Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 May, 2025

By Tim Siccion and Shambhavi Gupta

Global private equity exits in fossil fuels are on the rise and are about to surpass the transaction value reached in 2024.

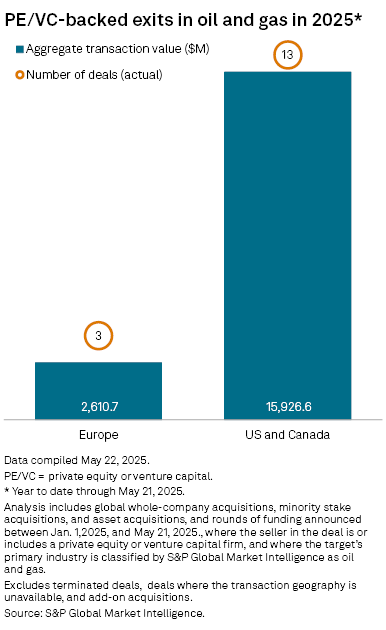

Private equity exits in the oil and gas industry amounted to $18.54 billion across 17 deals between Jan. 1 and May 21, less than $1 billion away from the $19.41 billion amassed in full year 2024, according to S&P Global Market Intelligence data.

Private equity divestments in the sector followed the US administration's January executive order to prioritize the development of domestic energy resources, including oil and natural gas. The sector's exit activity bucks the trend in overall private equity exits, which fell to a two-year low in the first quarter.

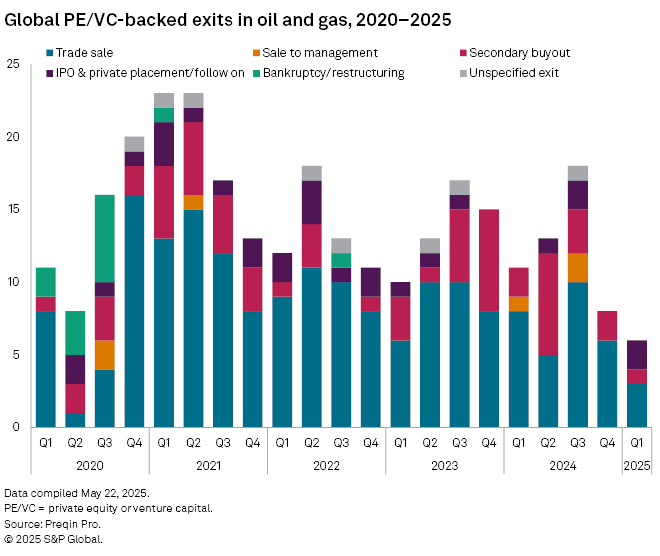

Trade sales remained the most numerous type of oil and gas company exit in the first quarter, according to Preqin Pro data. IPOs were the second-most numerous private equity exit route.

– Catch up on private equity trends in pharmaceuticals.

– Learn more about pension funds' private equity allocations.

– Read our latest In Play reports featuring rumored deals.

North America and Europe accounted for virtually all private equity-backed exits in the oil and gas sector so far in 2025. The US and Canada had 13 exits totaling $15.93 billion, while Europe, including the UK, had three exits totaling $2.61 billion. Asia-Pacific had one private equity-backed exit in oil and gas, according to Market Intelligence data.

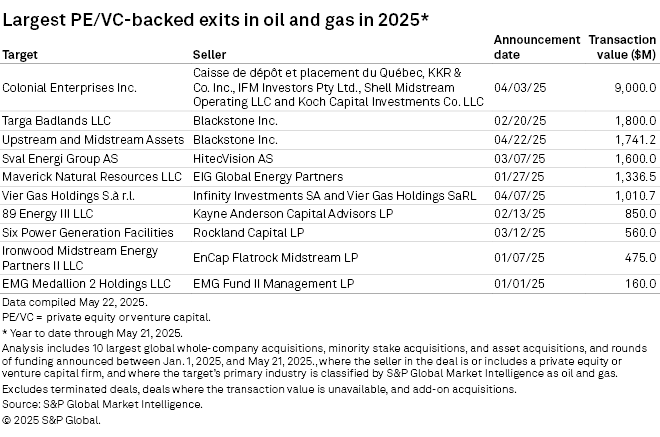

Largest private equity exits

The largest divestment in 2025 through May 21 was a $9 billion transaction in which KKR & Co. Inc. and Caisse de dépôt et placement du Québec is selling their stakes in US refined oil pipeline operator Colonial Enterprises Inc. to Brookfield Infrastructure Partners LP.

The second-largest was Blackstone Inc.'s $1.8 billion sale of its 45% stake in Houston-based oil and gas gathering system operator Targa Badlands LLC to Targa Resources Corp.

Blackstone's pending $1.74 billion sale of certain upstream and midstream assets to US natural gas producer EQT Corp. ranked third.