Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 May, 2025

By Beata Fojcik

Large banks in central Europe aim to keep risk costs in check this year as they navigate economic uncertainty amid global tariff tensions.

US President Donald Trump on April 2 unveiled sweeping tariffs on global trading partners, but later postponed some of the tariffs for 90 days.

EU countries still face a 10% levy. In addition, a 25% tariff on certain goods, including vehicles, remains.

'Interesting times ahead'

Austria-based Raiffeisen Bank International AG (RBI) is preparing for the potential fallout from trade disruptions, having launched an internal stress test of its loan book to assess tariff sensitivity.

"I'm satisfied that we are well prepared for interesting times ahead," Chief Risk Officer Hannes Mösenbacher said during a May 6 earnings call.

RBI booked €71 million of additional management overlays in the first quarter for its core business, excluding Russia. Overlays are additional reserves that cover potential losses from novel risks that are beyond the scope of typical credit risk models.

This was primarily due to heightened economic uncertainty, even as credit risk in its core business during the period was "very benign," according to Mösenbacher.

Société Générale SA's Czech unit, Komercní banka a.s., booked a temporary reserve

Despite the reserve, Komercní banka improved its risk outlook for the year, projecting it to fall on the lower end of the range of 0 bps to 10 bps, significantly below its through-the-cycle range of 20 bps to 30 bps.

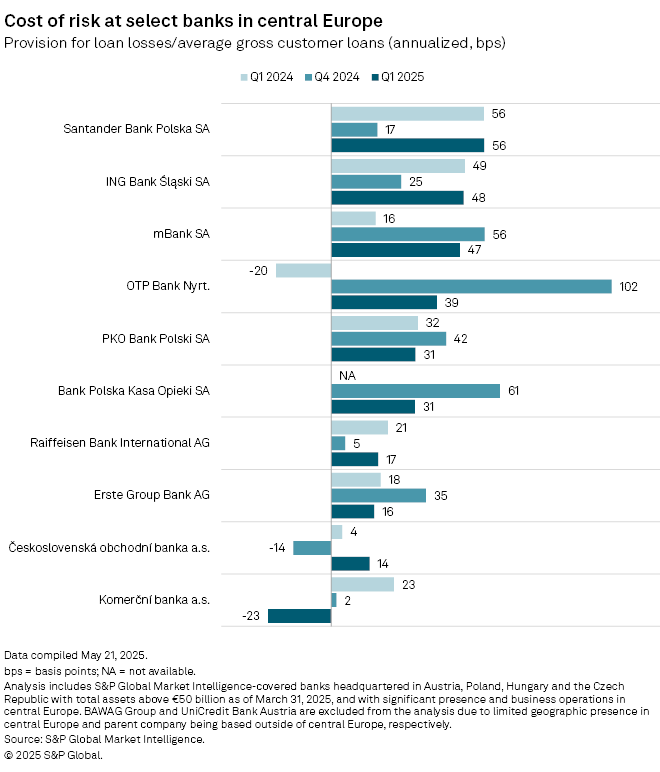

Komercní banka was the only lender in a sample of 10 major banks in central Europe with a negative cost of risk — measured as annualized loan loss provisions as a proportion of average gross customer loans — in the first quarter due to a net release of provisions, according to S&P Global Market Intelligence data. KBC Group NV's Czech unit Ceskoslovenská obchodní banka a. s., RBI and fellow Austrian lender Erste Group Bank AG also had some of the lowest risk costs in the sample.

Similar to RBI, Erste reaffirmed its risk cost guidance for the year.

"Despite this very good start to the year, we decided to remain prudent and confirm our 2025 risk cost guidance unchanged at about 25 basis points, not least because there's a lot of uncertainty out there that impairs visibility. … Should these concerns fade away as the year passes and our credit risk performance stays healthy, we will certainly revisit the outlook," Erste Chief Risk Officer Alexandra Habeler-Drabek said in an April 30 earnings call.

Commerzbank AG's Polish unit, mBank SA, also confirmed its 2025 cost of risk outlook at between 70 bps and 80 bps, with its executives noting April 30 that currently there are no negative implications for its corporate clients from the heightened trade tensions.

MBank, along with Polish lenders Santander Bank Polska SA and ING Bank Slaski SA, had the highest first-quarter costs of risk in the sample.

Lending outlook

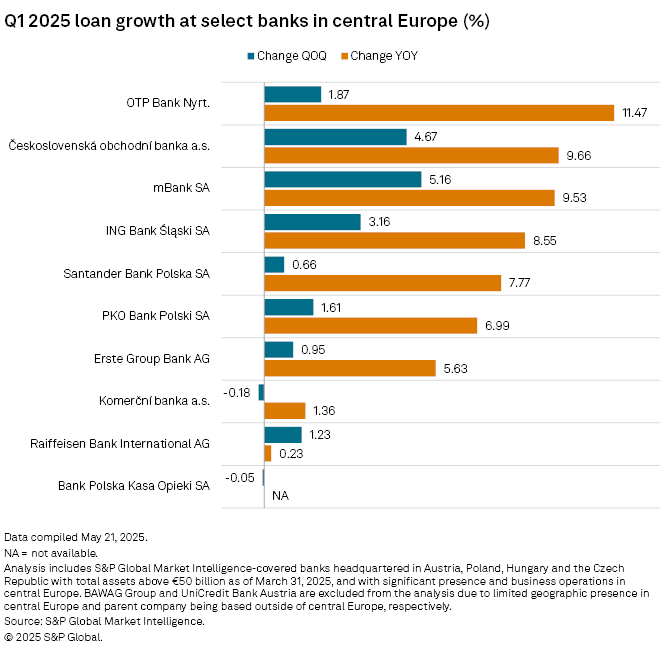

Erste, RBI and Hungary-based OTP Bank Nyrt. reaffirmed their loan growth outlooks for the year. Erste is anticipating loan growth of about 5%, while RBI expects to expand its portfolios by 6%-7%, excluding Russia. OTP Bank anticipates foreign currency-adjusted organic performing loan growth above the 9% reported in 2024.

Poland's largest lender, PKO Bank Polski SA, also expects loan growth to continue this year, supported by a recent 50-bps interest rate cut by the Polish central bank. PKO Bank is optimistic that negotiations between the US and its trading partners will yield constructive outcomes, which could positively influence both the global and Polish economies, thereby enhancing lending prospects throughout 2025.

MBank expects its corporate and retail loan portfolios to outpace market growth, although it acknowledged a downside risk from US tariffs in its first-quarter earnings presentation.

Almost all banks in the sample demonstrated year-over-year loan growth in the first quarter. Most also exhibited quarter-over-quarter lending growth, with Komercní banka and Poland-based Bank Polska Kasa Opieki SA being the two exceptions.

Supported by loan growth, all banks in the sample demonstrated year-over-year growth in first-quarter net interest income (NII).

PKO Bank recorded the highest year-over-year NII growth, surpassing 15%. OTP Bank followed with an 11.3% growth. OTP Bank was also the only institution in the sample to demonstrate quarterly growth.

Erste reported the lowest year-over-year growth and the highest quarterly decline, with its NII up 1.1% from first quarter of 2024 and down 3.4% from the linked quarter.

"If I had to summarize our NII performance for the first quarter of 2025 in one sentence, I would probably say we are moving along our plateau: sometimes a little up, sometimes a little down, but a plateau it still is," Erste CFO Stefan Dörfler said April 30, adding that the result met the lender's expectations.

Despite the strong loan growth and NII performance, OTP Bank underperformed its peers in terms of first-quarter net profit due to a significant tax burden in its home market of Hungary. OTP Bank posted first-quarter attributable net profit of 186.8 billion Hungarian forints, down almost 22% year over year and 25% quarter over quarter.

Even with the increased tax burden, OTP Bank reaffirmed its 2025 outlook for adjusted return on equity at slightly below the 23.5% level in 2024.

As of May 22, US$1 was equivalent to 22.07 Czech koruny and 357.32 Hungarian forints.