Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 May, 2025

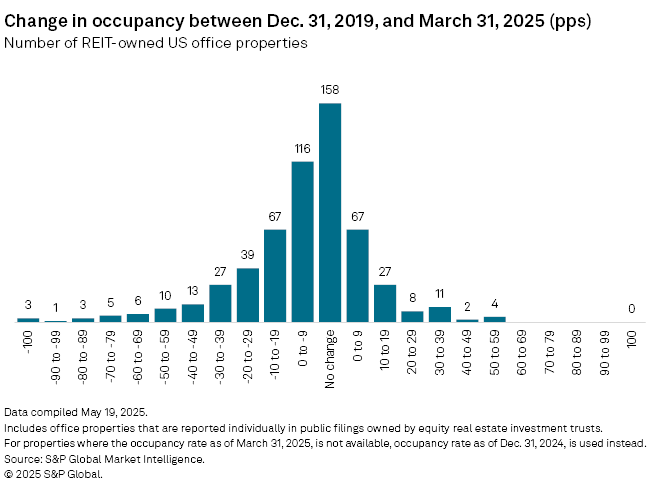

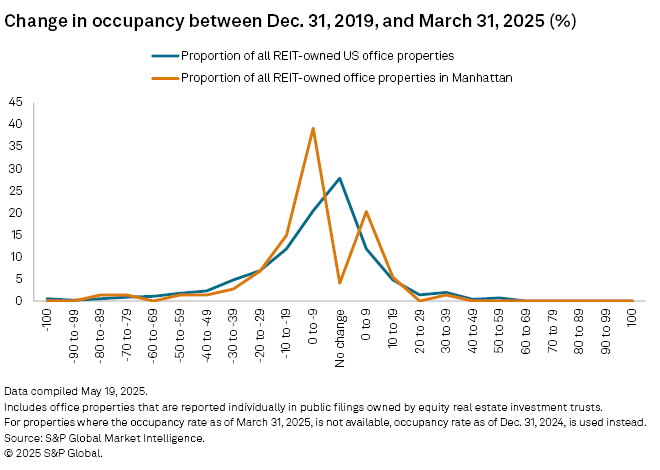

The occupancy of 51.1% of real estate investment trust-owned office properties in the US declined between Dec. 31, 2019 — prior to the COVID-19 pandemic — and March 31, 2025, according to S&P Global Market Intelligence analysis.

Occupancy remained unchanged for 28.1% of the properties in the analysis and rose for 20.9% of the properties.

Premier office properties — the highest-quality buildings — fared relatively well. BXP Inc. CEO Owen Thomas said on the REIT's first-quarter earnings call that the premier office buildings in the five central business districts markets where the company operates — Boston, New York, San Francisco, Seattle and Washington, DC — have higher occupancy rates compared with the broader office market in those districts.

Manhattan office properties

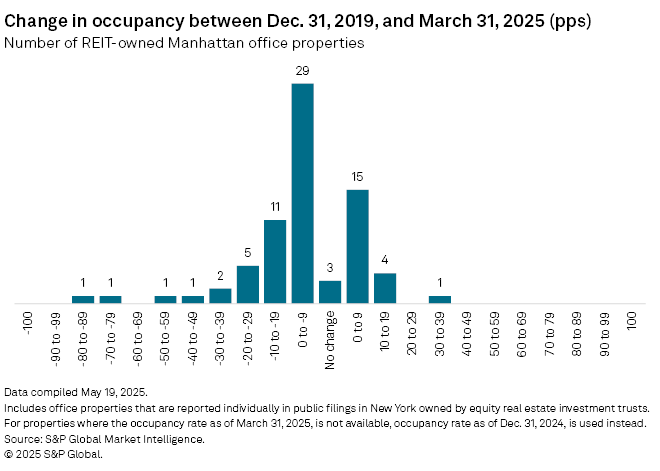

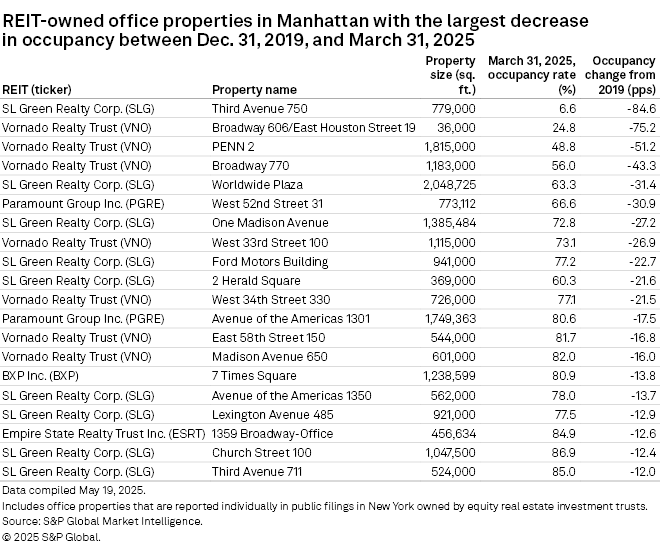

In Manhattan, the largest office market in the US, nearly 70% of the office properties owned by REITs in the area logged declines in occupancy rates since 2019.

Over the same time period, 27% of REITs recorded an increase in occupancy rate, a higher proportion than broader US office properties. Only three office properties in Manhattan, or 4.1% of the analyzed properties, had no change in occupancy.

While SL Green Realty Corp.'s Third Avenue 750 logged the largest occupancy decline, down to 6.6%, the REIT is in the process of converting the office building into a residential property.

Office-to-residential conversion projects have gained momentum in New York City following legislation in 2024 that provides tax exemptions to commercial buildings converted for residential use, provided the building contains a certain percentage of affordable units.

"[There are] a lot of conversion candidates, particularly downtown, where the prices of the bricks and mortar and land enable conversion on an economic basis," SL Green CEO Marc Holliday said on the REIT's first-quarter earnings call. Holliday estimates that more than 25 million square feet of office space would be converted to residential within the city.

Broadway 606/East Houston Street 19, in which Vornado Realty Trust owns a 50% interest, had the second-highest occupancy drop of more than 75 percentage points since 2019-end. On Sept. 5, 2024, the property's $74 million nonrecourse mortgage loan matured and was not repaid, and the lender declared a default event.

Vornado's PENN 2 was also on the list, but its large drop in occupancy stems from the property being fully placed into service in the first quarter following a $750 million redevelopment plan. In March, Vornado signed a 337,000-square-foot lease at PENN 2 with Universal Music Group NV.

Vornado's Broadway 770 closed the first quarter at an occupancy rate of 56%. However, on May 5, the REIT completed a master lease with New York University to lease 1,076,000 square feet at the property on a triple net basis for a 70-year lease term.

Occupancy rate increases in Manhattan

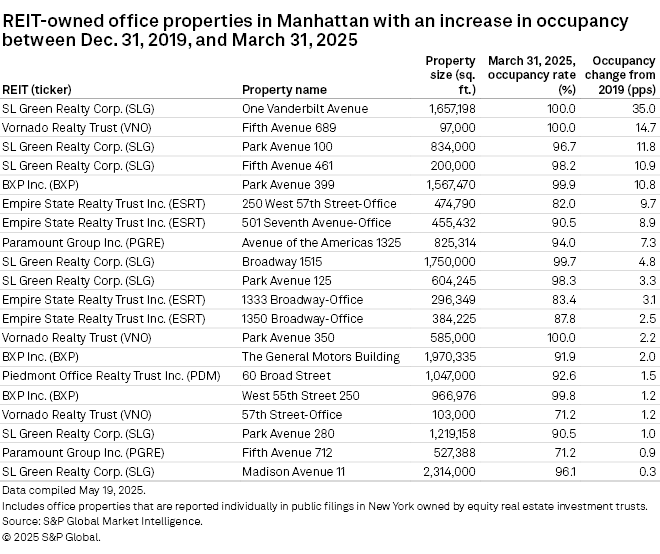

Market Intelligence identified 20 Manhattan office properties with an increase in occupancy between 2019 and March 31, 2025.

As of March 31, the occupancy of SL Green's One Vanderbilt Avenue rose 35 percentage points from the end of 2019 to become fully leased.

Occupancy at Vornado's Fifth Avenue 689 also grew to 100% leased as of March-end, a 14.7-percentage-point increase over the time period.

Other office properties that increased occupancy by double digits included SL Green's Park Avenue 100 and Fifth Avenue 461, as well as BXP's Park Avenue 399.

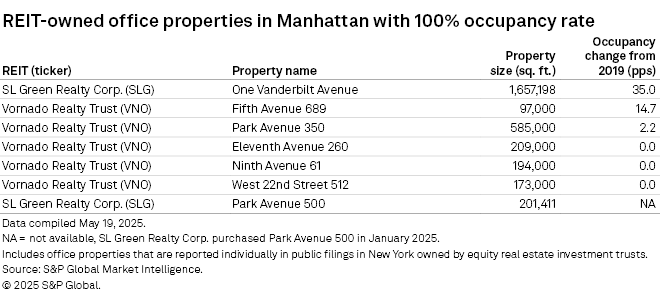

Seven Manhattan office properties in the analysis achieved 100% occupancy as of March 31.

In addition to One Vanderbilt Avenue, SL Green's Park Avenue 500 was also fully leased at the end of the first quarter, while Vornado owned five fully leased office properties in the city: Fifth Avenue 689, Park Avenue 350, Eleventh Avenue 260, Ninth Avenue 61 and West 22nd Street 512.