Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 May, 2025

By Nick Lazzaro

|

|

An aging US workforce, accelerated in part by the COVID-19 labor shock, is likely to exacerbate worker supply issues over the next decade.

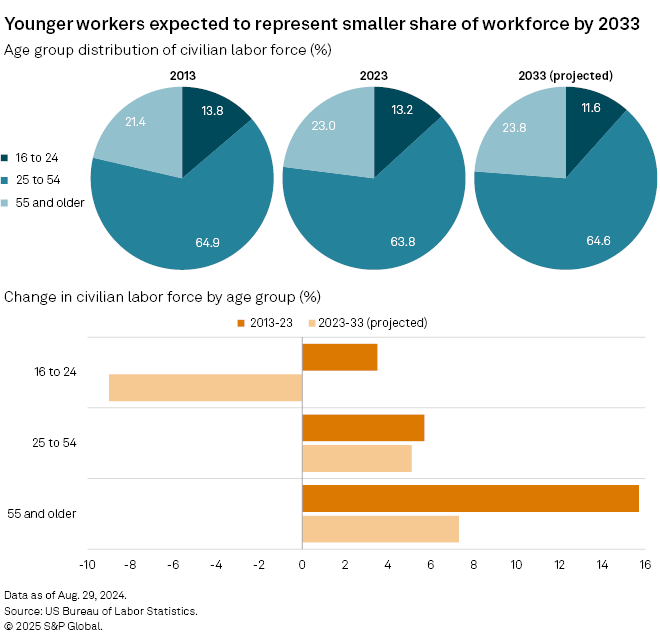

Workers aged 55 and over will drive much of the expected 3.7% growth in the US civilian labor force over the decade ending in 2033, less than half the growth recorded in the preceding 10 years, according to the latest US Bureau of Labor Statistics (BLS) projections. The number of workers aged 55 and older is projected to rise 7.3% during that time, compared to a 5.1% gain in "prime age" workers from 24 to 54 years old and a 9% drop in those between the ages of 16 and 24.

This aging trend has been going on since the 2010s but was brought into greater focus following a wave of early retirements during the pandemic. The accelerated pace of retirements is expected to continue, putting further strain on the age and size of the US workforce.

"We're seeing that 10,000 workers every single day turn 65 to reach retirement age, and we're seeing that the employment growth is now slowing to a crawl," said ADP Chief Economist Nela Richardson in an interview with S&P Global Market Intelligence. "There's going to be more consumers in the economy now than producers going forward."

The size of the US employment cohort and the civilian labor force, which includes employed workers and unemployed workers actively seeking jobs, will be constrained by slower population growth. The US civilian noninstitutional population is projected to expand at an annual rate of 0.6% from 2023 to 2033, compared with an annual rate of 0.8% from 2013 to 2023, according to BLS data.

Challenges from the greying population

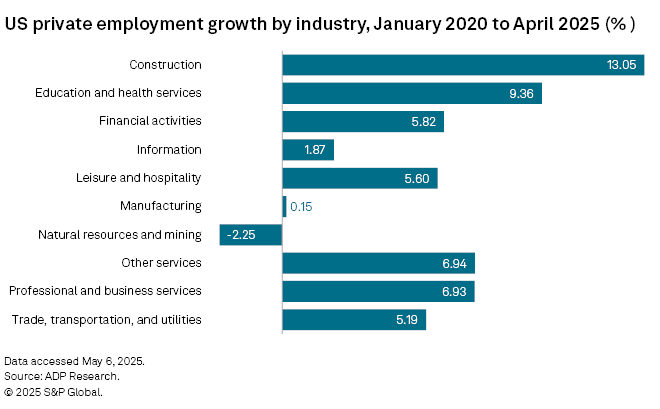

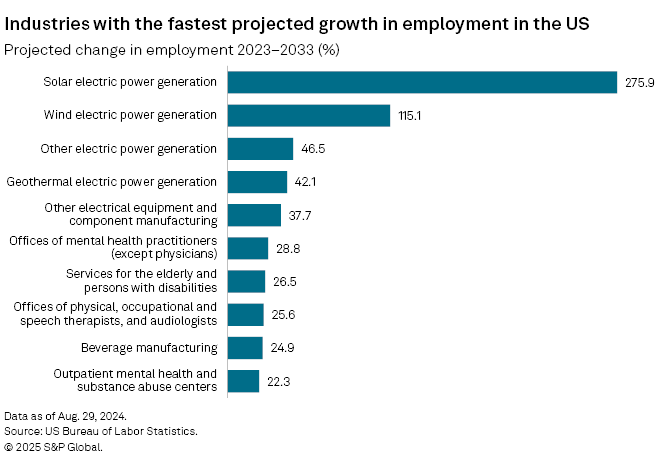

As the US population ages, labor demand will shift, causing labor supply shortages in certain industries that could push up wages.

"As consumption patterns are steered more towards older workers, you're going to see the labor markets focus change with much more demand for jobs related to healthcare," Richardson said. "But we don't have enough nursing professors to grow the crop of new nurses, and we've done some research showing that the tenure of the average nurse is shrinking."

Beyond healthcare, worker shortages will likely affect employment in education, childcare, accounting, construction, manufacturing, and transportation and logistics, Richardson said.

Shortages loomed even as young workers returned to the labor force after the pandemic. The US civilian labor force between the ages of 16 and 24 grew 3.25% from 2019 to 2024, according to BLS data. Workers in this age group totaled 21.78 million people and comprised 12.95% of the labor force in 2024, up from 12.90% in 2019. The workforce between the ages of 45 and 54 rose only 0.02% over the same five-year period while the workforce between the ages of 55 and 64 slipped 1.58%.

Moreover, the labor participation rate of 36.9% among workers between the ages of 16 and 19 in 2024 exceeded the pre-pandemic rate of 35.3% in 2019, but the participation rate for workers from ages 20 to 24 fell to 71.5% from 72.2% in that time frame. The overall US labor participation rate, which stood at 62.6% in 2024, has improved steadily since 2020, but is still below the 2019 rate of 63.1%.

"In the short term, many firms will face labor shortages unless there is an extended period of recession," Mark Ma, associate professor of business administration at the University of Pittsburgh, told Market Intelligence. "In the medium to long term, this may or may not be a problem because the development of automation and AI technology may decrease the demand for labor."

Shifting values add to shortage risk

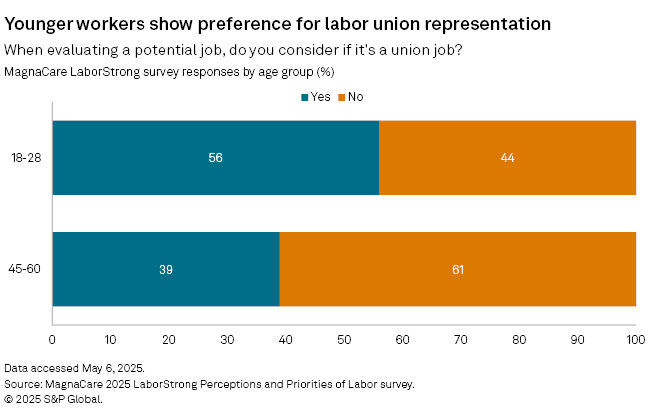

Evolving workplace values among younger workers may further amplify labor shortages in certain industries, according to Joe Morrone, vice president of labor relations business development at MagnaCare, a third-party healthcare benefits administrator.

For instance, workers within the Generation Z cohort tend to value work-life balance and hybrid work flexibility more than older generations by a wide margin, Morrone said, in reference to results from a survey conducted by MagnaCare through its LaborStrong initiative.

"Their preference for flexibility and reservations around traditional employment models may create gaps in traditional roles vacated by older generations," Morrone told Market Intelligence. "Without changes in workplace culture and job design, labor shortages could persist, even with a willing and values-driven younger workforce."

Priorities surrounding hybrid work, work-life balance, wage inequality and job security are also drawing Gen Z workers to support labor unions, which could play a role in bridging the gap between their values and workplace environments.

"Gen Z's strong support for unions doesn't necessarily signal a shift toward manufacturing roles. Instead, data suggests that they are redefining what union representation means and where it applies," Morrone said. "Their interest in unions is less about the sector itself and more about seeking institutional support in the evolving workplace, particularly in jobs affected by automation and nontraditional work arrangements."

These workplace shortages could be alleviated to a certain degree through employment programs that seek to expand job opportunity prospects to groups with nontraditional backgrounds, such as military veterans, that may otherwise be overlooked by potential employers.

Healthcare, skilled trades, logistics, supply chain management and technology are all examples of in-demand industries that could address their labor supply challenges by increasing their consideration of military veteran job candidates, benefiting from their leadership, technical skills and crisis management experience, Ross Dickman, CEO of Hire Heroes USA, told Market Intelligence.

"One of the biggest challenges is helping employers understand how veterans fit into their organizations," Dickman said. "Many civilian employers struggle to interpret military job experience, often due to unfamiliar terminology or a lack of familiarity with nontraditional career paths."