Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2025

By John Wu and Marissa Ramos

Green bond issuance in China will likely maintain momentum, backed by the government's policy push, after sales in the first four months of 2025 touched a three-year high.

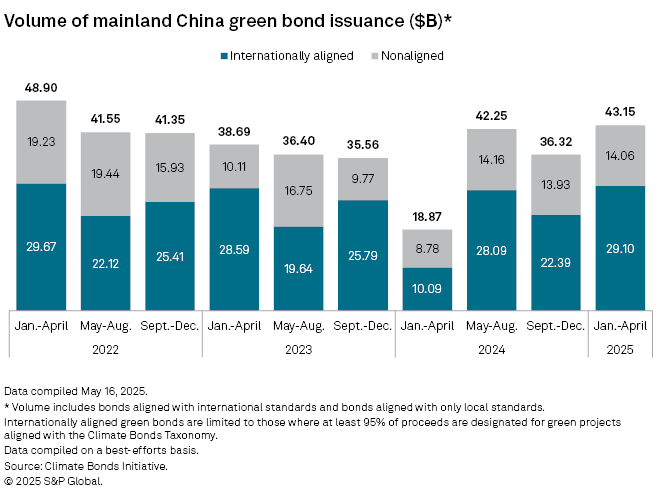

According to Climate Bonds Initiative (CBI) data, an aggregate $29.10 billion of internationally aligned green bonds were sold in mainland China from January to April, the highest since the same period in 2022. That represented a jump of 188% from 2024, when issuance hit a multiyear low of $10.09 billion.

"The need for investment in China's transition to a low-carbon economy remains significant and green bonds have proven to be an effective tool for supporting issuers in this effort. This will continue to foster rapid growth in the green bond market, as we have witnessed in recent years," said Rui Li, fixed income portfolio manager at AXA Investment Managers, in a May 20 email interview.

Li said green bond issuances quickly resumed following the temporary disruption in early April due to the volatile market conditions triggered by the trade disputes, partly fueled by China's issuance of green government bonds.

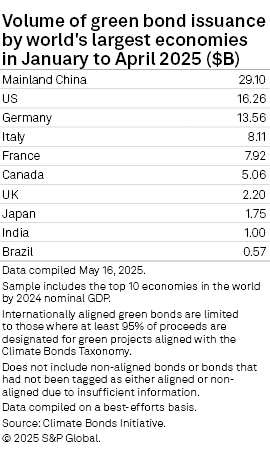

China also topped the global issuance league table for the period, followed by $16.26 billion in the US and $13.56 billion in Germany. Among major Asia-Pacific economies, Japan ranked eighth globally with $1.75 billion in issued green bonds, a place higher than India's $1.00 billion.

China, along with the US and India, is among the largest emitters of greenhouse gases in the world. After its emissions peak by 2030, China is aiming to achieve net-zero by 2060. Chinese authorities are encouraging alignment with international standards and are trying to curb greenwashing, a practice used by issuers to overstate environmental claims to take advantage of lower borrowing costs.

China's CO2 emissions fell 1.6% year over year in the first quarter, according to the latest analysis by Carbon Brief, a UK-based climate website. This is the first time such a drop has been driven not by economic weakness but by surging clean energy generation.

On April 3, China's Ministry of Finance sold the government's first green bonds, worth 6 billion Chinese yuan, on the London Stock Exchange's International Securities Market.

The issuance framework serves as the foundation for the issuance of international sovereign green bonds of the government, aiming to encourage more domestic issuers to participate and attract further investment in the green financial markets, the LSE said in an April 3 news release.

"We believe this issuance will encourage local governments, financial institutions and corporates to further engage in the green bond market, thereby creating positive momentum for the Chinese green bond market," AXA IM's Li said. AXA IM earlier described the issuance as "the sector's latest significant development which has markedly expanded in recent years."

Nonaligned

Total issuance, including the nonaligned portion, sold by Chinese issuers also hit a three-year high at $43.15 billion, translating to a year-over-year surge of 129%, according to CBI.

Internationally aligned green bonds are issued in accordance with the EU-China Common Ground Taxonomy, released in late 2021, outlining economic activities recognized by China and the EU that substantially contribute to climate change mitigation.

The amount of nonaligned green bonds issued in the first four months of 2025 was $14.06 billion, an increase of 60.1% from a year ago. The figure, however, stood between $13.93 billion recorded in the September-December period of 2024 and $14.16 billion in May-August 2024.