faster-than-expected Fed rate cuts could also pose risks to OCBC's earnings, according to the note.

After two years of strong earnings growth, two of the three Singapore banks posted a year-over-year fall in net profit in the first quarter of 2025, while UOB's income was flat at S$1.49 billion. Net profit at DBS declined to S$2.90 billion from S$2.95 billion, while at OCBC, it fell to S$1.88 billion from S$1.98 billion, Market Intelligence data showed. DBS said its net profit in 2025 is expected to be lower than the previous year, mainly due to the 15% global minimum tax.

DBS held its nonperforming loans ratio steady at 1.10%, the same level as a year ago. OCBC posted an improvement in its ratio to 0.90% from 1.00%, while UOB reported an increase in its ratio to 1.60% from 1.50% a year ago, the data showed.

Higher provisions

"Recent escalations in trade tensions have heightened macroeconomic risks and market volatility," DBS CEO Tan Su Shan said May 8 in comments accompanying the bank's first-quarter earnings. "As uncertainty persists, we will stay nimble to capture opportunities while prudently managing risks."

The banks stepped up their provisioning to cushion the potential slowdown in loans and deterioration in asset quality. DBS added S$205 million in general provisions to its reserves, taking its total allowance reserves to 137% of its nonperforming loans as of March 31, 2025, compared with 125% a year ago.

OCBC has prudently set aside credit allowances to buffer its portfolio on a forward-looking basis in view of the challenging economic outlook, OCBC CEO Helen Wong said on May 9 after the bank announced its first-quarter earnings.

"Looking ahead, the heightened uncertainties brought about by the shifts in trade policies and geopolitical risks are expected to have a dampening effect on overall economic growth in the region," Wong said.