Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 May, 2025

ING Groep NV now aims to sit on a higher capital stock at the end of 2025 in the face of global economic and market uncertainty.

The Netherlands' largest bank by assets had been aiming to lower its common equity Tier 1 ratio to roughly 12.5% by the end of 2027. By the end of 2025, however, it now targets a ratio of between 12.8% to 13%. The 2027-end target was unchanged.

CEO Steven van Rijswijk said during the bank's May 2 first-quarter earnings call that hiking the target was purely driven by macroeconomic uncertainty. ING made the decision on its own and did not involve regulators. He indicated that the higher target is temporary and that the bank could revert to the original roughly 12.5% target "depending on how things will be."

ING's CET1 ratio — at 13.6% at the end of March and 13.1% if the new €2 billion share buyback is considered — has been significantly above the target for a few years now, putting investors and observers on the lookout for how the bank would deploy its excess capital. The bank has previously said it would make the reduction in roughly equal steps.

Still building capital

Although the bank just completed a €2 billion buyback and announced another program of the same size, the higher CET1 ratio could impact future shareholder returns. Investors may feel somewhat disappointed in the higher target, Citi Research analyst Marta Sanchez Romero said in a note. She said, however, that ING has a track record of building capital.

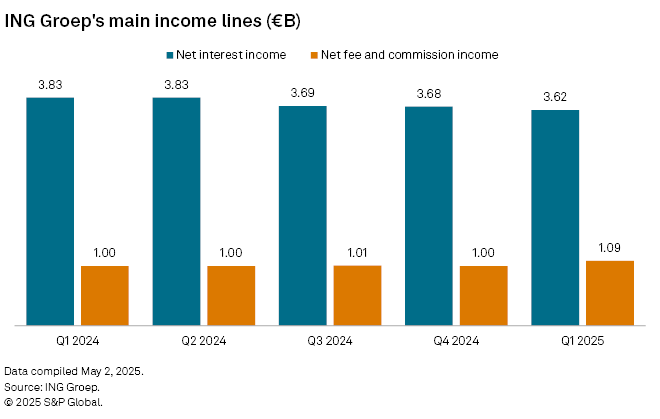

ING posted a first-quarter net result of €1.46 billion, ahead of the €1.41 billion consensus estimate compiled by Visible Alpha, a part of S&P Global Market Intelligence. The result was down nearly 8% year over year, largely due to lower net interest income and heavier expenses.

The net result added about 40 basis points to the bank's CET1 ratio, according to an earnings presentation.

'No winners' in tariff game

Higher tariffs on US imports have triggered economic uncertainty, and the bank and its clients would need more time to determine its impact, risk chief Ljiljana Čortan said during the earnings call.

"We know that tariffs are not good for everyone, and there are clearly no winners in that game," Čortan said.

In its wholesale banking business, the direct impact of the tariffs would be limited as ING operates mainly in less-impacted economies and its lending exposures are to less-pressured industries, she said. Wholesale banking accounts for some 32% of ING's balance sheet.

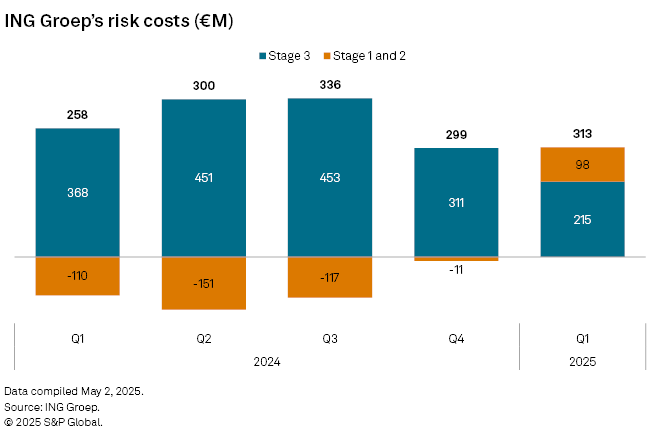

ING booked risk costs — listed as additions to loan loss provisions in its financial statements — of €313 million in the quarter. Though higher than the year-ago €258 million, the risk costs were equivalent only to 18 bps of average customer lending and below the through-the-cycle average of roughly 20 bps, the bank said.

The risk costs included €98 million for Stage 1 and 2 loans, or loans at increased risk of default. Provisions for Stage 3 loans, or credit-impaired loans, declined to €215 million from €368 million a year ago.

ING's shares were up more than 5% during the late-morning trading in Amsterdam.