Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 May, 2025

By Sheikh Rishad and Hussain Shah

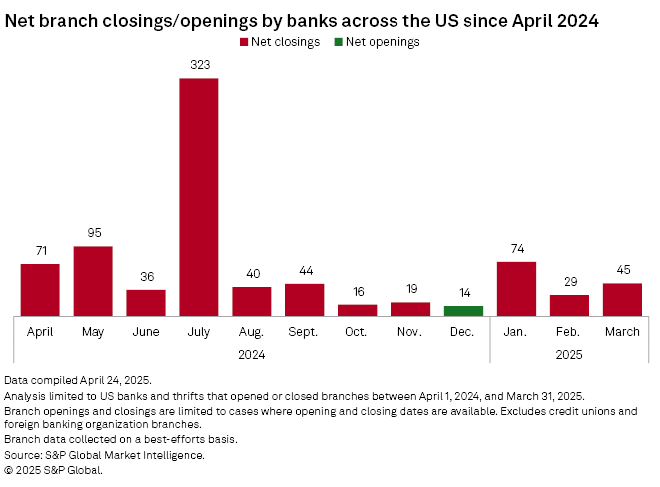

Thanks in part to actions taken by two of the largest banks in the US, branch closings accelerated sharply on a sequential basis in the first quarter.

There were 148 first-quarter net branch closings, up from just 21 in the fourth quarter of 2024, according to S&P Global Market Intelligence data.

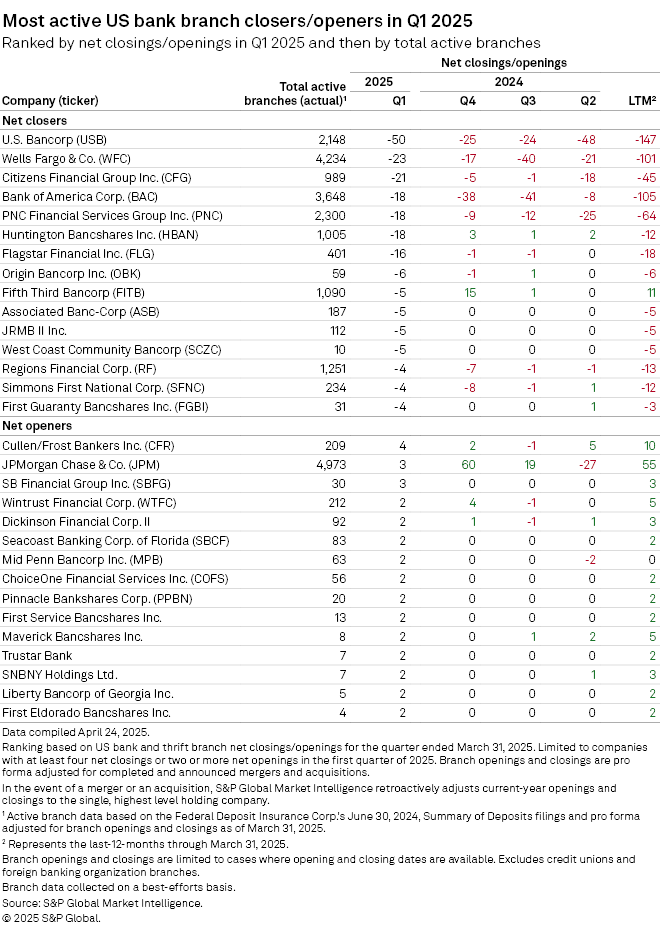

Most active banks

U.S. Bancorp reported 50 net branch closures in the first quarter, the most in the entire industry. California accounted for 18 of those closures.

Wells Fargo & Co. was the second-most active net closer with 23 net branch closings in the period. Citizens Financial Group Inc. was the third-most active net closer, reporting 21 net branch closures in the first quarter. Bank of America Corp., PNC Financial Services Group Inc. and Huntington Bancshares Inc. followed next, with 18 net branch closings apiece.

Huntington Bancshares' first-quarter closures were mostly in the Midwestern states of Ohio, Illinois and Michigan, along with one in Indiana and two in Pennsylvania. The company is opening branches in North Carolina and South Carolina and accelerating expansion in those states, President and CEO Stephen Steinour said on an April 17 conference call. The bank had announced in September 2024 that it planned to open 55 branches over five years in the Carolinas; it now aims to achieve that goal within three years.

|

– Access a template for US banks and thrifts branch openings and closings in 2024. – |

Flagstar Financial Inc. had 16 net branch closures during the first quarter. The company recorded $6 million in accelerated lease costs related to branch closures, CFO Lee Smith said on an April 25 earnings call. Smith added that around 23 branch closures will occur at the end of June, some private client locations will be merging and exiting in early July and further branch consolidations will happen at the end of September.

Fifth Third Bancorp made five net branch closings in the first quarter. CFO Bryan Preston said on an April 17 conference call that investments in Southeast branches will add momentum in gathering low-cost, stable retail deposits.

Cullen/Frost Bankers Inc. expanded its footprint by opening four new branches in the first quarter, securing the top spot for net openings.

JPMorgan Chase & Co. and SB Financial Group Inc. recorded net opening of three branches as of March 31, the second highest in the industry.

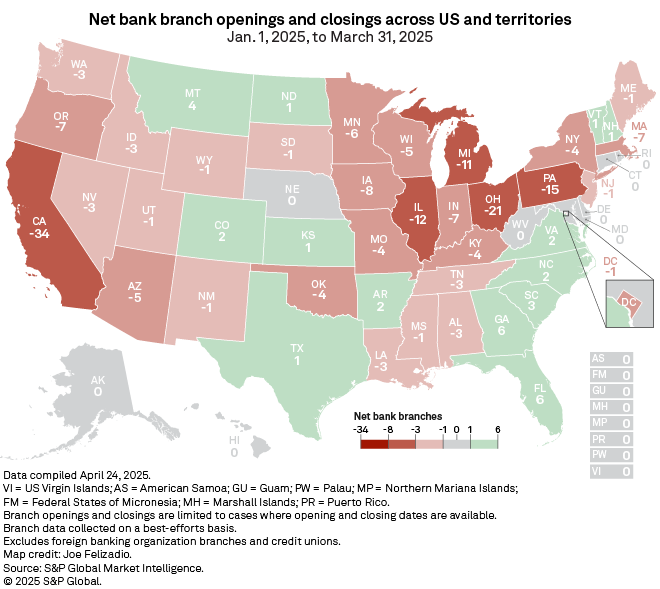

Activity by state

California recorded the most net branch closings in the quarter at 34; Ohio followed with 21. Pennsylvania registered the third-largest number of net branch closings at 15. Illinois reported a dozen net closures, closely followed by Michigan with 11.

Florida and Georgia each recorded six net branch openings in the first quarter. In Florida, 19 branches were opened while 13 branches were closed. Meanwhile, in Georgia, 10 branches were opened and four branches were shuttered.