Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 May, 2025

By Tom Jacobs and Malik Ozair Zafar

|

An aerial view of flood damage along the French Broad River after the passage of Hurricane Helene on Oct. 3, 2023, in Marshall, North Carolina. Five tropical cyclones in 2024 caused inflation-adjusted damage totaling $124 billion, according to the National Oceanic and Atmospheric Association's National Centers for Environmental Information. |

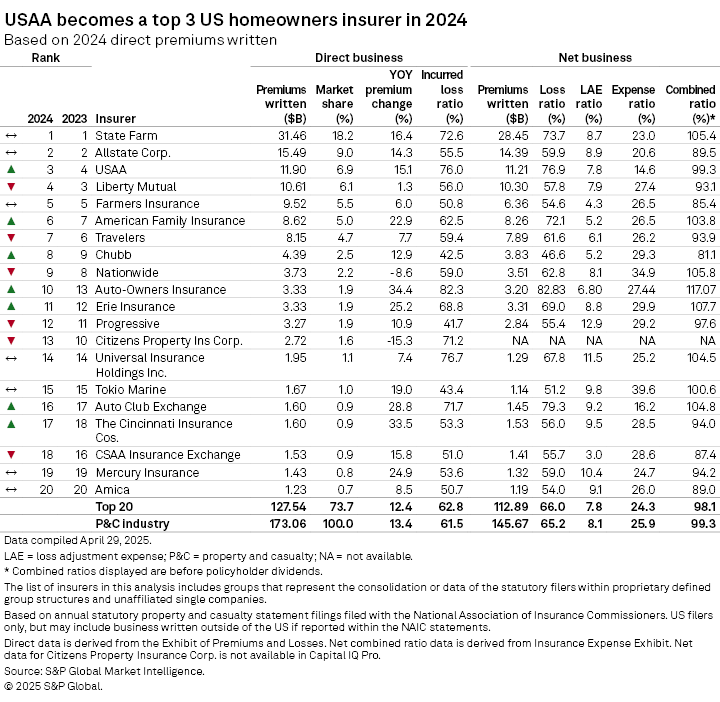

Premiums in the the US homeowners insurance market rose significantly in 2024 while its combined ratio fell below 100% for the first time in five years.

Direct premiums written (DPW) in the sector rose 13.4% to $173.06 billion, the highest since 2015, up from $152.66 billion in 2023, according to an S&P Global Market Intelligence analysis. The increase was the second-highest since 2015, behind a 14.1% increase in 2023.

State Farm Mutual Automobile Insurance Co. reported a 16.4% year-over-year increase in DPW to $31.46 billion in 2024 from $27.04 billion, giving the Bloomington, Ill.-based insurer an 18.2% market share.

The Allstate Corp. had the second-largest share of the market at 9% on $15.49 billion in DPW, a 14.3% year-over-year increase from $13.55 billion.

United Services Automobile Association moved one spot up to third place with a 6.9% share, booking a 15.1% year-over-year increase in DPW to $11.9 billion. Liberty Mutual Holding Co. Inc. fell back into fourth place with a 6.1% share on $10.61 billion in DPW, a 1.3% rise from 2023.

The DPWs of two of the top 10 insurers in the analysis rose 20% or higher year over year. Auto-Owners Insurance Co. Inc. booked a 34.4% increase, while American Family had a 22.9% improvement.

Four others in the top 10 booked increases of 10% or higher: State Farm at 16.4%, United Services Automobile Association at 15.1%, Allstate at 14.3% and Chubb Ltd. at 12.9%. Nationwide Mutual Insurance Co., the only company among the top 10 that saw a decrease in DPW, registered an 8.6% decline to $3.73 billion from $4.08 billion in 2023.

Insurers' aggressive pursuit of homeowners rate increases fueled the rise in premiums. The national average rise in owner-occupied homeowner rates in 2024 rose to 11% from 9.7% in 2023, according to Market Intelligence's RateWatch application.

Net loss and combined ratios for the industry improved in 2024 despite the effects of five tropical cyclones and numerous severe weather events.

The net combined ratio of 99.3% was an 11.2-percentage-point improvement from 110.5% in 2023 and marked the first time since 2019 that the ratio was below 100%. The net loss ratio of 65.2% was also the lowest since 2019 and a 10.3-percentage-point year-over-year improvement from 75.5%.

Four insurers in the top 10 of the analysis had combined ratios of over 100%: Auto Owners Exchange at 117.07%, Nationwide at 105.8%, State Farm at 105.4% and American Family at 103.8%. The four lowest ratios belonged to Chubb, at 81.1%; Farmers, at 85.4%; Allstate, at 89.5%; and Liberty Mutual, at 93.1%.

The net loss adjustment expense (LAE) ratio finished 2024 at 8.1%, its lowest level in 20 years. The previous low was 8.8% in 2018.

The net combined and loss ratios of all insurers in the top 10 of the analysis decreased from 2023. Nationwide's loss ratio decreased the steepest at 21.5 percentage points, while Farmers' dropped 21.3 points. Allstate and Liberty Mutual followed, with decreases of 14.9 and 14.0, respectively.

States hit hard by Helene, storms

Insurers' direct loss and loss-adjusted expense ratios in 2024 rose above 90% in several states as a result of severe convective storms in the second and third quarters of 2024 and from Hurricane Helene in the third quarter.

Nebraska, which was impacted by tornadoes and hail in two separate storms last June, had the highest direct loss/LAE ratio of any state at 136.6%. Also affected were Missouri at 94.2% and Arkansas at 90.4%

Hurricane Helene, which came ashore on Florida's Big Bend coast as a Category 4 storm on Sept. 26, 2024, made a devastating turn into the Southeastern states that resulted in severe flooding and raised insured losses to between $10 billion and $17.5 billion. The losses drove the direct loss/LAE ratio to 113.3% in Georgia and 106.7% in South Carolina.

Wildfires from June 17, 2024, to July 7, 2024, swept through New Mexico, generated inflation-adjusted losses of $1.8 billion and pushed the state's direct loss/LAE ratio to 119.2%, the second-highest in the analysis.