Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 May, 2025

China's banks have likely settled into a phase of relatively muted profitability after the COVID-19 pandemic, as gross domestic product grows at a pace more consistent with a middle-income economy.

Key profitability metrics — such as return on average assets (ROAA) and return on average equity (ROAE) — have declined at Chinese banks since the onset of the pandemic, S&P Global Market Intelligence data shows. The banking sector's ROAA declined to a decadal low of 0.71% in 2024, compared with 0.82% in 2020 and 1.07% in 2015. ROAE has similarly been on a steady decline, falling to 8.71% in 2024 from 9.93% in 2020 and 14.99% in 2015.

"It's a more disciplined and targeted growth model, not stagnation," Steve Alain Lawrence, chief investment officer of Balfour Capital Group, told Market Intelligence via email on May 16. Lawrence pointed to stable ROAA and return on equity above 10% at the big Chinese lenders in the first quarter of 2025.

The "new normal" for Chinese banks is about "policy-guided lending efficiency," Lawrence said. "Credit is flowing to strategic areas like [electric-vehicle] supply chains, semiconductors and AI manufacturing zones in Shenzhen and Anhui."

Upper-middle-income economy

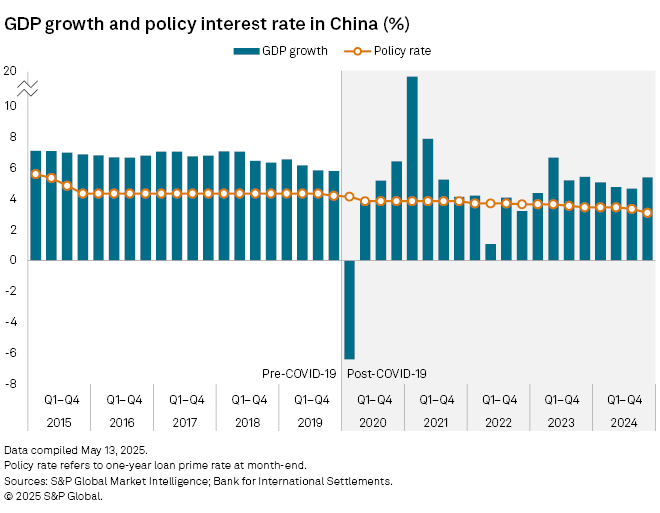

China's GDP grew at an average of more than 9% for nearly three decades as the nation opened up and reformed its economy. China is now an upper-middle-income country, according to the World Bank. The challenge is to find new drivers of growth while addressing the social and environmental legacies of its previous development path, the World Bank says in its overview of the country. It notes that growth has moderated in recent years in the face of structural constraints that include a decline in the working age population, diminishing returns to investment and slowing productivity growth.

China exited the pandemic with GDP growth near 5%, a target that the world's second-biggest economy has also set for 2025.

"As the major financial supporting channel to the Chinese economy, the banking sector will continue to expand their core businesses in the coming years, but at a much slower pace," Benny Cheung, China South financial services market leader at EY, told Market Intelligence on May 13. "Profitability will likely remain under pressure as [a] low interest rate environment and stagnant economic growth could stay for years," said Cheung.

China's banking sector faces increasing uncertainty in the macro environment, EY said in its China Banking 2024 Review and Outlook Report, released May 12. Challenges include weak growth momentum in major economies, continued geopolitical conflicts, intensified trade conflicts and financial market volatility, and slowing domestic demand.

Not just COVID

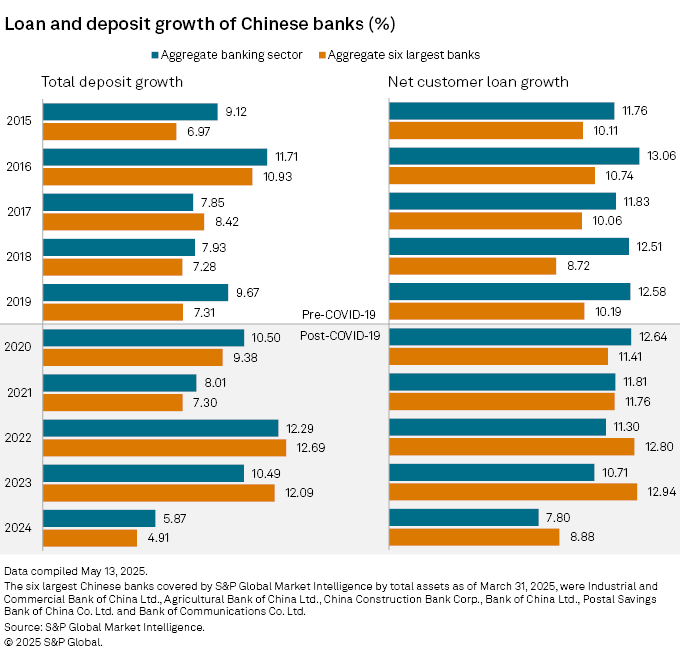

Aggregate loans at Chinese banks grew 7.80% in 2024, the slowest rate in the last 10 years, Market Intelligence data shows. Deposits, similarly, fell to a decade-low of 5.87%.

China's central bank has remained on a path of monetary easing after the pandemic's impact on the economy. While other global central banks, such as the US Federal Reserve and European Central Bank, moved to tighten their monetary policy to dampen rising inflation in the recovery phase of the pandemic, the People's Bank of China (PBOC) was an outlier, seeking to support economic growth.

The global interest rate cycle has since turned, and rates have declined since early 2024. The People's Bank of China has continued to push rates lower, though at a slower pace.

In early May, the central bank lowered its benchmark seven-day reverse repo rate by 10 basis points to an all-time low of 1.4% and the reserve requirement ratio for banks to 7.5% from 8.0%.

The PBOC's moves "will further strain banks that are already grappling with likely lower economic growth this year, as the tariff tensions hurt jobs and some industries in China and raise default risk," S&P Global Ratings analysts wrote in a May 8 report.

Asset quality defended

Aggregate net interest margins at Chinese banks have declined to 1.46% in 2024, compared with 2.48% in 2015, Market Intelligence data shows.

Chinese banks have so far been able to defend their asset quality despite slowing profitability and falling margins. Aggregate problem loans as a percentage of gross customer loans have edged lower to 1.31% from 1.57% over the past decade, according to Market Intelligence data.

"While asset quality is closely related to the macroeconomic conditions, the sector-wide level of problem loans will likely remain stable as corporate lending will more than offset the uncertainty from retail credits," EY's Cheung said.

Big six

Aggregate loans at six state-owned commercial lenders — Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd., China Construction Bank Corp., Bank of China Ltd., Postal Savings Bank of China Co. Ltd. and Bank of Communications Co. Ltd. — grew 8.88% in 2024, slowing from 12.94% in 2023, Market Intelligence data shows.

Still, lending and deposit growth at the six lenders has largely outpaced the industry average in the post-COVID era — a reversal from previous years when they often trailed their peers.

"State banks are the first responders to macroeconomic policy," said Lawrence of Balfour Capital. They are following guidance from the authorities to support GDP targets, job creation, and industrial upgrading, he said.