Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 May, 2025

A nurse administers a dose of the Pfizer COVID-19 vaccine at a three-day vaccination clinic in Wilmington, California, in 2021. |

US health insurers face unprecedented financial strain amid high medical costs and shifting membership numbers as stress created by the COVID-19 pandemic have exposed major weaknesses in the nation's medical system.

The rising costs associated with Medicare Advantage, an expanded version of government-subsidized health plans aimed at older adults, is nothing new for managed care companies. But the issue has reached a critical point over the last couple of years even as some insurers may have turned a corner after securing rate increases.

Health insurers have repeatedly raised the alarm about rising Medicare costs and inadequate rates since 2023. While issues remain, the Trump administration recently agreed to a 5.06% Medicare Advantage rate increase for 2026, up from the 2.2% the previous administration seemed poised to approve.

Compounding the financial difficulties facing health insurers are changes in Medicaid, the government-subsidized health plans for low-income families. Medicare and Medicaid plans are offered through the federal government and private insurers, with the latter relying on government reimbursements to offset costs.

After the federal government paused state-led disenrollment of Medicaid members for nearly three years following the onset of COVID, the process restarted in 2023, leading to some healthier, less-costly individuals losing access to the plans. The process also resulted in fewer paying customers for health insurers.

"Now we're seeing the aftermath, which is a negative in terms of financial results for the sector," said James Sung, director of insurance ratings for S&P Global Ratings.

A COVID booster

The membership of Medicaid, along other Affordable Care Act plans, grew during the pandemic as the federal government worked to ensure Americans had access to enough health coverage, according to Sung.

"That led to record low uninsured rates during the pandemic, which was generally a positive for the sector in terms of getting more membership and revenue growth," Sung said.

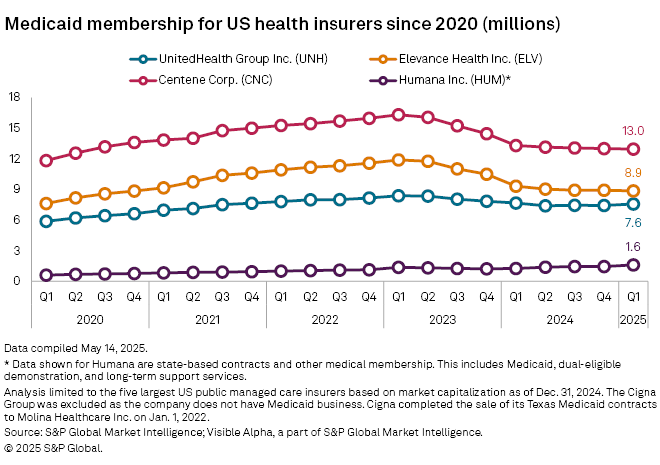

Even as death rates and hospitalizations related to COVID-19 soared, health insurers fared unexpectedly well initially, Sung said, buoyed by a drop in utilization, membership growth in Medicaid and Medicare, and some financial protections. The Medicaid and Medicare membership of a majority of the largest publicly traded health insurers expanded steadily in the quarters following the onset of the pandemic in the US, with most hitting their highest total membership figures in the first two quarters of 2023.

UnitedHealth Group Inc.'s membership grew to about 8.4 million Medicaid members by the second quarter of 2023 from about 5.9 million Medicaid subscribers in the first quarter of 2020, according to an analysis by S&P Global Market Intelligence.

Among other insurers, the growth was even more pronounced. For instance, Elevance Health Inc.'s membership increased to 11.8 million by the second quarter of 2023 from about 7.6 million in the first quarter of 2020.

Delayed reaction

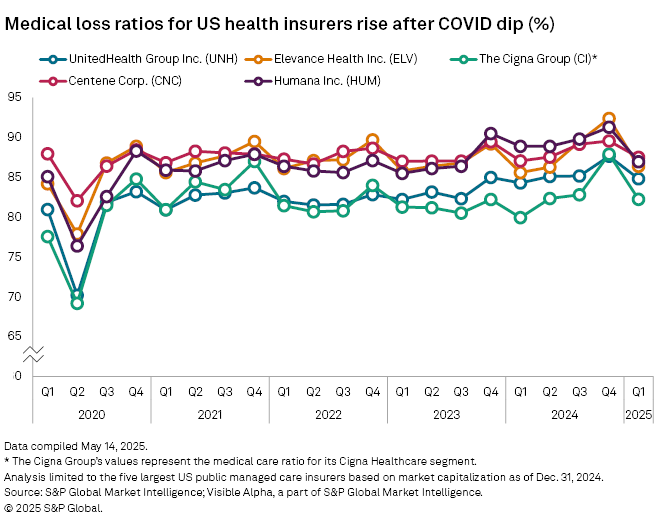

As people began to feel comfortable returning to hospitals to get delayed care and inflationary pressures hit, health insurers felt the impact with a rise in Medicare Advantage noted in the spring of 2023. The pace of medical loss ratio (MLR) increases was gradual following a very low second quarter 2020, though the fourth quarters for each following year saw spikes, according to an S&P Global Market Intelligence analysis.

However, by the fourth quarter of 2024, medical loss ratios were at new highs across the board. Elevance's MLR was 92.4% in the fourth quarter of 2024, the highest of any health insurer since 2020 and a sharp rise from 77.9% in the second quarter of 2020.

While MLRs were climbing toward their peaks, the Medicaid redetermination process was underway, leading to Medicaid disenrollment across the industry. Medicaid remains a hot political issue, with Republicans in the House of Representatives seeking to add work-reporting requirements to access care. The House on May 22 narrowly approved a spending bill with such requirements, as well with some Medicaid cuts. The measure now heads to the Senate, which is expected to make certain changes to the legislation.

"Most likely they'll be targeting adding work requirements versus some of the more severe scenarios," Sung said. "But the impact could be manageable for the sector."

Managed care M&A

The insurance industry overall saw a surge of M&A deals as the pandemic faded and health companies experienced a similar bump, according to Banee Pachuca, a partner at Winston & Strawn.

"On the provider side, there might have been a bigger boom because there was so much private equity involved, creating bidding wars," Pachuca said. "And then on the managed care side there was more traditional M&A."

While managed care M&A ticked up, it was not as intense as seen in other sectors, Pachuca added.

Seven of the 10 largest M&A deals since 2020 where managed care companies were targets occurred in either 2020 or 2021, the largest of which was Centene Corp.'s $2.57 billion acquisition of Magellan Health Inc..

The second largest was MetLife Inc.'s $1.68 billion acquisition of Versant Health Inc. in 2020. The biggest deal since 2021 was Molina Healthcare Inc.'s acquisition of Connecticare Holding Co. Inc. for $350 million in 2024.

In the years since the pandemic, additional attention has been paid to regulatory efforts in the health sector, according to Pachuca.

"It is heightened across the entire managed care industry, likely due to deal volume and size and not necessarily a change in law or policy, as opposed to the healthcare services sector which involves changes in law with the enactment of state transaction notification laws," Pachuca said. "Regulatory concerns seemed like they were more intense and a driver of transactions, as opposed to just another process you would go through."

UnitedHealth's woes

Perhaps no managed care insurer has struggled more of late than UnitedHealth, which saw its stock take a historic plunge following an "unusual and unacceptable" first quarter, according to former CEO Andrew Witty.

Turmoil in UnitedHealth's C-suite, which began with the assassination of UnitedHealthcare CEO Brian Thompson in early December 2024, continued with Witty abruptly stepping down in May. Former CEO Stephen Hemsley returned to his old role on May 13, and announced the company was pulling its 2025 guidance.

The slide deepened on May 15 after The Wall Street Journal reported that UnitedHealth was facing a Justice Department probe into possible Medicare fraud. UnitedHealth did not respond to a request for comment.

The health insurance giant has not communicated well with investors and is facing a trust deficit, according to Leerink analyst Whit Mayo. More broadly, managed care companies are not accurately pricing for elevated cost trends, Mayo said.

"If I've learned anything in the last 24 months, is that health insurance actuaries have no ability to capture inflections in medical cost trends," Mayo said.