Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

01 May, 2025

By Karl Angelo Vidal and Shambhavi Gupta

Private equity deals in metals and mining companies are expected to grow as demand increases for minerals essential to the global energy transition, such as silver, copper and lithium.

"We're incredibly bullish around the need of these critical minerals to carry out the energy transition," Martin Valdes, head of private equity strategy at Resource Capital Funds, told S&P Global Market Intelligence. "It's not energy transition only anymore — it's also decarbonization, electrification and penetration of electric vehicles."

Global lithium production grew to the highest level on record in the fourth quarter of 2024, at 105,000 metric tons, according to Market Intelligence data. The output of most other battery metals declined due to weak prices.

In the US, the Trump administration added 10 mining projects to a permitting dashboard in response to a presidential executive order to boost domestic mineral production.

"A lot of new mines are needed to be built and that will require a lot of capital. Private equity will play an important role alongside the public markets in fulfilling that additional supply," Valdes said.

– Download a spreadsheet with data featured in this story.

– Read about global private equity deals in metals and mining in 2024.

– Explore more private equity coverage.

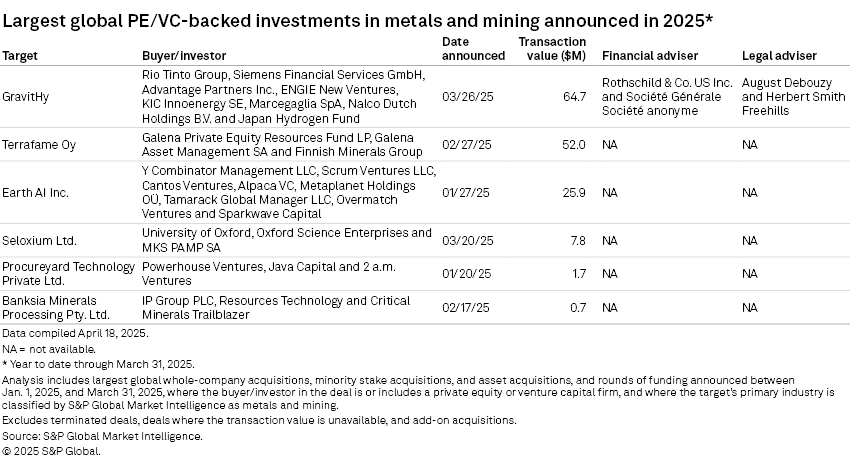

Private equity-backed deal value in metals and mining stood at $152.8 million in the first quarter, significantly lower than $4.35 billion in the same period in 2024, according to Market Intelligence data.

The substantially higher first-quarter value in 2024 was mainly due to one large deal announced at the start of that year: Stockholm-based Stegra AB, formerly H2 Green Steel, secured $4.14 billion in a round of funding that included participation from Just Climate LLP and M12.

Largest 2025 deals

The largest private equity transaction in metals and mining in the first quarter was a $64.7 million round of funding for French steel company GravitHy. Private equity firms Advantage Partners Inc., Engie New Ventures and KIC Innoenergy SE participated in the transaction.

In the second-largest deal, Finland-based mining company Terrafame Oy secured $52 million in a round of funding from investors including Galena Asset Management SA-managed Galena Private Equity Resources Fund LP.

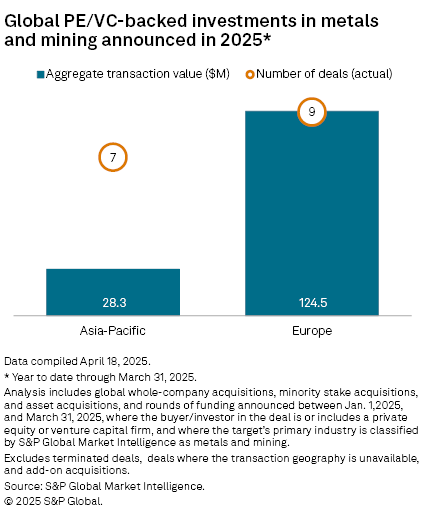

Europe secured the largest private equity-backed funding among all regions in the first quarter, with $124.5 million. Asia-Pacific came in second, with $28.3 million.

Sector headwinds

The uncertain direction of geopolitical trade tensions and their impact on the metals and mining sector are headwinds for investment.

The US has, in particular, put China under scrutiny. The Trump administration initiated an investigation into imports of processed critical minerals as it seeks to address the country's supply chain vulnerabilities and to reduce dependence on China.

"The trade tensions put metals in a specific position," said Antti Grönlund, managing director for private equity at Appian Capital Advisory LLP. "It's becoming that critical for nations who want to manufacture and who need these commodities."