Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 May, 2025

By Tyler Hammel

US insurers posted mixed results on Wall Street this week despite executives downplaying tariff risks.

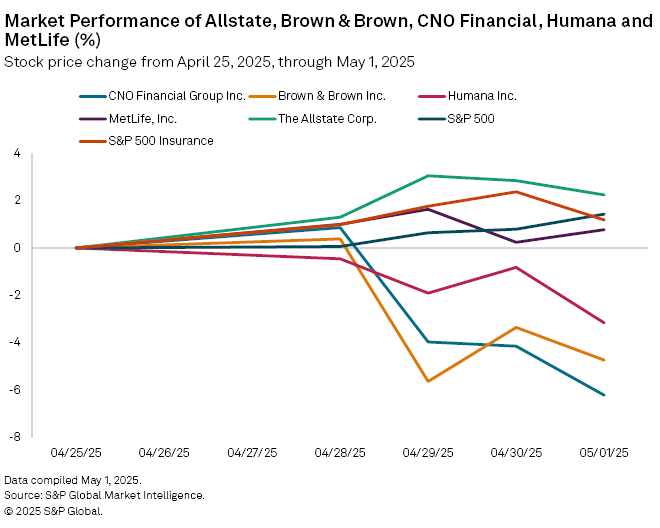

Brown & Brown Inc. fell 4.7% from April 25 to May 1, even as it reported double-digit revenue growth and very little impact from proposed US tariffs. CEO J. Powell Brown said during a Tuesday earnings call that business conditions remain stable, though growth expectations are modest.

William Blair analyst Adam Klauber maintained a "market perform" rating, citing Brown & Brown's slower organic growth, flat margins and increased deal activity.

CNO Financial Group Inc. dropped 6.2%, and Humana Inc. declined 3.2%.

MetLife Inc. rose 0.8%, and The Allstate Corp. gained 2.2%. The S&P 500 Insurance Index climbed 1.18%, while the broader S&P 500 advanced 2.12%.

Delayed reaction

Allstate CEO Tom Wilson said the company expects to manage any tariff-related effects on its operations.

"[It] takes a while [for tariffs] to rattle through new car prices, used car prices, dealers, to people fixing cars, to us replacing [a] car," Wilson said during the earnings call. He added that pandemic-driven inflation hit "incredibly rapidly" as used car prices surged 60% in under two years.

"We're going to manage ... whatever the impacts of tariffs are, just as we did the inflation that came through the pandemic," Wilson said.

Auto repair and replacement costs are likely to rise, he noted, as are home repair costs, though at about half the pace.

After the call, Piper Sandler analyst Paul Newsome rated Allstate "overweight," citing strong returns on equity despite high catastrophe losses from wildfires and storms.

"It was a good quarter for Allstate," Newsome wrote. "Management reaffirmed confidence in its ability to grow profitably."