Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 May, 2025

By Vanya Damyanova and Cheska Lozano

| Banks' provisions surged as lockdowns in the first year of the COVID-19 pandemic caused severe recessions across major European economies and globally. |

Recent tariff-induced market volatility has renewed concerns about the way European banks' provision for emerging risks.

The variability of management's judgment when determining expected credit losses (ECLs) makes it difficult to compare banks' health and has caused confusion in the market. Post-model adjustments (PMAs) or management overlays, which skewed asset quality metrics during the COVID-19 pandemic, are doing so again when banks account for novel risks such as the US tariffs announced in early April.

"When one bank says €100 million and another bank says €200 million, some of that is due to their portfolio mix, but from an investor's perspective, it's really hard to compare and contrast reliably or effectively because of that scope for management judgment," Osman Sattar, accounting specialist at S&P Global Ratings' Europe, the Middle East and Africa financial institutions team, said in an interview.

The pandemic triggered unprecedented economic disruption for which there was scant historical data, meaning some risks could not be adequately assessed using standard modeling. Bank risk managers therefore applied a lot of their own judgement in provisioning for ECLs, with some being more conservative than others when setting aside extra capital via PMAs. This resulted in a high variance in ECL provisions and disclosures under the new IFRS 9 accounting standard, in force since 2018, and prompted questions about the real credit risk on banks' books.

Since then, banks have faced various hard-to-model risks, such as surging inflation and the ensuing rapidly rising interest rates. PMAs were widely used to safeguard against these risks, triggering regulatory warnings about a lack of transparency and calls for a more harmonized approach.

PMAs were recognized as a key tool for mitigating model limitations under IFRS 9, but they "played a much bigger role than anyone expected" during COVID-19 and subsequent shocks, Sattar said. Many banks have begun stacking up overlays following the US tariff announcements and more are likely to follow suit in the coming quarters, Sattar said.

Different takes on tariffs

Differing interpretations of the impact of emerging risks could affect the size of overlays, causing uncertainty when evaluating banks' asset quality. Some tariff-related overlays made by UK banks for the first quarter were questioned by analysts.

HSBC Holdings PLC was asked about a plausible downside scenario it ran on the impact of tariffs, which resulted in a $150 million overlay in the quarter, based on 25% probability of the parameters in the scenario materializing. A 100% probability of that scenario would result in a $500 million ECL charge, CFO Manveen Kaur told analysts during an earnings call. When asked for more details, Kaur said the scenario did not include second- and third-order effects of tariffs that are "going to be hard to quantify."

Standard Chartered PLC, which has a similar Asia-focused business model to HSBC, was asked for its reasoning behind the 15% probability weighting in its downside scenario on tariff-related risks.

"You've only taken a 5-percentage-point change in your downside scenario, whereas some of your peers have taken much larger adjustments through," Citi analyst Andrew Coombs said on the bank's earnings call. CFO Diego De Giorgi said the downside scenario was "very, very severe" and that the bank applied the weighting that was "consistent with that particularly aggressive type of scenario." StanChart, which is much smaller than HSBC in terms of total assets, took out a $23 million overlay for tariff-related risks in the quarter.

Lloyds Banking Group PLC, whose business is largely UK-focused and therefore seen as relatively shielded from tariffs, surprised analysts with a £100 million overlay on the potential impact of US trade policy changes. When questioned, CFO William Chalmers said on an earnings call that the overlay is not addressing any impacts the bank is experiencing currently, and that "a good part of that £100 million may not be necessary" in the coming quarters.

Regulators in the EU and UK have warned banks against overreliance on management judgement, insufficient transparency and lack of a coordinated approach to overlays.

In a July 2024 report, the European Central Bank criticized certain "design flaws" in EU banks' approaches such as "umbrella overlays" that cover a wide range of risks with no further differentiation, and the use of overlays in portfolios exposed to novel risks — such as abrupt changes in inflation, supply chain disruptions and climate-related risks — without assessing which loans might be at higher risk of default.

"A third of the banks still lack a sound process for processing information and rely excessively on purely subjective judgement," the ECB said, referring to findings in a thematic review of bank practices conducted in November 2023.

– Read the FinReg monthly banking regulation roundup on S&P Global Market Intelligence.

– Compare banks using the Peer Analysis template on S&P Capital IQ Pro.

The Bank of England made similar comments in a May 2023 supervisory statement, saying banks must be able to demonstrate risks relating to model limitations "are adequately understood, monitored and managed, including through the use of expert judgement," and the need for model adjustments should be sufficiently justified and clearly recorded.

More overlays

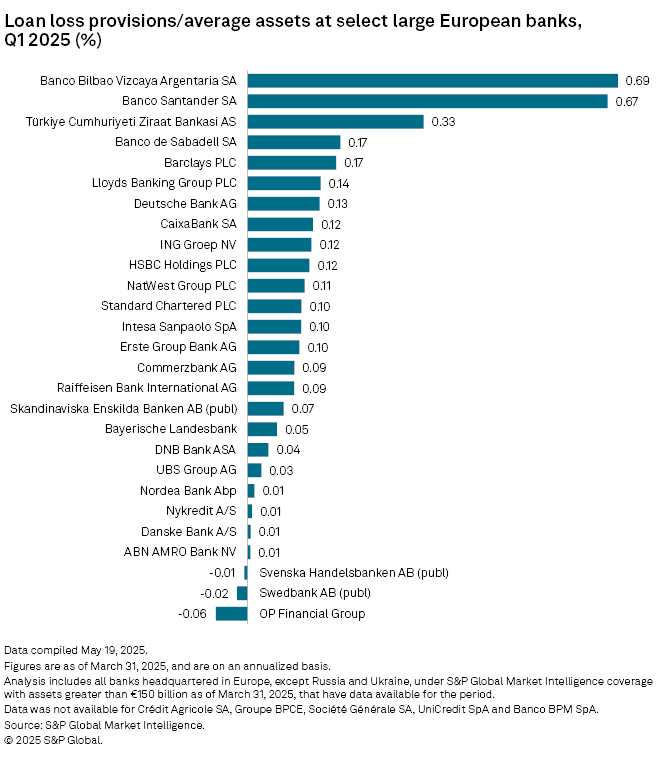

European banks' cost of risk — calculated as the simple average of loan loss provisions as a share of average total net customer loans — has remained relatively low in the years following the pandemic despite emerging economic and geopolitical risks. This could be down to banks using leftover COVID-era overlays to offset part of these new risks, Maria Rivas, senior vice president, European financial institution ratings at Morningstar DBRS, said in an interview.

The cost of risk levels in recent years therefore do not adequately reflect the pressures banks have been facing since the pandemic, Rivas said.

"You really need to go into the details of each bank to understand where they are right now," Rivas said.

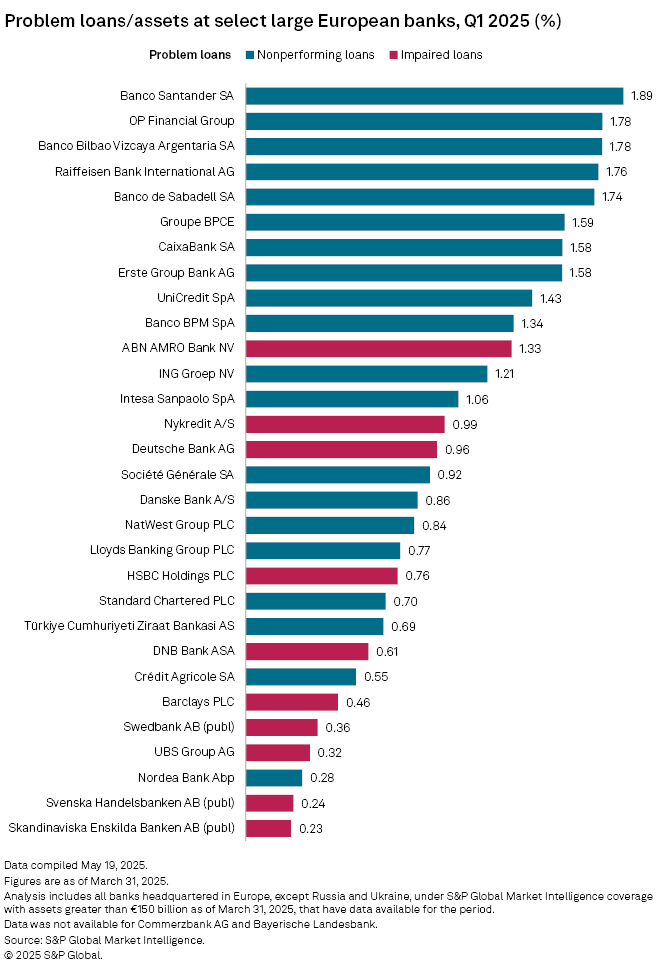

Some asset quality deterioration was observed in 2024, but it varied across Europe and was most notable in countries such as Austria and Germany, Marco Troiano, head of financial institutions at Scope Ratings, said in an email.

Tariffs and the ensuing market volatility have increased uncertainty and broadened the range of scenarios, meaning banks may well add to provisioning levels via overlays, according to Troiano.

With strong regulatory and audit focus on the use of overlays, "the market has become better at identifying, quantifying and assessing the continuous need for these adjustments," Cem Dedeaga, head of risk modeling UK and Ireland at management consulting firm Oliver Wyman, said in an email.

Practices at leading banks have evolved from looking at linear relationships among macro-variables and risk levels to modeling underlying fundamentals, according to Dedeaga. For example, this includes debt composition, energy intensity and cost-revenue elasticity for corporates.

"This has enabled more accurate sector-specific and, for the largest tickets, even single name-level assessments for cost of risk," Dedeaga said.

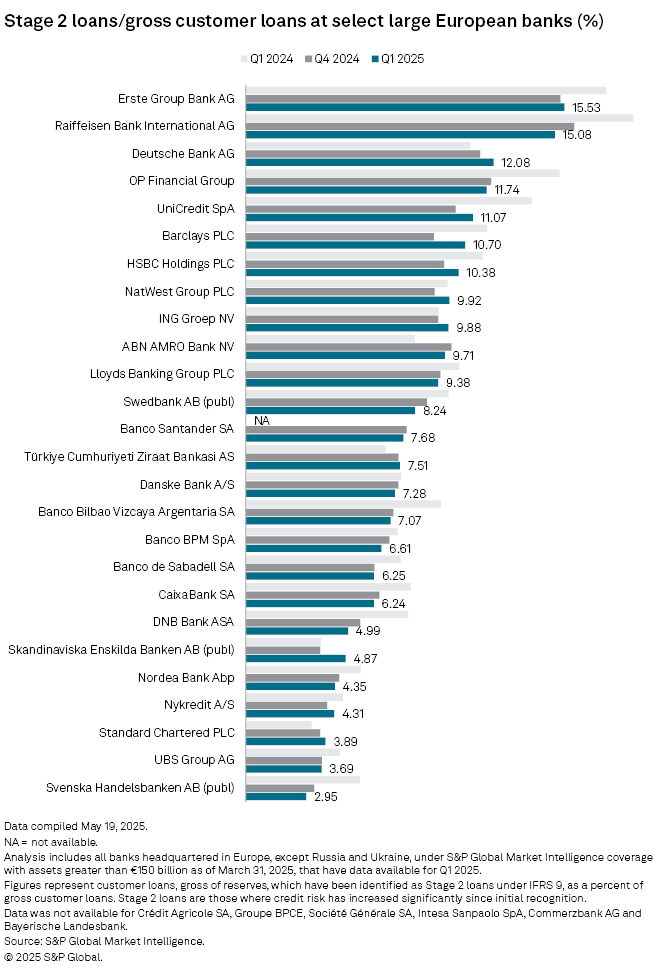

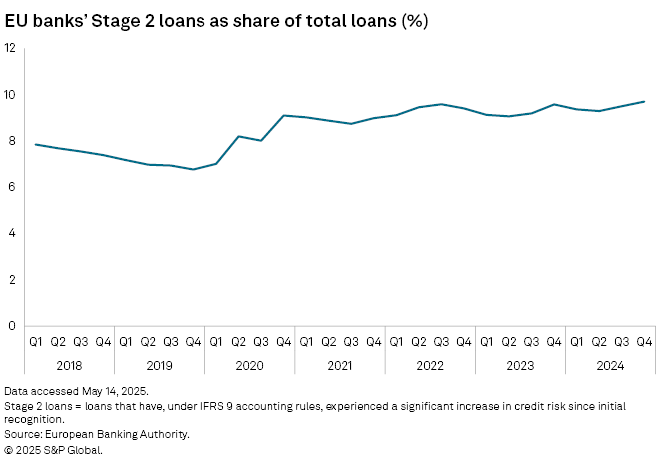

There has also been progress on the so-called loan staging under IFRS 9. This was a key point of divergence in bank ECL provisions during COVID-19 due to a wide variance of interpretations of what constitutes the significant increase in credit risk that would trigger the transfer of performing loans to a higher-risk category, known as Stage 2.

Under IFRS 9, Stage 1 loans are performing loans, Stage 2 are those where there has been a significant increase in credit risk since initial recognition, and Stage 3 are nonperforming loans.

IFRS 9 offers "a fair degree of subjectivity" in the assessment of Stage 2 transitions which led to "some fairly fundamental divergences" in loan staging across banks, making a comparison between institutions quite hard, Dedeaga said.

Regulators carried out reviews to harmonize the different approaches.

"While there are still differences, due also to possible markets' peculiarities, the amount of divergence is smaller than before," Dedeaga said.

Prepare for divergence

There will likely be greater convergence due to regulatory measures such as the ECB's decision to include Stage 2 policies into its supervisory review and evaluation process, penalizing banks with policies it deems to be overly optimistic relative to portfolio fundamentals, Sattar at S&P Global Ratings said.

Yet, the situation is not going to improve immediately due to the "judgmental nature of IFRS 9, particularly with overlays," the analyst said.

"IFRS 9 is much more judgment-based than principles-based. So you have that inherent flexibility in the framework," Sattar noted.

Differences in downside scenario probability weightings are also more likely to persist when banks make their ECL assessments and provision for that, according to Giles Edwards, sector lead European financial institutions at S&P Global Ratings.

"For exactly the same portfolio, you're going to have a different view of what the future looks like," Edwards said in an interview. Some variance though is intended in IFRS 9 and there could be good reasons for some differences in approach, Edwards said.