Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 May, 2025

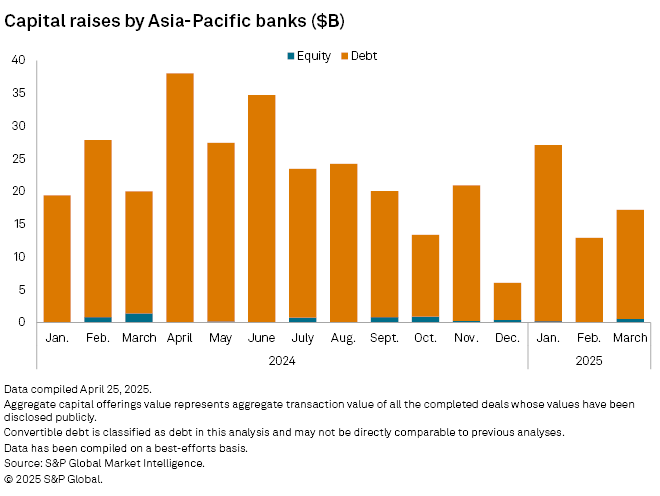

Capital raising by Asia-Pacific banks recovered in March after slumping in the previous month as major lenders in Japan and Singapore tapped the debt market amid a stable interest rate environment.

Banks in the region raised an aggregate of $16.65 billion through debt during the month, according to S&P Global Market Intelligence data compiled on a best-efforts basis. While the figure represented a 29.0% increase from February, it was still 10.5% lower than a year ago.

Japan's Sumitomo Mitsui Trust Bank Ltd. was the largest debt issuer in the region in March, with an aggregate of $2.50 billion raised through four offerings, according to Market Intelligence data.

Asian Development Bank issued the largest single debt deal of $2.0 billion and completed an additional nonconvertible debt issuance of $79.0 million denominated in Turkish lira, bringing its total March issuance to $2.079 billion, the data show. The Philippines-based multilateral lender raised an aggregate debt of $736.5 million in February.

Singapore-based United Overseas Bank Ltd. raised $2.0 billion through three deals.

The global bond markets were largely stable in March as major central banks held rates steady. The Bank of Japan kept its policy rate at 0.50%, following an increase from 0.25% in mid-January, and held the rate steady at its May 1 meeting. Meanwhile, the US Federal Reserve has maintained its benchmark rate at 4.5% since cutting it in December 2024.

Other active debt issuers included DBS Group Holdings Ltd., Singapore's largest bank by assets, which raised $874.47 million through two deals. Sydney-based Commonwealth Bank of Australia raised approximately $1.50 billion through issuances denominated in US dollars and Swiss francs.

Most major commercial lenders from China, the world's second-largest economy, were on the sidelines during March. Shanghai-based New Development Bank, a policy bank engaging in mobilizing resources for infrastructure and development projects in China, Brazil, Russia, India and South Africa, raised $1.25 billion through the issuance of a nonconvertible note.

Indian equity stirs

Three Indian banks, UCO Bank, Central Bank of India and Punjab & Sind Bank, accounted for nearly all of the $551.40 million in equity capital raised by Asia-Pacific banks in March, an increase from zero in the previous month. Still, the figure was 61.2% lower than the $1.42 billion in equity capital raised by banks in the region a year ago. March is the last month of the financial year for Indian companies.

Indian equities gained in March, with the Nifty 50 stock index rising 6.3% to break a five-month losing streak, during which foreign investors pulled funds from the South Asian nation.