Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 May, 2025

By Tim Siccion and Shambhavi Gupta

Global private equity and venture capital investments in commercial services firms are lagging compared to last year, but are poised to accelerate in the near-term driven by the sector's resilient market fundamentals.

"The services that these companies are providing aren't nice-to-haves or luxuries," said Alex Di Santo, head of private equity in Europe at fund administrator Gen II Fund Services LLC. "They're necessities as long as we have a global economy, whether it's booming or less active."

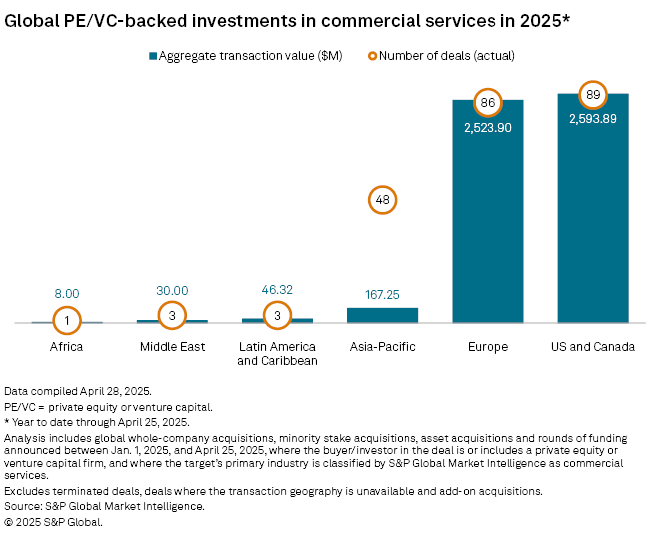

From January to April 25, private equity deal value in commercial services reached $5.37 billion across 230 deals, less than half the $12.83 billion amassed by 285 deals in the first four months of 2024, according to S&P Global Market Intelligence data.

The commercial services sector includes companies that provide a variety of essential business solutions including human resource outsourcing, health and safety management, consulting, legal and accounting services.

Di Santo believes private equity flows in services firms will "continue quite strongly" in the next three to five years, driven by the industry's recurring revenues, predictable cash flows and stable client base.

"On top of that, you've got increasing global regulation, increased technology deployment and the advent of AI," Di Santo said. "With all of those things, businesses across the globe need to rely on professional service firms to support them given the complexity of technology and regulation."

Di Santo anticipates opportunities in the outsourcing services subsector.

"There's certainly a movement toward more outsourcing now," Di Santo said, adding that the more global regulation and advances in technology, the more firms will need to rely on an outsourcing provider to support them. "It just contributes to yes, more growth on the professional services company side, which again, creates more interest from the [private equity] houses."

– Download a spreadsheet with data featured in this story.

– Catch up on private equity deals in April.

– Read up on venture capital funding rounds in April.

Macfarlanes LLP, a London-based law firm, wrote in a January report that consolidation opportunities and a requirement for capital to invest in new technology are some of the factors that make the sector attractive to private equity. Challenges distinct to investing in services firms that could hinder private equity involvement include deal structure, tax considerations and regulatory issues, according to the report.

Di Santo highlighted restrictive regulations as a hurdle affecting recent private equity investments in the sector.

"There're restrictions and regulations around how you can invest in some of these businesses," Di Santo said, but noted that "there's always a way around these challenges" and "there's always a way that deals can be done."

Almost all of the private equity deal value year to date as of April 25 went to North America and Europe. Firms in the US and Canada received the most private equity investments in the year so far at $2.59 billion across 89 deals. Europe was a close second with $2.52 billion from 86 deals.

Largest private equity deals

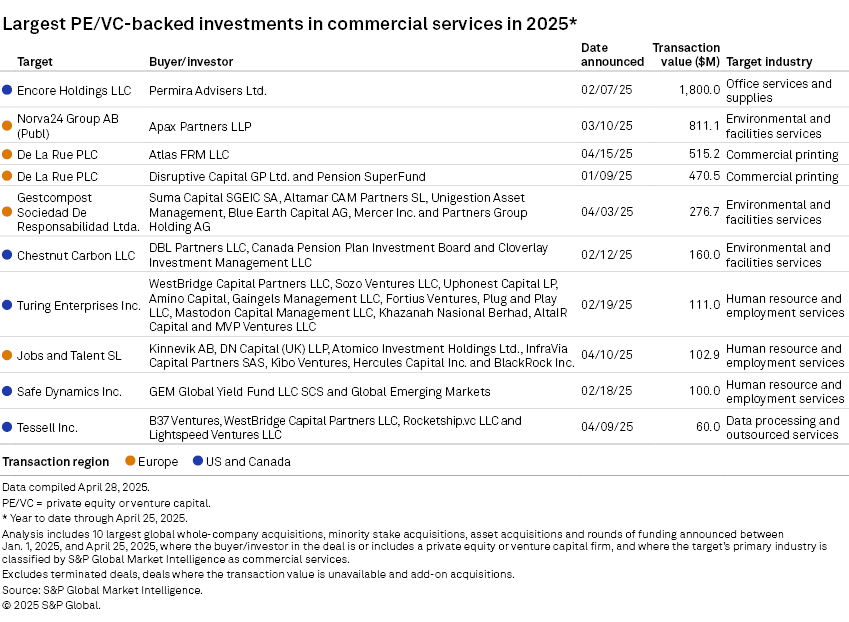

The largest private equity-backed deal in the commercial services industry in 2025 so far is Permira Advisers Ltd.'s $1.8 billion acquisition of US fire protection services provider Encore Holdings LLC from Levine Leichtman Capital Partners LLC.

The second largest deal is Apax Partners LLP's $811.1 million buyout of Norwegian underground infrastructure maintenance services provider Norva24 Group AB (Publ).